Answered step by step

Verified Expert Solution

Question

1 Approved Answer

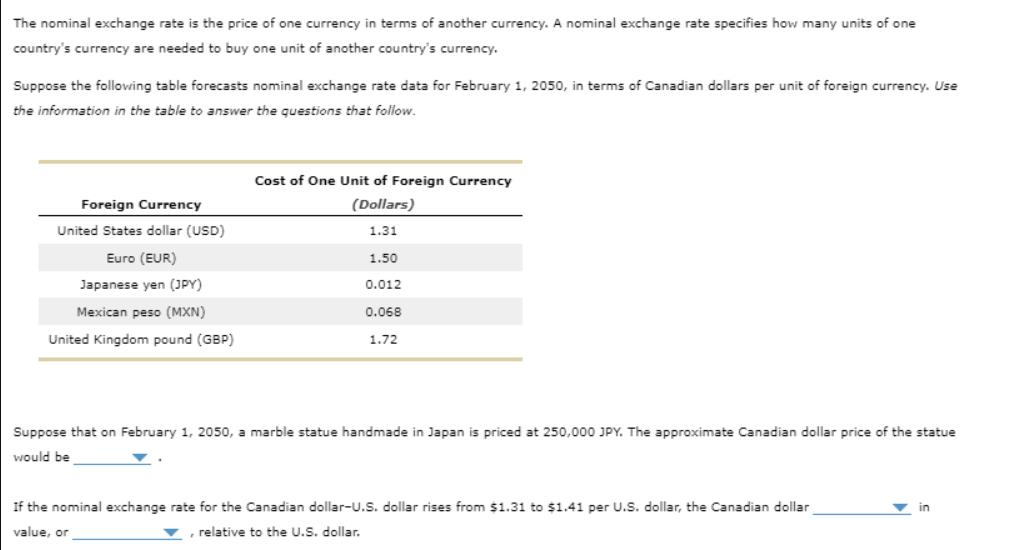

The nominal exchange rate is the price of one currency in terms of another currency. A nominal exchange rate specifies how many units of

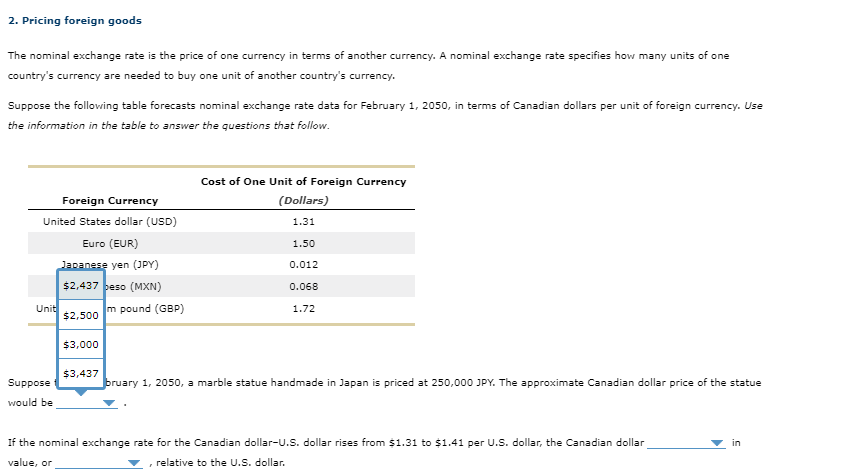

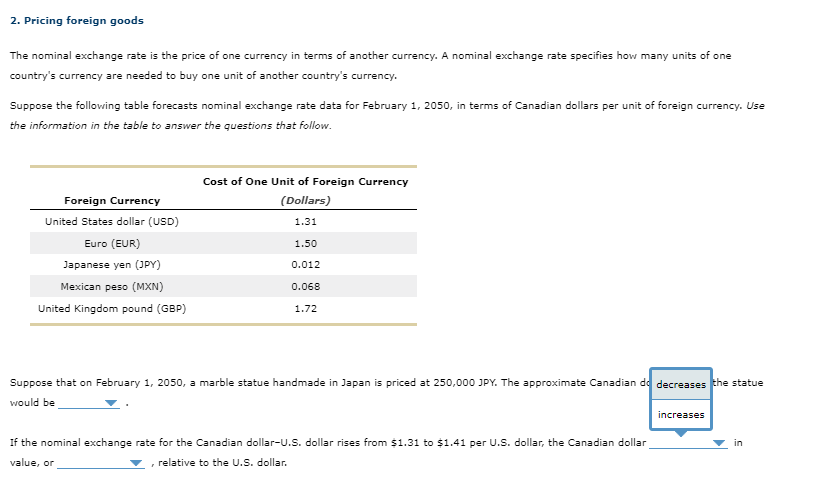

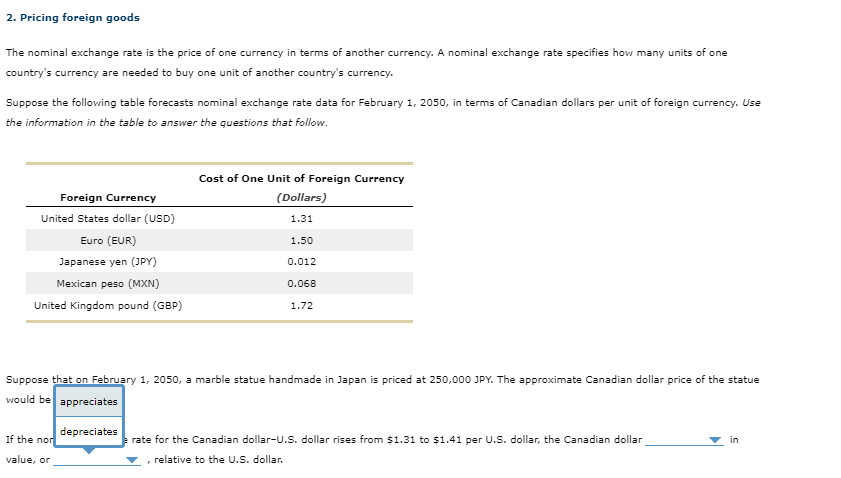

The nominal exchange rate is the price of one currency in terms of another currency. A nominal exchange rate specifies how many units of one country's currency are needed to buy one unit of another country's currency. Suppose the following table forecasts nominal exchange rate data for February 1, 2050, in terms of Canadian dollars per unit of foreign currency. Use the information in the table to answer the questions that follow. Foreign Currency United States dollar (USD) Euro (EUR) Japanese yen (JPY) Mexican peso (MXN) United Kingdom pound (GBP) Cost of One Unit of Foreign Currency (Dollars) 1.31 1.50 0.012 0.068 1.72 Suppose that on February 1, 2050, a marble statue handmade in Japan is priced at 250,000 JPY. The approximate Canadian dollar price of the statue would be If the nominal exchange rate for the Canadian dollar-U.S. dollar rises from $1.31 to $1.41 per U.S. dollar, the Canadian dollar value, or relative to the U.S. dollar. in 2. Pricing foreign goods The nominal exchange rate is the price of one currency in terms of another currency. A nominal exchange rate specifies how many units of one country's currency are needed to buy one unit of another country's currency. Suppose the following table forecasts nominal exchange rate data for February 1, 2050, in terms of Canadian dollars per unit of foreign currency. Use the information in the table to answer the questions that follow. Cost of One Unit of Foreign Currency (Dollars) Foreign Currency United States dollar (USD) Euro (EUR) 1.31 1.50 Japanese yen (JPY) 0.012 $2,437 beso (MXN) 0.068 Unit m pound (GBP) 1.72 $2,500 Suppose would be $3,000 $3,437 bruary 1, 2050, a marble statue handmade in Japan is priced at 250,000 JPY. The approximate Canadian dollar price of the statue If the nominal exchange rate for the Canadian dollar-U.S. dollar rises from $1.31 to $1.41 per U.S. dollar, the Canadian dollar value, or relative to the U.S. dollar. in 2. Pricing foreign goods The nominal exchange rate is the price of one currency in terms of another currency. A nominal exchange rate specifies how many units of one country's currency are needed to buy one unit of another country's currency. Suppose the following table forecasts nominal exchange rate data for February 1, 2050, in terms of Canadian dollars per unit of foreign currency. Use the information in the table to answer the questions that follow. Foreign Currency United States dollar (USD) Euro (EUR) Japanese yen (JPY) Mexican peso (MXN) United Kingdom pound (GBP) Cost of One Unit of Foreign Currency (Dollars) 1.31 1.50 0.012 0.068 1.72 Suppose that on February 1, 2050, a marble statue handmade in Japan is priced at 250,000 JPY. The approximate Canadian do decreases the statue would be increases If the nominal exchange rate for the Canadian dollar-U.S. dollar rises from $1.31 to $1.41 per U.S. dollar, the Canadian dollar value, or , relative to the U.S. dollar. in 2. Pricing foreign goods The nominal exchange rate is the price of one currency in terms of another currency. A nominal exchange rate specifies how many units of one country's currency are needed to buy one unit of another country's currency. Suppose the following table forecasts nominal exchange rate data for February 1, 2050, in terms of Canadian dollars per unit of foreign currency. Use the information in the table to answer the questions that follow. Foreign Currency United States dollar (USD) Euro (EUR) Japanese yen (JPY) Mexican peso (MXN) United Kingdom pound (GBP) Cost of One Unit of Foreign Currency (Dollars) 1.31 1.50 0.012 0.068 1.72 Suppose that on February 1, 2050, a marble statue handmade in Japan is priced at 250,000 JPY. The approximate Canadian dollar price of the statue would be appreciates If the nor value, or depreciates rate for the Canadian dollar-U.S. dollar rises from $1.31 to $1.41 per U.S. dollar, the Canadian dollar , relative to the U.S. dollar. in

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started