Answered step by step

Verified Expert Solution

Question

1 Approved Answer

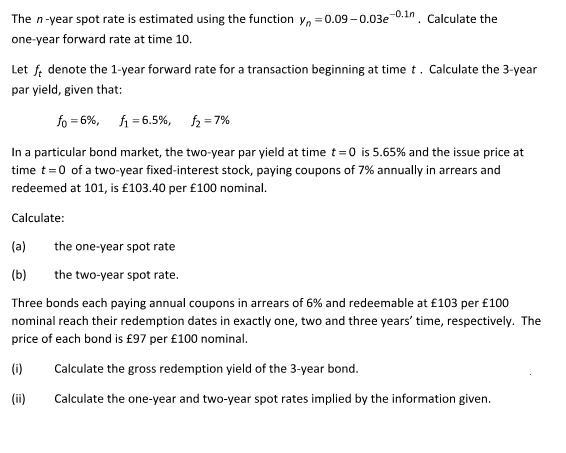

The n-year spot rate is estimated using the function yn=0.09-0.03e-0.1n. Calculate the one-year forward rate at time 10. Let ft denote the 1-year forward

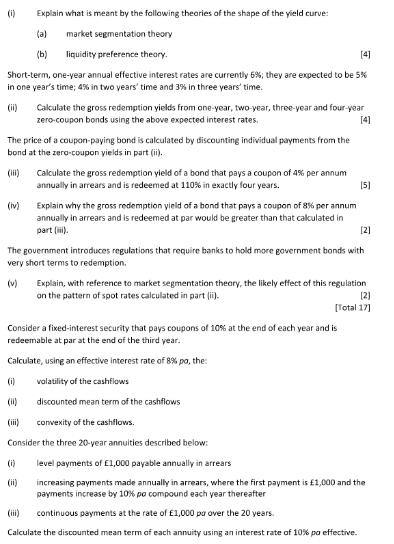

The n-year spot rate is estimated using the function yn=0.09-0.03e-0.1n. Calculate the one-year forward rate at time 10. Let ft denote the 1-year forward rate for a transaction beginning at time t. Calculate the 3-year par yield, given that: fo=6%, f1=6.5%, f=7% In a particular bond market, the two-year par yield at time t=0 is 5.65% and the issue price at time t=0 of a two-year fixed-interest stock, paying coupons of 7% annually in arrears and redeemed at 101, is 103.40 per 100 nominal. Calculate: (a) the one-year spot rate (b) the two-year spot rate. Three bonds each paying annual coupons in arrears of 6% and redeemable at 103 per 100 nominal reach their redemption dates in exactly one, two and three years' time, respectively. The price of each bond is 97 per 100 nominal. (i) Calculate the gross redemption yield of the 3-year bond. (ii) Calculate the one-year and two-year spot rates implied by the information given. (0) Explain what is meant by the following theories of the shape of the yield curve: (a) market segmentation theory (b) liquidity preference theory. [4] Short-term, one-year annual effective interest rates are currently 5%; they are expected to be 5% in one year's time; 4% in two years' time and 3% in three years' time. The price of a coupon-paying bond is calculated by discounting individual payments from the bond at the zero-coupon yields in part (ii). (ii) (iv) Calculate the gross redemption yields from one-year, two-year, three-year and four-year zero-coupon bonds using the above expected interest rates. [4] Calculate the gross redemption yield of a bond that pays a coupon of 4% per annum annually in arrears and is redeemed at 110% in exactly four years. (i) Explain why the gross redemption yield of a bond that pays a coupon of 8% per annum annually in arrears and is redeemed at par would be greater than that calculated in part(). The government introduces regulations that require banks to hold more government bonds with very short terms to redemption. (0) [5] (v) Explain, with reference to market segmentation theory, the likely effect of this regulation on the pattern of spot rates calculated in part (ii). Consider a fixed-interest security that pays coupons of 10% at the end of each year and is redeemable at par at the end of the third year. Calculate, using an effective interest rate of 8% pa, the: volatility of the cashflows discounted mean term of the cashflows (iii) convexity of the cashflows. Consider the three 20-year annuities described below: [2] [2] [Total 17] level payments of 1,000 payable annually in arrears increasing payments made annually in arrears, where the first payment is 1,000 and the payments increase by 10 % po compound each year thereafter (iii) continuous payments at the rate of 1,000 pa over the 20 years. Calculate the discounted mean term of each annuity using an interest rate of 10% po effective.

Step by Step Solution

★★★★★

3.37 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

1 The nyear spot rate is estimated using the function yn009003e01n Given n10 Substitute in the function y10009003e1 0090030367900900110079 Therefore the oneyear forward rate at time 10 is 79 2 Let f0 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started