Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The NPV is greater than 0 , so we would accept the project. b . P V of C F = C F 1 (

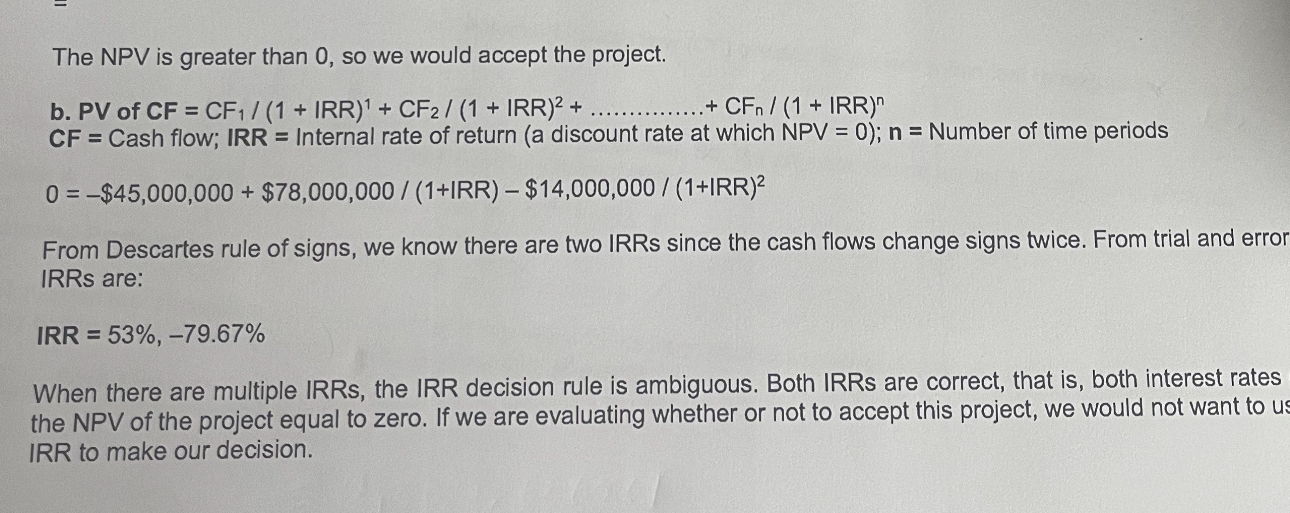

The NPV is greater than so we would accept the project.

b of dotsdotsdotsdotsdots

Cash flow; IRR Internal rate of return a discount rate at which NPV ; Number of time periods

$$$

From Descartes rule of signs, we know there are two IRRs since the cash flows change signs twice. From trial and error IRRs are:

IRR

When there are multiple IRRs, the IRR decision rule is ambiguous. Both IRRs are correct, that is both interest rates the NPV of the project equal to zero. If we are evaluating whether or not to accept this project, we would not want to us IRR to make our decisioNN

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started