Answered step by step

Verified Expert Solution

Question

1 Approved Answer

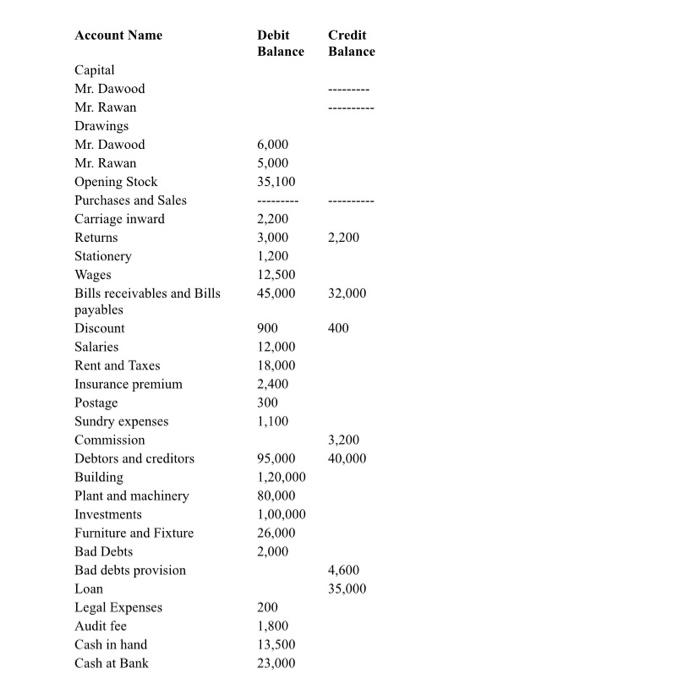

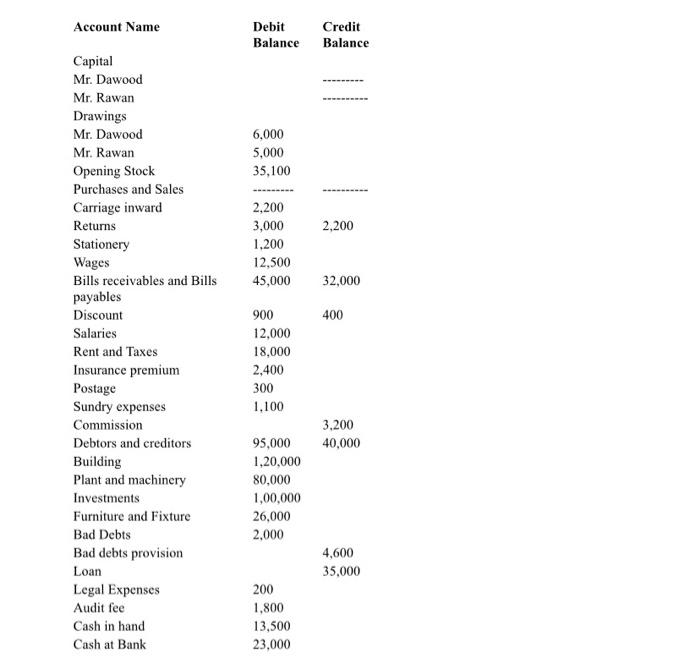

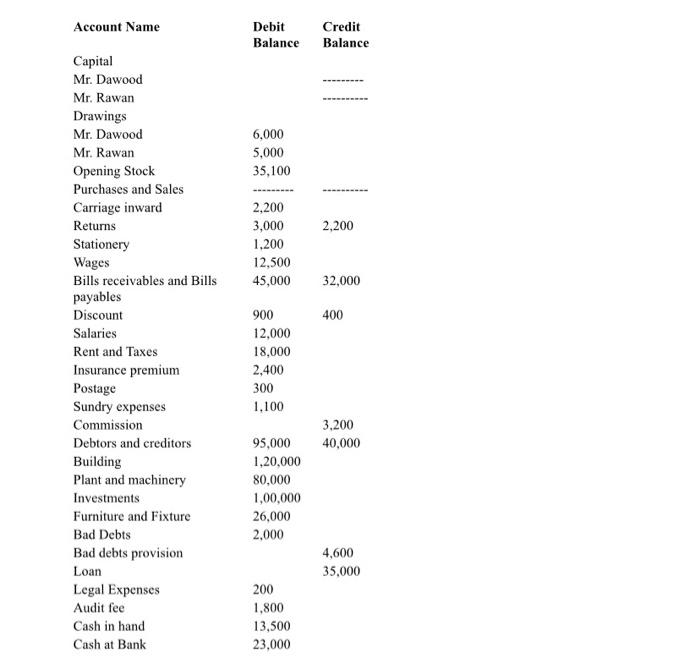

the numbrs that is not complete should be Of your choice . Account Name Debit Balance Credit Balance Capital Mr. Dawood Mr. Rawan Drawings Mr.

the numbrs that is not complete should be Of your choice .

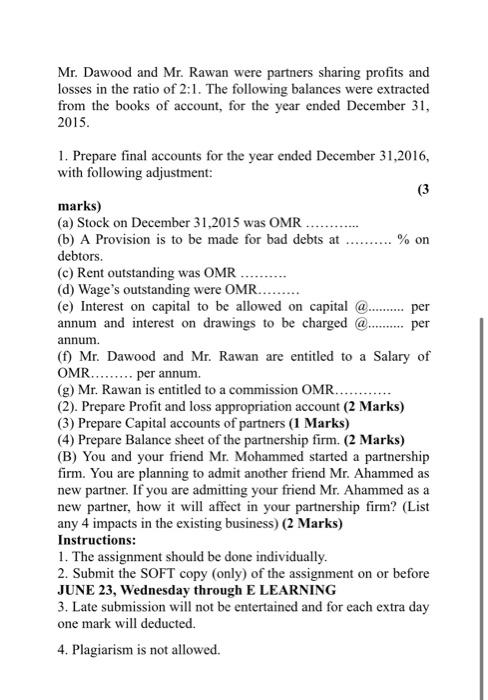

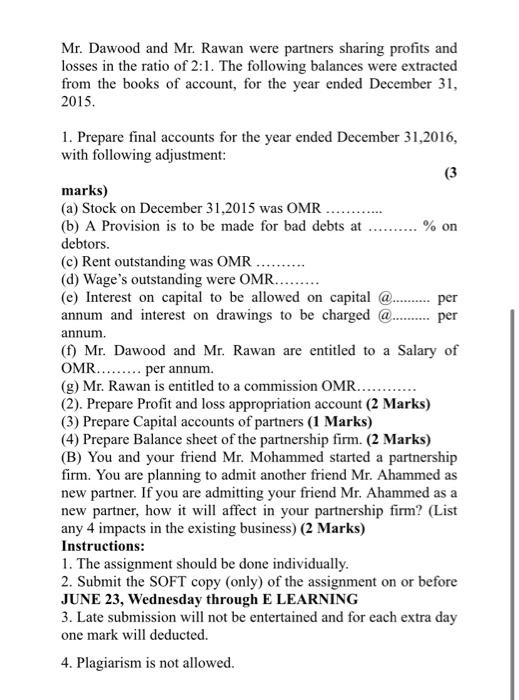

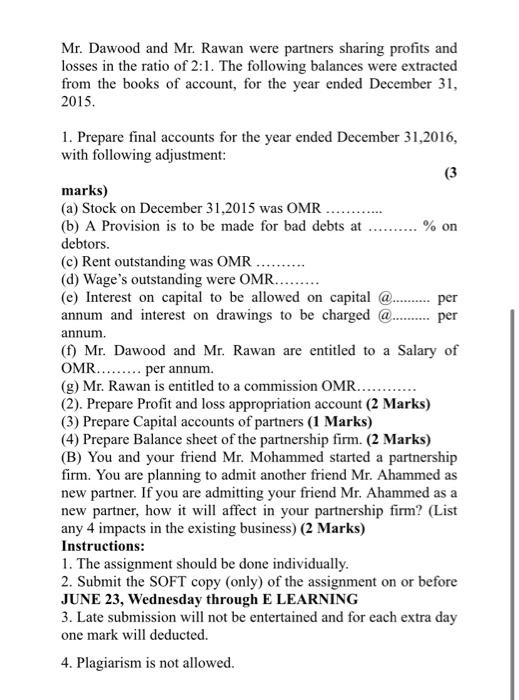

Account Name Debit Balance Credit Balance Capital Mr. Dawood Mr. Rawan Drawings Mr. Dawood 6,000 Mr. Rawan 5,000 35,100 2,200 Opening Stock Purchases and Sales Carriage inward Returns Stationery Wages Bills receivables and Bills payables Discount 2,200 3,000 1,200 12,500 45,000 32,000 900 400 Salaries 12,000 Rent and Taxes 18,000 2,400 300 Insurance premium Postage Sundry expenses Commission 1.100 3,200 40,000 Debtors and creditors Building Plant and machinery Investments 95,000 1,20,000 80,000 1,00,000 Furniture and Fixture 26,000 2,000 Bad Debts 4,600 35,000 Bad debts provision Loan Legal Expenses Audit fee 200 1,800 Cash in hand 13,500 Cash at Bank 23,000 Account Name Debit Credit Balance Balance Capital Mr. Dawood Mr. Rawan Drawings Mr. Dawood 6,000 5,000 35,100 2,200 2,200 3,000 1.200 12,500 45,000 32,000 Mr. Rawan Opening Stock Purchases and Sales Carriage inward Returns Stationery Wages Bills receivables and Bills payables Discount Salaries Rent and Taxes Insurance premium Postage Sundry expenses Commission 900 400 12,000 18,000 2,400 300 1.100 3,200 40,000 Debtors and creditors Building Plant and machinery Investments 95,000 1,20,000 80,000 1,00,000 26,000 2,000 Furniture and Fixture 4,600 35,000 Bad Debts Bad debts provision Loan Legal Expenses Audit fee Cash in hand Cash at Bank 200 1.800 13,500 23,000 Mr. Dawood and Mr. Rawan were partners sharing profits and losses in the ratio of 2:1. The following balances were extracted from the books of account, for the year ended December 31, 2015. 1. Prepare final accounts for the year ended December 31,2016, with following adjustment: (3 marks) (a) Stock on December 31,2015 was OMR ........... (b) A Provision is to be made for bad debts at debtors. (c) Rent outstanding was OMR .... (d) Wage's outstanding were OMR... (e) Interest on capital to be allowed on capital @. per annum and interest on drawings to be charged @. per % on annum. (1) Mr. Dawood and Mr. Rawan are entitled to a Salary of OMR......... per annum. (g) Mr. Rawan is entitled to a commission OMR... (2). Prepare Profit and loss appropriation account (2 Marks) (3) Prepare Capital accounts of partners (1 Marks) (4) Prepare Balance sheet of the partnership firm. (2 Marks) (B) You and your friend Mr. Mohammed started a partnership firm. You are planning to admit another friend Mr. Ahammed as new partner. If you are admitting your friend Mr. Ahammed as a new partner, how it will affect in your partnership firm? (List any 4 impacts in the existing business) (2 Marks) Instructions: 1. The assignment should be done individually. 2. Submit the SOFT copy (only) of the assignment on or before JUNE 23, Wednesday through E LEARNING 3. Late submission will not be entertained and for each extra day one mark will deducted. 4. Plagiarism is not allowed. Account Name Debit Balance Credit Balance Capital Mr. Dawood Mr. Rawan Drawings Mr. Dawood 6,000 Mr. Rawan 5,000 35,100 2,200 Opening Stock Purchases and Sales Carriage inward Returns Stationery Wages Bills receivables and Bills payables Discount 2,200 3,000 1,200 12,500 45,000 32,000 900 400 Salaries 12,000 Rent and Taxes 18,000 2,400 300 Insurance premium Postage Sundry expenses Commission 1.100 3,200 40,000 Debtors and creditors Building Plant and machinery Investments 95,000 1,20,000 80,000 1,00,000 Furniture and Fixture 26,000 2,000 Bad Debts 4,600 35,000 Bad debts provision Loan Legal Expenses Audit fee 200 1,800 Cash in hand 13,500 Cash at Bank 23,000 Account Name Debit Credit Balance Balance Capital Mr. Dawood Mr. Rawan Drawings Mr. Dawood 6,000 5,000 35,100 2,200 2,200 3,000 1.200 12,500 45,000 32,000 Mr. Rawan Opening Stock Purchases and Sales Carriage inward Returns Stationery Wages Bills receivables and Bills payables Discount Salaries Rent and Taxes Insurance premium Postage Sundry expenses Commission 900 400 12,000 18,000 2,400 300 1.100 3,200 40,000 Debtors and creditors Building Plant and machinery Investments 95,000 1,20,000 80,000 1,00,000 26,000 2,000 Furniture and Fixture 4,600 35,000 Bad Debts Bad debts provision Loan Legal Expenses Audit fee Cash in hand Cash at Bank 200 1.800 13,500 23,000 Mr. Dawood and Mr. Rawan were partners sharing profits and losses in the ratio of 2:1. The following balances were extracted from the books of account, for the year ended December 31, 2015. 1. Prepare final accounts for the year ended December 31,2016, with following adjustment: (3 marks) (a) Stock on December 31,2015 was OMR ........... (b) A Provision is to be made for bad debts at debtors. (c) Rent outstanding was OMR .... (d) Wage's outstanding were OMR... (e) Interest on capital to be allowed on capital @. per annum and interest on drawings to be charged @. per % on annum. (1) Mr. Dawood and Mr. Rawan are entitled to a Salary of OMR......... per annum. (g) Mr. Rawan is entitled to a commission OMR... (2). Prepare Profit and loss appropriation account (2 Marks) (3) Prepare Capital accounts of partners (1 Marks) (4) Prepare Balance sheet of the partnership firm. (2 Marks) (B) You and your friend Mr. Mohammed started a partnership firm. You are planning to admit another friend Mr. Ahammed as new partner. If you are admitting your friend Mr. Ahammed as a new partner, how it will affect in your partnership firm? (List any 4 impacts in the existing business) (2 Marks) Instructions: 1. The assignment should be done individually. 2. Submit the SOFT copy (only) of the assignment on or before JUNE 23, Wednesday through E LEARNING 3. Late submission will not be entertained and for each extra day one mark will deducted. 4. Plagiarism is not allowed

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started