Question

Lilly Company reports the following information about its financial statements and tax return for a year (amounts in euros): The government taxes taxable income at

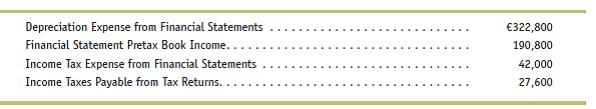

Lilly Company reports the following information about its financial statements and tax return for a year (amounts in euros):

The government taxes taxable income at a rate of 40%. Permanent differences result from municipal bond interest that appears as revenue in the financial statements but is exempt from income taxes. Temporary differences result from the use of accelerated depreciation for tax returns and straight-line depreciation for financial reporting. Reconstruct the income statement for financial reporting and for tax reporting for the year, identifying temporary differences and permanent differences.

Depreciation Expense from Financial Statements 322,800 Financial Statement Pretax Book Income... 190,800 Income Tax Expense from Financial Statements 42,000 Income Taxes Payable from Tax Returns. 27,600

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The following is the reconstructed income statement Particulars Financial statements Type of differe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started