Answered step by step

Verified Expert Solution

Question

1 Approved Answer

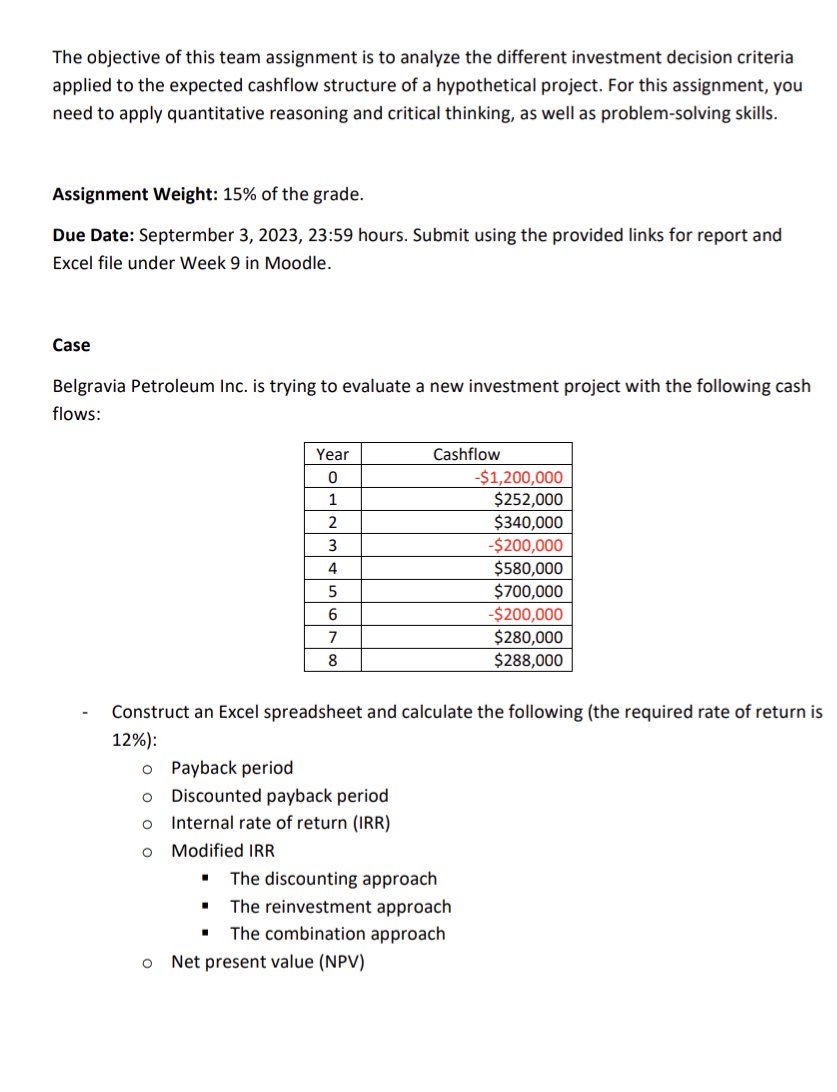

The objective of this team assignment is to analyze the different investment decision criteria applied to the expected cashflow structure of a hypothetical project.

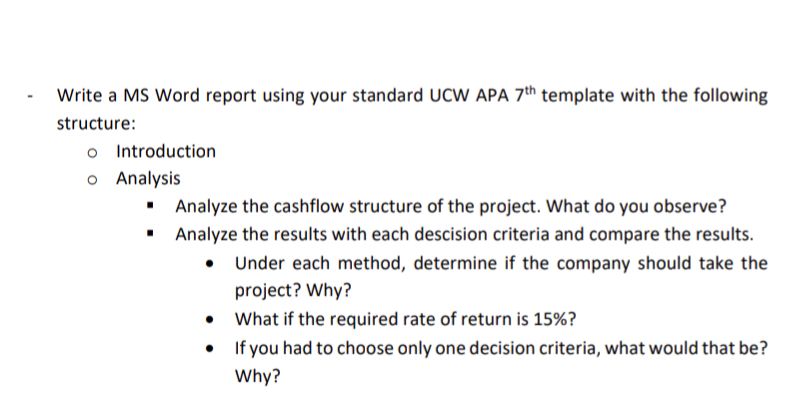

The objective of this team assignment is to analyze the different investment decision criteria applied to the expected cashflow structure of a hypothetical project. For this assignment, you need to apply quantitative reasoning and critical thinking, as well as problem-solving skills. Assignment Weight: 15% of the grade. Due Date: September 3, 2023, 23:59 hours. Submit using the provided links for report and Excel file under Week 9 in Moodle. Case Belgravia Petroleum Inc. is trying to evaluate a new investment project with the following cash flows: Year 0 1 2 3 4 5 6 7 8 Cashflow The discounting approach The reinvestment approach The combination approach O Net present value (NPV) -$1,200,000 $252,000 $340,000 Construct an Excel spreadsheet and calculate the following (the required rate of return is 12%): o Payback period O Discounted payback period O Internal rate of return (IRR) Modified IRR O -$200,000 $580,000 $700,000 -$200,000 $280,000 $288,000 Write a MS Word report using your standard UCW APA 7th template with the following structure: o Introduction o Analysis Analyze the cashflow structure of the project. What do you observe? Analyze the results with each descision criteria and compare the results. Under each method, determine if the company should take the project? Why? What if the required rate of return is 15%? If you had to choose only one decision criteria, what would that be? Why?

Step by Step Solution

★★★★★

3.37 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

1 Payback Period The payback period is the length of time required to recover the initial investment To calculate the payback period you need to deter...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started