Question

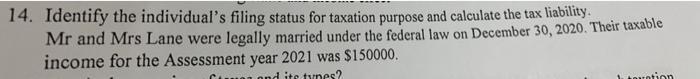

14. Identify the individual's filing status for taxation purpose and calculate the tax liability. Mr and Mrs Lane were legally married under the federal

14. Identify the individual's filing status for taxation purpose and calculate the tax liability. Mr and Mrs Lane were legally married under the federal law on December 30, 2020. Their taxable income for the Assessment year 2021 was $150000. Cumar and its types? Lovation

Step by Step Solution

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Step 12 For a couple to be eligible to file jointly they m...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Essential Statistics In Business And Economics

Authors: David Doane, Lori Seward

3rd Edition

1260239500, 978-1260239508

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App