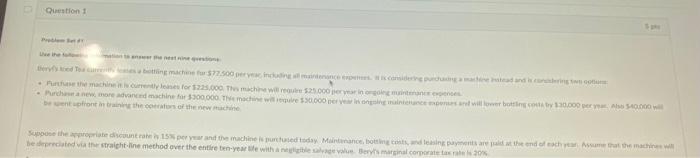

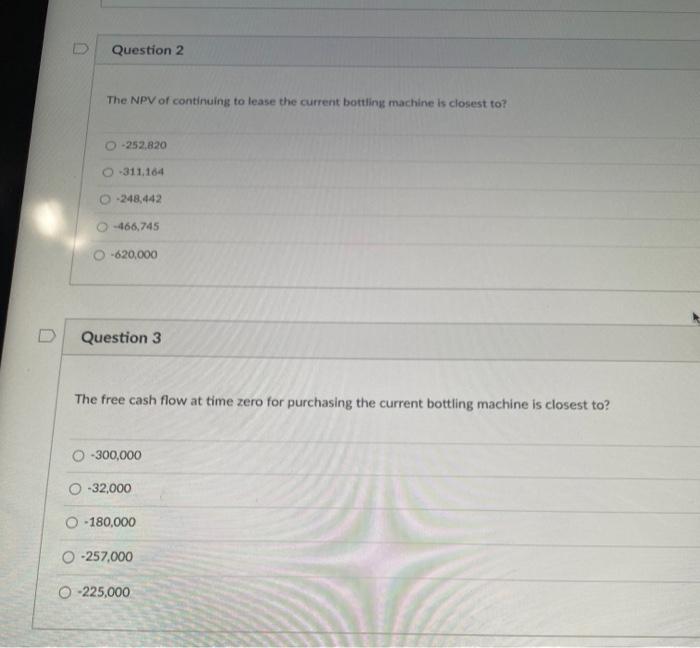

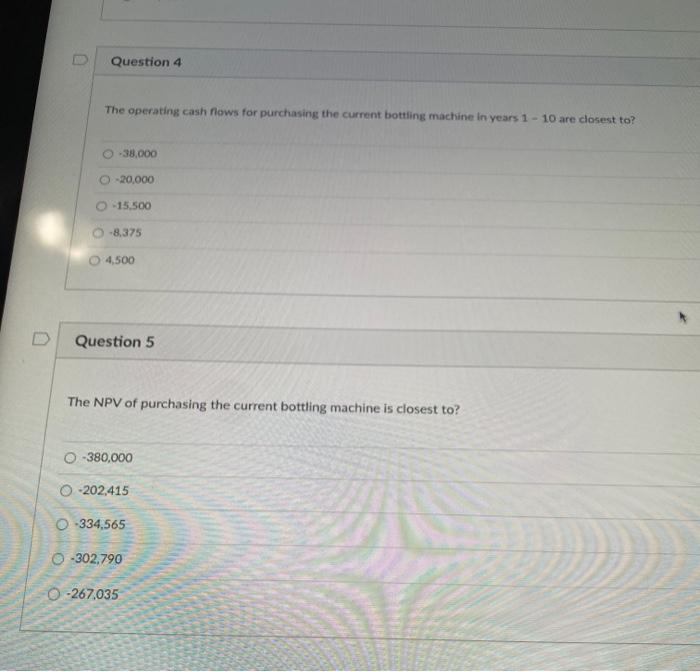

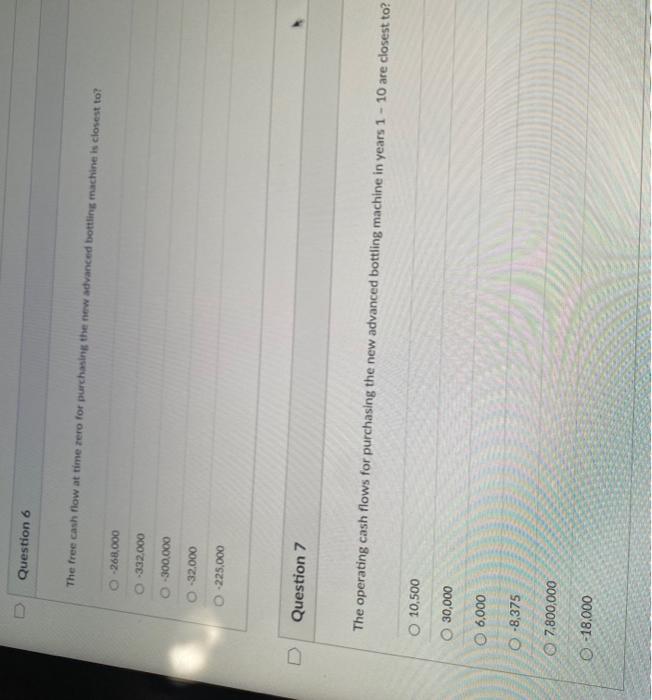

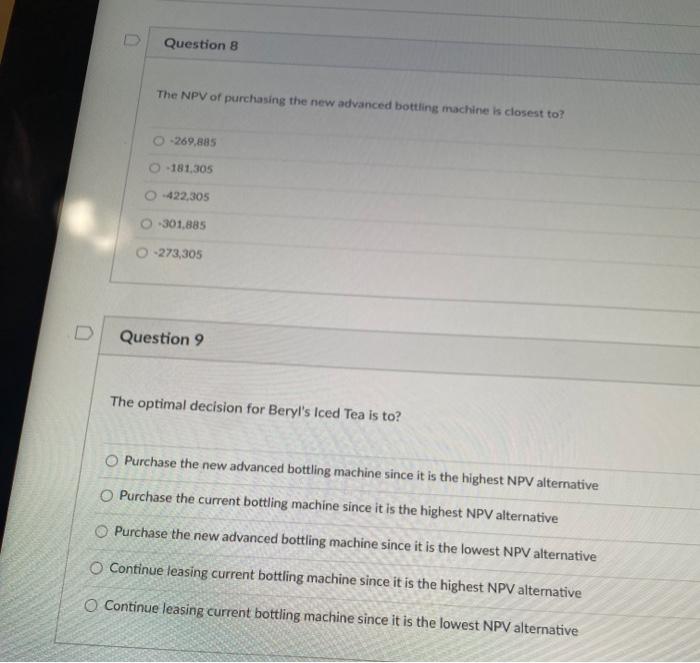

The NPV of continuing to lease the current bottling machine is closest to? 252,820 311,164 248,442 466,745 620,000 Question 3 The free cash flow at time zero for purchasing the current bottling machine is closest to? 300,000 32,000 180,000 257,000 225,000 The operating cash fows for purchasing the current botting machine in years 1 - 10 are closest to? 38,000 20,000 15,500 8,375 4,500 Question 5 The NPV of purchasing the current bottling machine is closest to? 380,000 202,415 334,565 302,790 267,035 Question 6 The free cash flow at time zero for purchasing the new advanced bottling machine is closest to? 268,000 332000 300000 32.000 225.000 Question 7 The operating cash flows for purchasing the new advanced bottling machine in years 110 are closest to? 10,500 30,000 6,000 8,375 7.800,000 18,000 The NPV of purchasing the new advanced bottling machine is closest to? 269,8185 181,305 422,305 301,885 273,305 Question 9 The optimal decision for Beryl's Iced Tea is to? Purchase the new advanced bottling machine since it is the highest NPV alternative Purchase the current bottling machine since it is the highest NPV alternative Purchase the new advanced bottling machine since it is the lowest NPV alternative Continue leasing current bottling machine since it is the highest NPV alternative Continue leasing current bottling machine since it is the lowest NPV alternative The NPV of continuing to lease the current bottling machine is closest to? 252,820 311,164 248,442 466,745 620,000 Question 3 The free cash flow at time zero for purchasing the current bottling machine is closest to? 300,000 32,000 180,000 257,000 225,000 The operating cash fows for purchasing the current botting machine in years 1 - 10 are closest to? 38,000 20,000 15,500 8,375 4,500 Question 5 The NPV of purchasing the current bottling machine is closest to? 380,000 202,415 334,565 302,790 267,035 Question 6 The free cash flow at time zero for purchasing the new advanced bottling machine is closest to? 268,000 332000 300000 32.000 225.000 Question 7 The operating cash flows for purchasing the new advanced bottling machine in years 110 are closest to? 10,500 30,000 6,000 8,375 7.800,000 18,000 The NPV of purchasing the new advanced bottling machine is closest to? 269,8185 181,305 422,305 301,885 273,305 Question 9 The optimal decision for Beryl's Iced Tea is to? Purchase the new advanced bottling machine since it is the highest NPV alternative Purchase the current bottling machine since it is the highest NPV alternative Purchase the new advanced bottling machine since it is the lowest NPV alternative Continue leasing current bottling machine since it is the highest NPV alternative Continue leasing current bottling machine since it is the lowest NPV alternative