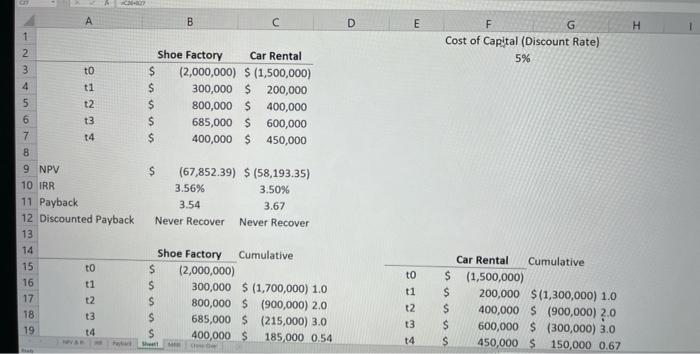

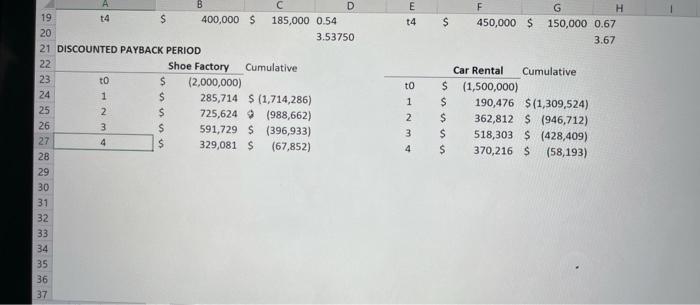

The objective of management is the maximization of shareholders' wealth. This should be the ultimate objective of capital budgeting decisions as well. Let's assume you are hired as a financial adviser for Multiple Industries Corp. Your firm has two options: . Starting an automated footwear manufacturing plant in an emerging market country. The project will have a 30-years life. Assume that all raw materials and production inputs are available in such country. The company will export the finalized shoes to USA. Is it a promising or flawed concept (How)? To give you the feeling of a visionary business leader, please watch the following video: Future Footwear Technology - Shoe Manufacturing by Robots e Starting a new car rental company in New York. This implies acquiring a new large fleet of passenger cars. The target customers will be the tourists visiting the city. Is it a promising or flawed concept (How)? To give you the feeling of a visionary business leader, please watch the following video: Car Wars: A $500M Bet, the Future of Rental Cars : Hertz Im not endorsing any particular opinion or proposition stated in these videos Please state your recommendation to your company in regards to these two options. You are expected to make (qualitative / not quantitative use of the concepts learned in Chapter 10. Feel free to consider some relevant aspects such as currency, taxation, risk, Prior to posting your thoughts and ideas, please make sure to: . Read Chapter 10 Watch the corresponding videos Make sure you will provide some factual arguments justifying your standpoint Groups will need to make an original contribution and comment on one of their peer-groups in order to qualify for full credit. Review the Netiquette Policy for more information and tips to help you communicate effectively in the discussion forums. A B D E H 1 F G Cost of Capital (Discount Rate) 5% 4 NM O o Shoe Factory Car Rental $ (2,000,000) S (1,500,000) $ 300,000 $ 200,000 $ 800,000 $ 400,000 S 685,000 $ 600,000 $ 400,000 $ 450,000 to t1 t2 t3 t4 5 6 7 B $ (67,852.39) S (58.193.35) 3.56% 3.50% 3.54 3.67 Never Recover Never Recover 9 NPV 10 IRR 11 Payback 12 Discounted Payback 13 14 15 TO 16 17 t2 18 19 to Shoe Factory Cumulative $ (2,000,000) S 300,000 $ (1,700,000) 1.0 s 800,000 $ (900,000) 2.0 685,000 $ (215,000) 3.0 400,000 $ 185,000 0.54 Car Rental Cumulative $ (1,500,000) $ 200,000 $(1,300,000) 1.0 400,000 $ (900,000) 2.0 600,000 $ (300,000) 3.0 S 450,000 $ 150,000 0.67 t2 t3 UU She E t4 $ F 450,000 $ G H 150,000 0.67 3.67 to 9 1 2 3 1 C D 19 14 400,000 $ 185,000 0.54 20 3.53750 21 DISCOUNTED PAYBACK PERIOD 22 Shoe Factory Cumulative 23 to $ (2,000,000) 24 1 $ 285,714 $ (1,714,286) 25 $ 725,624 (988,662) 26 $ 591,729 $ (396,933) 27 4 $ 329,081 (67,852) 28 29 30 31 32 33 34 35 36 37 Car Rental Cumulative $ (1,500,000) S 190,476 $(1,309,524) $ 362,812 $ (946,712) $ 518,303 $ (428,409) $ 370,216 $ (58,193) 2 3 4 om Meeting You are viewing Robinson Raye screen View Option Mirella Mori Arce Zamera Chini Robinson Reyes Barbra Palacios ACROBAT dalys CH B D H 1 E G Cost of Capital (Discount Rate) 5% JOAN 2 Shoe Factory Car Rental 3 $ (2,000,000) S (1,500,000) ti $ 300,000 $200,000 5 t2 $ 800,000 $ 400,000 6 t3 $ 685,000 $ 600,000 7 t4 $ 400,000 $ 459,000 8 9 NPV $ (67,852.39) nov(E2,04:07) 10 IRR 11 Payback 12 Discounted Payback 13 14 15 16 17 18 19 e M Unte Stop Video Participants Chat Share Screen Reaction Type here to search 99