Question

The oil market has been hit by an unprecedented combination of negative-demand and positive supply shocks due to the COVID-19 pandemic. Oil prices suffered an

The oil market has been hit by an unprecedented combination of negative-demand and positive supply shocks due to the COVID-19 pandemic.

Oil prices suffered an historic collapse after Saudi Arabia shocked the market by launching a price war against onetime ally Russia.

On 20 April 2020, the May contract for West Texas Intermediate (WTI) oil delivery fell into negative territory, closing at -$37.63 on the NASDAQ stock exchange.

Question

a.Use the knowledge you learned from Risk Management to explain the meaning of long an oil futures contract and reasons that the May contract for West Texas Intermediate (WIT) oil fell into negative.

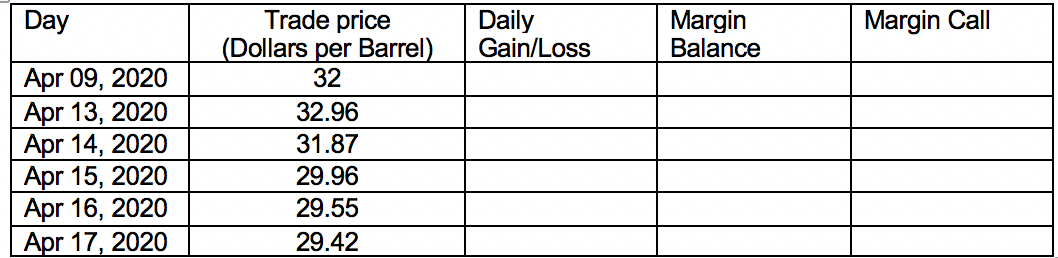

b. A trader bought two July futures contracts. Each contract is for the delivery of 1,000 barrels. The initial margin is $11,250 per contract and the maintenance margin is $9,000. Calculate the daily gain and loss and margin account balance from April 13, 2020 to April 15, 2020 and explain when the investor will receive a margin call and how much does he need to top up?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started