Answered step by step

Verified Expert Solution

Question

1 Approved Answer

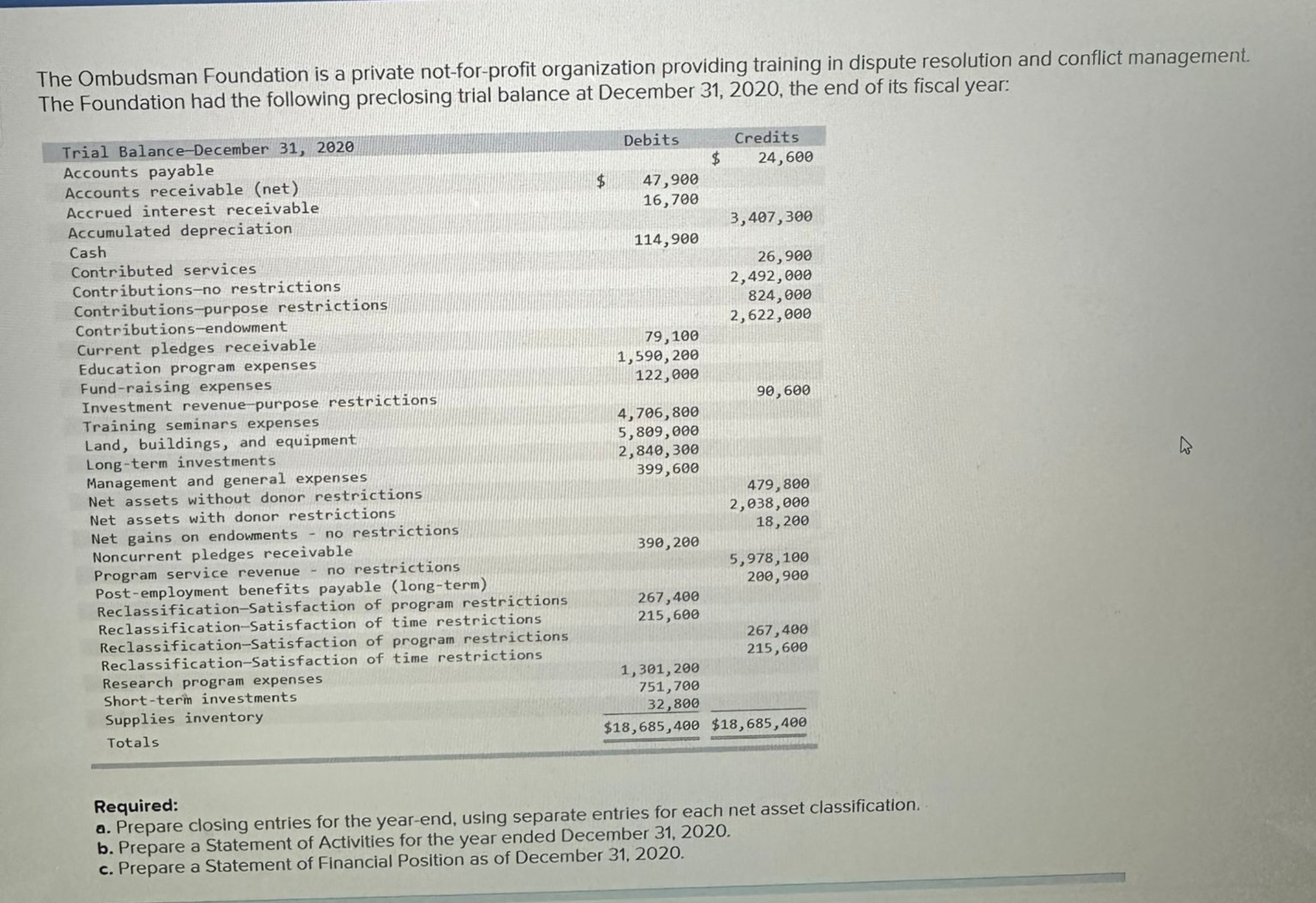

The Ombudsman Foundation is a private not - for - profit organization providing training in dispute resolution and conflict management. Required A Required B Required

The Ombudsman Foundation is a private notforprofit organization providing training in dispute resolution and conflict management. Required

Required B

Required

Prepare closing entries for the yearend, using separate entries for each net asset classification. If no entry is required for a transactionevent select No Journal Entry Required" in the first account field.

tableNoEvent,General Journal,Debit,CreditReclassification to Net Assets without Donor RestrictionsExpiration of Time,Reclassification to Net Assets without Donor RestrictionsSatisfaction of Pros,Contributionswithout Donor Restrictions,Program Service Revenuewithout Donor Restrictions,Net Gains on Endowment Investmentswithout Donor Restrictions,Contributed Serviceswithout Donor Restrictions,Training Seminar Expense,,Education Program Expense,,Research Program Expense,,Management and General Expense,,FundRaising Expense,,Net Assetswithout Donor Restrictions,,Contributions to Programswith Donor Restrictions,Investment Revenue with Donor Restrictions,Contributions to Endowmentwith Donor Restrictions,Reclassification from Net Assets with Donor Restrictions Expiration of Tim VReclassification from Net Assets with Donor RestrictionsSatisfaction of PrNet Assetswith Donor Restrictions,,times

Prev

of

Next tableStatement of ActivitiesFor the Year Ended December tableNet AssetswithoutDonorRestrictionstableNet Assetswith DonorRestrictionsTotalRevenuesProgram Service Revenue,$$Contribution Revenues,times Contributed Services,Investment Revenue,,Net Gains on Endowment Investments,gamma Net Assets Released from RestrictionSatisfaction of Time Restrictions,Satisfaction of Program Restrictions,vvTotal Revenues,ExpensesTraining Seminar Expenses,Education Program Expenses,Research Program Expenses,Total Program Service Expenses,FundRaising Expenses,Management and General Expenses,Total Supporting Service Expenses,Total Expenses,Increase in Net Assets,times tableNet Assets January Net Assets December $ c Prepare a Statement of Financial Position as of December

Answer is not complete.

Complete this question by entering your answers in the tabs below.

Required

Required B

Required C

Prepare a Statement of Financial Position as of December

tableOMBUDSMAN FOUNDATIONStatement of Financial PositionAs of December Current Assets:CashVShortterm Investments,Supplies Inventories,Receivables:Accounts Receivable netPledges Receivable netAccrued Interest Receivable,Total Current Assets,,,$Noncurrent Assets:Pledges Receivable netLongterm Investments,Land Buildings, and Equipment netTotal Noncurrent Assets,,,

Mc

Graw

Prey

of

Next

points

tableAccounts Receivable netPledges Receivable netAccrued Interest Receivable,Total Current Assets,,,$Noncurrent Assets:Pledges Receivable netLongterm Investments,Land Buildings, and Equipment netVTotal Noncurrent Assets,,,Total Assets,,,$Current Liabilities:Accounts Payable,oxPhi Total Current Liabilities,,,Noncurrent Liabilities:Postemployment Benefits Payable,Total Noncurrent Liabilities,,,Total Liabilities,,$Net Assets:"Without Donor Restrictions,VWith Donor Restrictions,oTotal Net Assets,,$Total Liabilities and Net Assets,,$

The Foundation had the following preclosing trial balance at December the end of its fiscal year:

Required:

a Prepare closing entries for the yearend, using separate entries for each net asset classification.

b Prepare a Statement of Activities for the year ended December

c Prepare a Statement of Financial Position as of December

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started