Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The objective of the Continuing Case is to help you synthesize and integrate the various financial planning concepts you have been learning. The case

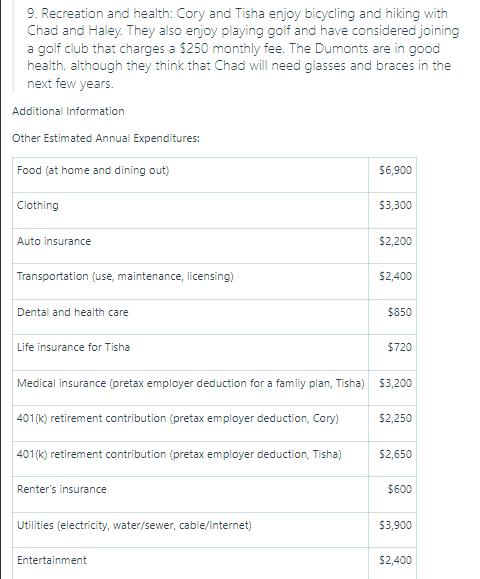

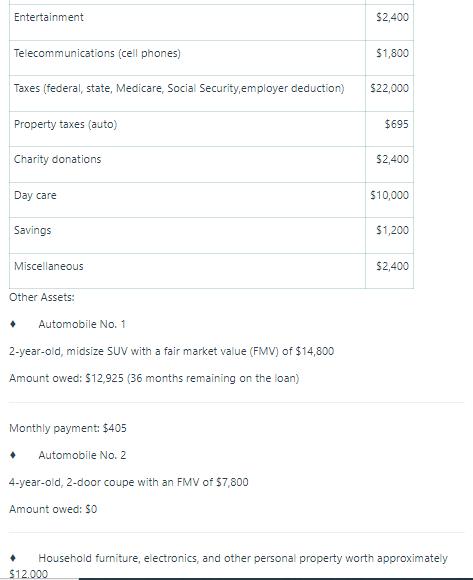

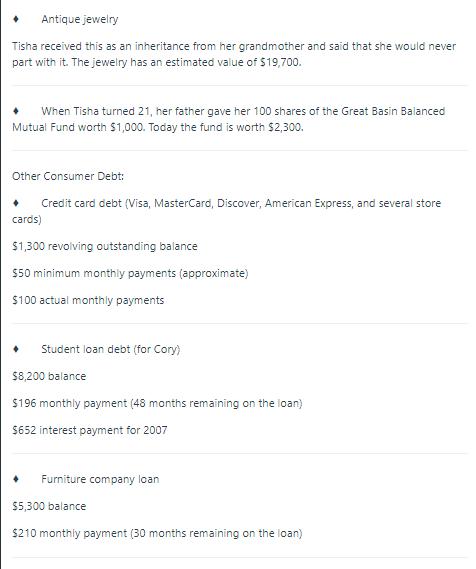

The objective of the Continuing Case is to help you synthesize and integrate the various financial planning concepts you have been learning. The case will help you apply your knowledge of constructing financial statements, assessing financial data and resources, calculating taxes, measuring risk exposures, creating specific financial plans for accumulating assets, and analyzing strengths and weaknesses in financial situations. At the end of each book part, you'll be asked to help Cory and Tisha Dumont answer their personal finance questions. By the end of the book, you'll know more about Cory and Tisha than you can imagine. Who knows-maybe you have encountered, or will encounter, the same issues that face the Dumonts. After helping the Dumonts answer their questions, perhaps you will be better equipped to achieve your own financial goals! Background Cory and Tisha Dumont recently read an article on personal financial planning in Money. The article discussed common financial dilemmas that families face throughout the life cycle. After reading the article, Cory and Tisha realized they have a lot to learn. They are considering enrolling in a personal finance course at their local university but feel they need more urgent help right now. Based on record-keeping suggestions in the Money article, Cory and Tisha have put together the following information to help you answer their personal finance questions. 1. Family: Cory and Tisha met in college when they were in their early 20s. They continued to date after graduation, and 6 years ago they got married. Cory is 31 years old. Tisha is 30 years old. Their son, Chad, just turned 4 years old, and their daughter, Haley, is 2 years old. They also have a very fat tabby cat named Ms. Cat. 2. Employment: Cory works as a store manager and makes $45,000 a year. Tisha works as an accountant and earns $53,000 a year. 3. Housing: The Dumonts currently rent a three-bedroom townhome for $2,000 per month, but they hope to buy a house. Tisha indicated that she would like to purchase a home within the next 3 to 5 years. The Dumonts are well on their way to achieving their goal. They opted for a small wedding and applied all gifts and family contributions to a market index mutual fund for their dream" house. When they last checked, the fund account had a balance of $13,000. Financial Concerns 1. Taxes: Cory and Tisha have been surprised at the amount of federal, state, Social Security, and Medicare taxes withheld from their pay. They aren't sure if the tax calculations are correct. 2. Insurance: They are unsure about the amount of automobile, home, health, and life insurance they need. Up until this point, they have always chosen the lowest premiums without much regard to coverage. They were a little amazed to learn recently that the cash value of Tisha's life insurance policy is only $1,800, although they have paid annual premiums of $720 for several years. 3. Credit and cash management: Cory and Tisha are curious about the use of credit. It seems they receive new credit card offers each week that promise a low interest rate and other bonuses. They aren't sure if they should be taking advantage of these offers or keeping their current credit cards. They are often surprised by the amount charged on their monthly credit card statements, and although they make a $100 payment each month, their combined account balances always seem to hover around $1,300. It is common for them to withdraw money from bank ATMs to cover daily expenses, and they usually carry about $100 in cash between them. Even so, it seems they often rely on their credit cards to make ends meet. 4. Savings: Cory and Tisha were intrigued by one of the recommendations made in the Money article: "Pay yourself first." In fact, it was this statement that prompted the Dumonts to review their finances. They like the concept but are unsure of how to go about implementing such a goal. They currently have a savings account balance of $2,500 that earns 3 percent in annual interest. The bank where they have their checking account requires them to keep a minimum balance of $1,000 in order to earn annual interest of 0.75 percent. Their current checking account balance is $1,800. 5. College savings: Cory and Tisha are concerned about college expenses for Chad and Haley, as they have experienced the impact of long-term student loan payments on their own financial situation. 6. Retirement savings: Cory and Tisha both know that they participate in a "qualified retirement plan" at work, but they don't know exactly what that means. They do not currently have an individual retirement account (IRA) or access to profitsharing plans. A recent statement from Cory's former employer indicated a value of $2,500 in retirement funds that he left with that company. 7. Risk: Cory is quick to point out that he doesn't like financial surprises. Tisha, on the other hand, indicated that she is willing to take financial risks when she thinks the returns are worthwhile. 8. Estate planning issues: The Dumonts do not have a will or any other estate planning documents. 9. Recreation and health: Cory and Tisha enjoy bicycling and hiking with Chad and Haley. They also enjoy playing golf and have considered joining a golf club that charges a $250 monthly fee. The Dumonts are in good health, although they think that Chad will need glasses and braces in the next few years. Additional Information Other Estimated Annual Expenditures: Food (at home and dining out) Clothing Auto insurance Transportation (use, maintenance, licensing) Dental and health care Life insurance for Tisha 401(k) retirement contribution (pretax employer deduction, Tisha) Renter's insurance Utilities (electricity, water/sewer, cable/Internet) $6,900 Entertainment $3,300 $2,200 Medical insurance (pretax employer deduction for a family plan, Tisha) $3,200 401(k) retirement contribution (pretax employer deduction, Cory) $2,400 $850 $720 $2,250 $2,650 $600 $3,900 $2,400 Entertainment Telecommunications (cell phones) Taxes (federal, state, Medicare, Social Security,employer deduction) Property taxes (auto) Charity donations Day care Savings Miscellaneous Other Assets: Automobile No. 1 2-year-old, midsize SUV with a fair market value (FMV) of $14,800 Amount owed: $12,925 (36 months remaining on the loan) Monthly payment: $405 Automobile No. 2 4-year-old, 2-door coupe with an FMV of $7,800 Amount owed: $0 $2,400 $12.000 $1,800 $22,000 $695 $2,400 $10,000 $1,200 $2,400 Household furniture, electronics, and other personal property worth approximately Antique jewelry Tisha received this as an inheritance from her grandmother and said that she would never part with it. The jewelry has an estimated value of $19,700. When Tisha turned 21, her father gave her 100 shares of the Great Basin Balanced Mutual Fund worth $1,000. Today the fund is worth $2,300. Other Consumer Debt: Credit card debt (Visa, MasterCard, Discover, American Express, and several store cards) $1,300 revolving outstanding balance $50 minimum monthly payments (approximate) $100 actual monthly payments. Student loan debt (for Cory) $8,200 balance $196 monthly payment (48 months remaining on the loan) $652 interest payment for 2007 Furniture company loan $5,300 balance $210 monthly payment (30 months remaining on the loan) $5,300 balance $210 monthly payment (30 months remaining on the loan) Part I: Financial Planning Using information from the income and expense statements and the balance sheet, calculate the following ratios: a. Current ratio b. Month's living expenses covered ratio c. Debt ratio d. Long-term debt coverage ratio e. Savings ratio

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the requested ratios for Cory and Tisha Dumont well use the provided income and expense statements and balance sheet Lets compute each ra...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started