Answered step by step

Verified Expert Solution

Question

1 Approved Answer

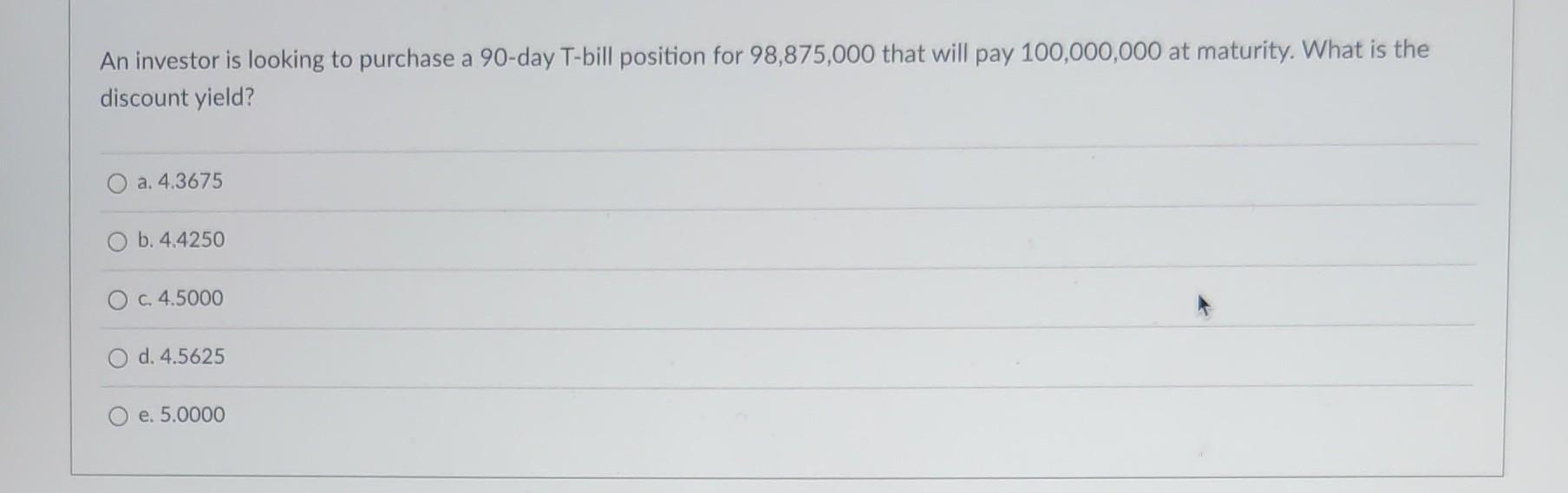

An investor is looking to purchase a 90 -day T-bill position for 98,875,000 that will pay 100,000,000 at maturity. What is the discount yield? a.

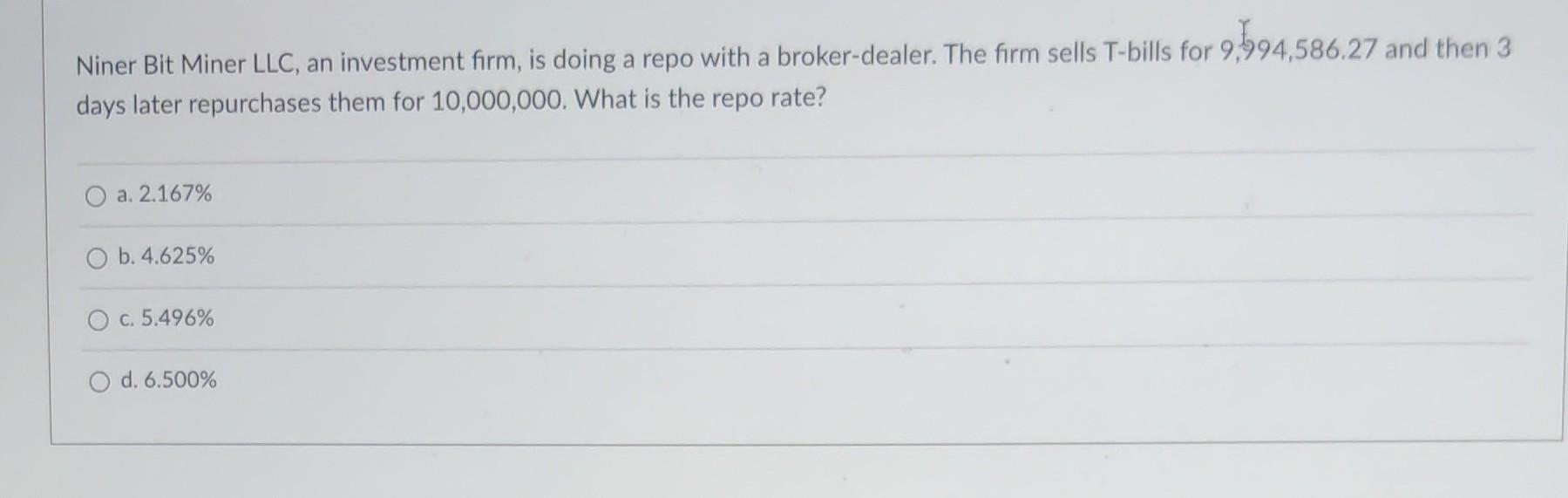

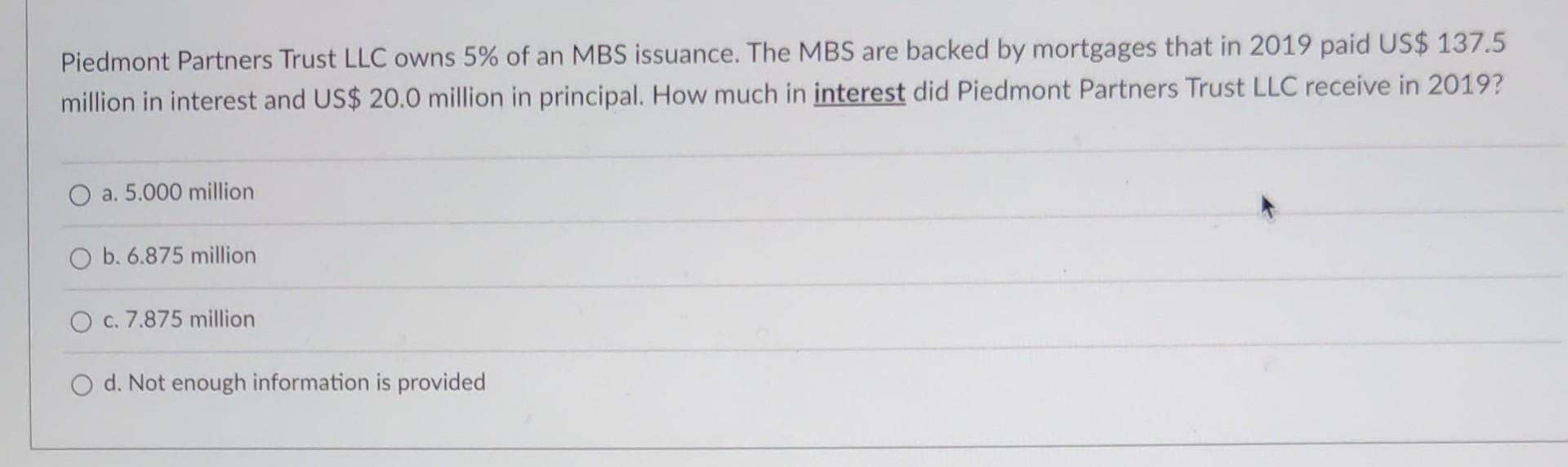

An investor is looking to purchase a 90 -day T-bill position for 98,875,000 that will pay 100,000,000 at maturity. What is the discount yield? a. 4.3675 b. 4.4250 c. 4.5000 d. 4.5625 e. 5.0000 Niner Bit Miner LLC, an investment firm, is doing a repo with a broker-dealer. The firm sells T-bills for 9,994,586.27 and then 3 days later repurchases them for 10,000,000. What is the repo rate? a. 2.167% b. 4.625% c. 5.496% d. 6.500% Piedmont Partners Trust LLC owns 5\% of an MBS issuance. The MBS are backed by mortgages that in 2019 paid US\$137.5 million in interest and US\$20.0 million in principal. How much in interest did Piedmont Partners Trust LLC receive in 2019 ? a. 5.000 million b. 6.875 million c. 7.875 million d. Not enough information is provided

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started