Answered step by step

Verified Expert Solution

Question

1 Approved Answer

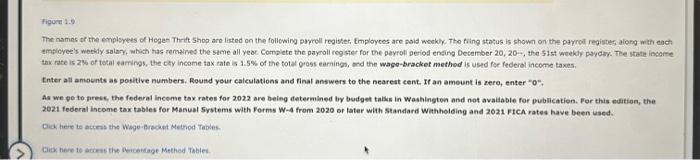

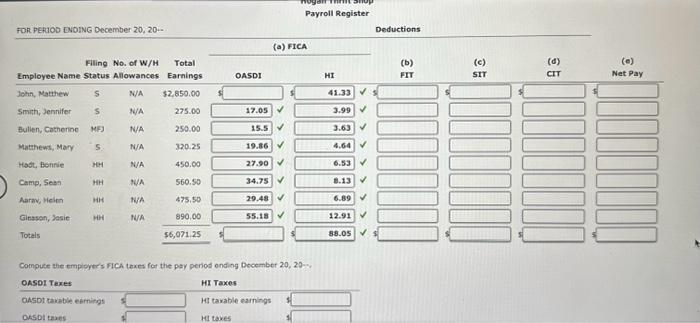

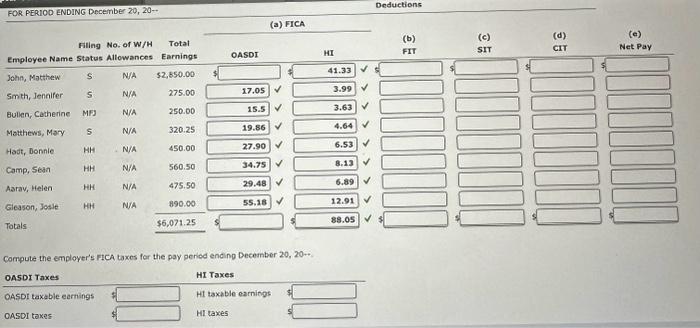

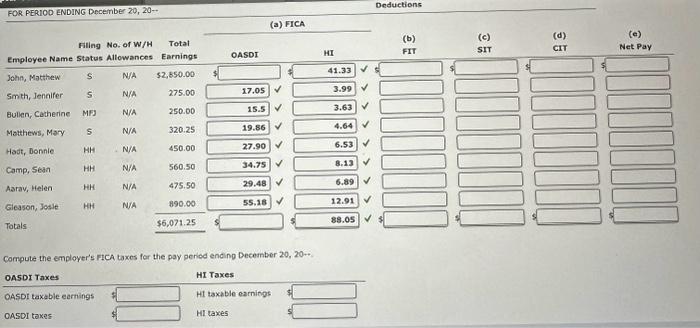

The of the employees of Hogan Thrift Shop are listed on the following payroll register. Employees are paid weeklyThe status is shown on the payroll

The of the employees of Hogan Thrift Shop are listed on the following payroll register. Employees are paid weeklyThe status is shown on the payroll registeralong with each employee's weekly which has remained the all yearComplete the register for the payroll period ending December 20, 20-, the 51st weekly paydayThe state income tax rate is 2% of total earnings, the income is of the total gross earningsand the wage -bracket method is used for federal income taxes

The names or the emplsyees of Hogen Thrit shop are listed an the following puproll register, tmployces are poid woekly, The fing stacus is shown on the parrol registes, aiong with each employee's weddy salay, which has remained the stme all yeot. Complete the paynoli reg ster for the payrol period ensing Decamber 20,20 , the sist weekdy parday. Tte state incame tax rate is 2% of total qarnings, the cty inceme tax tate is 3.5% of the totat grass eamingn, and the wage-bracket methed is ustd for federol income taxes, tnter all amoents as positive numbers. Rousd your calculations and finat answers to the neareat cent. It an amount is aero, enter "0", An we po to presc, the federal inceme tax rates for 2022 are being fetermlned by bodget tabs in washingten and not avaiable for publicatien. For this eation, the 2021 federal income tax tables for Manual 5ystems with Forms W-4 from 2020 or later whth standard Wathholding and 2021 Fich rates have been used. Cid here te ackes the Wage-Brecant Metrod Tabies. Ciak heve to acrest the Mewsestage Methed Tabled Compute the empioytr's fich texes for the pay period onding becember 20,20=. Compute the employer's FICA taxos for the pay peried ending December 20,20+ The names or the emplsyees of Hogen Thrit shop are listed an the following puproll register, tmployces are poid woekly, The fing stacus is shown on the parrol registes, aiong with each employee's weddy salay, which has remained the stme all yeot. Complete the paynoli reg ster for the payrol period ensing Decamber 20,20 , the sist weekdy parday. Tte state incame tax rate is 2% of total qarnings, the cty inceme tax tate is 3.5% of the totat grass eamingn, and the wage-bracket methed is ustd for federol income taxes, tnter all amoents as positive numbers. Rousd your calculations and finat answers to the neareat cent. It an amount is aero, enter "0", An we po to presc, the federal inceme tax rates for 2022 are being fetermlned by bodget tabs in washingten and not avaiable for publicatien. For this eation, the 2021 federal income tax tables for Manual 5ystems with Forms W-4 from 2020 or later whth standard Wathholding and 2021 Fich rates have been used. Cid here te ackes the Wage-Brecant Metrod Tabies. Ciak heve to acrest the Mewsestage Methed Tabled Compute the empioytr's fich texes for the pay period onding becember 20,20=. Compute the employer's FICA taxos for the pay peried ending December 20,20+ Enter amounts as positive numbersRound your and final answers to the nearest centan amount , enter "0"

As we to press, the federal income tax rates for 2022 are being determined by budget talks in Washington and not available for publicationFor this edition, the 2021 federal income tax tables for Manual Systems with Forms W-4 from 2020 or later with Standard Withholding and 2021 FICA rates have been used

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started