Question

The notes to the financial statements of Aggarwal Corporation for 2013 reveal the following information with respect to long-term debt. All interest rates in this

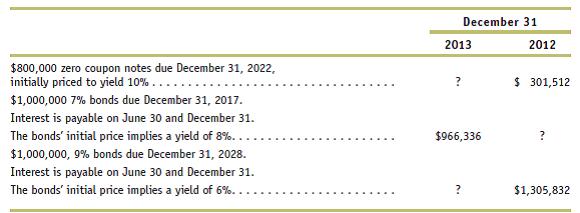

The notes to the financial statements of Aggarwal Corporation for 2013 reveal the following information with respect to long-term debt. All interest rates in this problem assume semiannual compounding and the effective interest method of amortization using amortized cost measurement based on the historical market interest rate.

a. Compute the carrying value of the zero coupon notes on December 31, 2013. A zero coupon note requires no periodic cash payments; only the face value is payable at maturity. Do not overlook the italicized sentence above.

b. Compute the amount of interest expense for 2013 on the 7% bonds.

c. On July 1, 2013, Aggarwal Corporation acquires half of the 9% bonds ($500,000 face value) in the market for $526,720 and retires them. Give the journal entry to record this retirement.

d. Compute the amount of interest expense on the 9% bonds for the second half of 2013.

December 31 2013 2012 $800,000 zero coupon notes due December 31, 2022, initially priced to yield 10% ... $ 301,512 ? $1,000,000 7% bonds due December 31, 2017. Interest is payable on June 30 and December 31. The bonds initial price implies a yield of 8%. $066,336 $1,000,000, 9% bonds due December 31, 2028. Interest is payable on June 30 and December 31. The bonds initial price implies a yield of 6%.. ? $1,305,832

Step by Step Solution

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a RFPV 1n 005800000PV1181 10518800000PV PV 80000024066 332417 The...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started