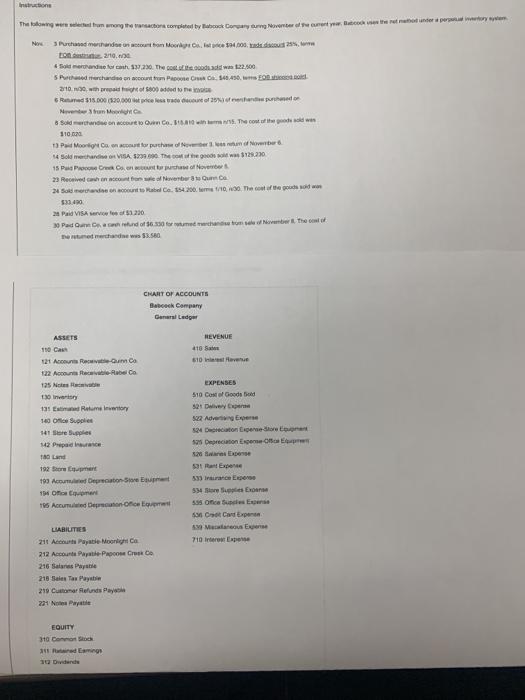

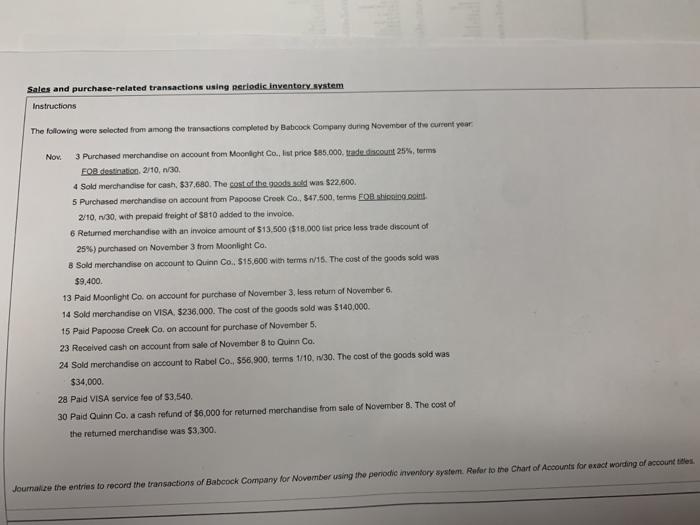

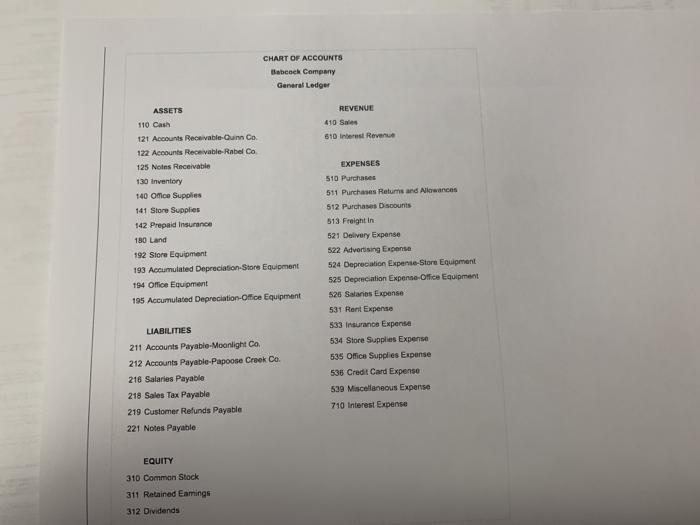

The one was trom mong actora torkated by the Corey tung November of want to the pet rated under per vetem Now Puchared methandise on tonton Holistic 400, do 25 20. Somerandite .230. The cos.dud 122.500 Sherchandise on coutume, 540.430, Food 20.90wth 609 done R$15.000 (320,000 price of shared November Soldane on to another. The concept 110.00 1) Porto Canto por 16 So the VISA 5239.00 The of the goods $123.230 15 Pu Present of November 23 Received when we were to Ouro 24 Soldated Co. 154.20. 1/1000. The cost of the good old 53.400 2 Paid VISA 9.230 Pedrasud of 630 med se to over the cost of et merchandise was 3.0 CHART OF ACCOUNTS Book Company Ganas Lugar REVENUE 118 510 ASSETS 110 CM 121 Autunno 122 Acebedo 125 New 130 invity 131 Raluminio 10 Supplies 141 Sare Supplies EXPENSES 510 Con Good 321 Delivery 22 Adv Expense Land 192 Store Cat 199 A Deprecation Store 1 on tamene 165 Acum Deus Derection Es 520 Expos 591 Rant Expense 5 Lance ES 54 Box Expert 710 Interop LIABILITIES 21 Arayati Moore 212 Account Payati Papcom Crus 216 Sanas Paste 215 Sien Tax Pays 219 Customer Refunds Pay 221 Noya EQUITY 310 Como Langs 10 Didende Sales and purchase-related transactions using periodic Inventory system Instructions The following were selected from among the transactions completed by Babcock Company during November of the current year Nov. 3 Purchased merchandise on account from Moonlight Co., lat price $85.000, sade.discount 25% terms EOB.destination, 2/10, 1/30, 4 Sold merchandise for cash. $37.680. The cost of the goods sold was $22.600 5 Purchased merchandise on account from Papoose Creek Co., 547.500,terms FOB shopoint 2/10, 1/30, with prepaid freight of $810 added to the invoice 6 Returned merchandise with an invoice amount of $13.500 ($18.000 list price less brade discount of 25%) purchased on November 3 from Moonlight Co. B Sold merchandise on account to Quinn Co. $15,600 with terms /15. The cost of the goods sold was $9,400 13 Paid Moonlight Co. on account for purchase of November 3. less retum of November 6, 14 Sold merchandise on VISA $236.000. The cost of the goods sold was $140,000 15 Paid Papoose Creek Co. on account for purchase of November 5. 23 Received cash on account from sale of November 8 to Quinn Co. 24 Sold merchandise on account to Rabel Co., $56,900, terms 1/10, 1/30. The cost of the goods sold was $34.000 28 Paid VISA service fee of $3.540. 30 Paid Quinn Co. a cash refund of $6,000 for returned merchandise from sale of November 8. The cost of the returned merchandise was $3,300. Journalize the entries to record the transactions of Babcock Company for November using the periodic inventory syster. Refer to the Chart of Accounts for exact wording of account the CHART OF ACCOUNTS Babcock Company General Ledger REVENUE 410 Sales 510 Interest Revenue ASSETS 110 Cash 121 Accounts Receivable-Quinn Co. 122 Accounts Recevable-Rabel Co 125 Notes Receivable 130 Inventory 140 Omce Supplies 141 Store Supplies 142 Prepaid Insurance 180 Land 192 Store Equipment 193 Accumulated Depreciation Store Equipment 194 Office Equipment 195 Accumulated Depreciation Office Equipment EXPENSES 510 Purchases 511 Purchases Returns and Allowances 512 Purchases Discounts 513 Freight in 521 Delivery Expense 522 Advertising Expense 524 Depreciation Expense-Store Equipment 525 Depreciation Expense-Office Equipment 526 Salanes Expense 531 Rent Expense 533 Insurance Expense 534 Store Supplies Expense 535 Office Supplies Expense 538 Credit Card Expense 539 Miscellaneous Expense 710 Interest Expense LIABILITIES 211 Accounts Payable-Moonlight Co. 212 Accounts Payable-Papoose Creek Co. 216 Salaries Payable 218 Sales Tax Payable 219 Customer Refunds Payable 221 Notes Payable EQUITY 310 Common Stock 311 Retained Eamings 312 Dividends