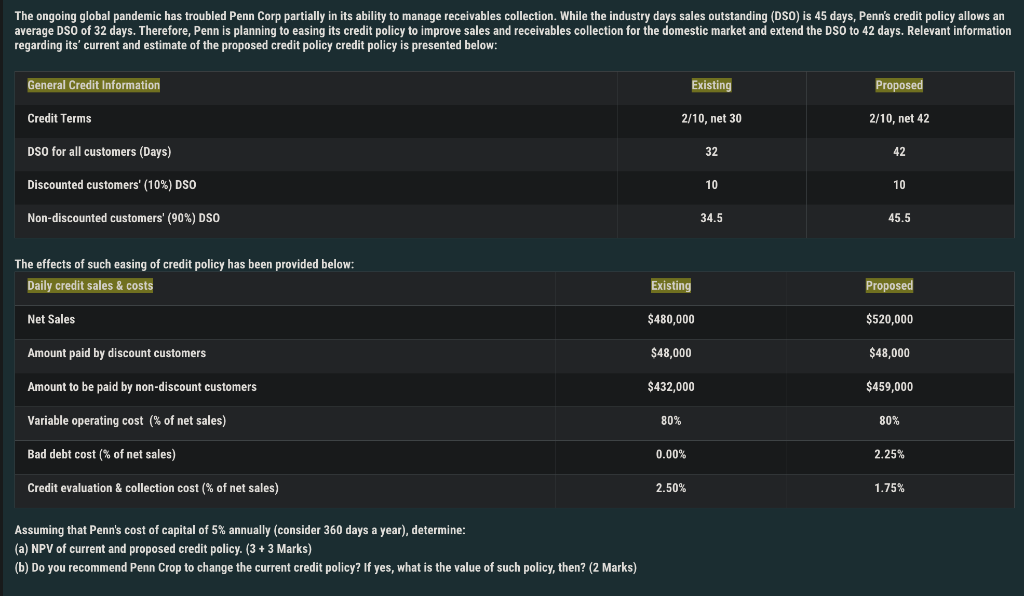

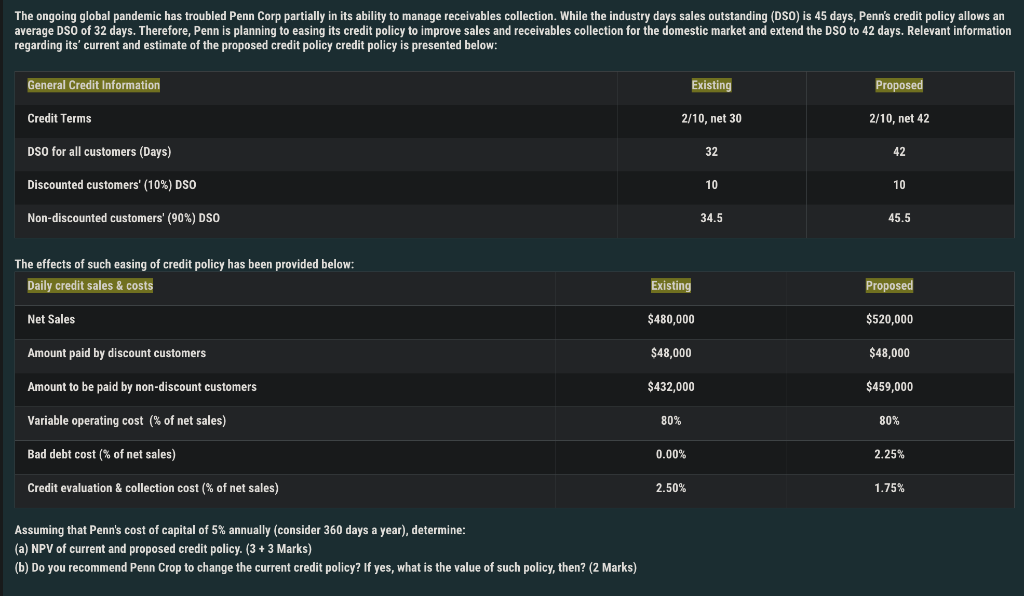

The ongoing global pandemic has troubled Penn Corp partially in its ability to manage receivables collection. While the industry days sales outstanding (DSO) is 45 days, Penn's credit policy allows an average DSO of 32 days. Therefore, Penn is planning to easing its credit policy to improve sales and receivables collection for the domestic market and extend the DSO to 42 days. Relevant information regarding its' current and estimate of the proposed credit policy credit policy is presented below: General Credit Information Existing Proposed 2/10, net 42 Credit Terms 2/10, net 30 DSO for all customers (Days) 32 42 Discounted customers' (10%) DSO 10 10 Non-discounted customers' (90%) DSO 34.5 45.5 The effects of such easing of credit policy has been provided below: Daily credit sales & costs Existing Proposed Net Sales $480,000 $520,000 Amount paid by discount customers $48,000 $48,000 Amount to be paid by non-discount customers $432,000 $459,000 Variable operating cost (% of net sales) 80% 80% Bad debt cost (% of net sales) 0.00% 2.25% Credit evaluation & collection cost (% of net sales) 2.50% 1.75% Assuming that Penn's cost of capital of 5% annually (consider 360 days a year), determine: (a) NPV of current and proposed credit policy. (3 + 3 Marks) (b) Do you recommend Penn Crop to change the current credit policy? If yes, what is the value of such policy, then? (2 Marks) The ongoing global pandemic has troubled Penn Corp partially in its ability to manage receivables collection. While the industry days sales outstanding (DSO) is 45 days, Penn's credit policy allows an average DSO of 32 days. Therefore, Penn is planning to easing its credit policy to improve sales and receivables collection for the domestic market and extend the DSO to 42 days. Relevant information regarding its' current and estimate of the proposed credit policy credit policy is presented below: General Credit Information Existing Proposed 2/10, net 42 Credit Terms 2/10, net 30 DSO for all customers (Days) 32 42 Discounted customers' (10%) DSO 10 10 Non-discounted customers' (90%) DSO 34.5 45.5 The effects of such easing of credit policy has been provided below: Daily credit sales & costs Existing Proposed Net Sales $480,000 $520,000 Amount paid by discount customers $48,000 $48,000 Amount to be paid by non-discount customers $432,000 $459,000 Variable operating cost (% of net sales) 80% 80% Bad debt cost (% of net sales) 0.00% 2.25% Credit evaluation & collection cost (% of net sales) 2.50% 1.75% Assuming that Penn's cost of capital of 5% annually (consider 360 days a year), determine: (a) NPV of current and proposed credit policy. (3 + 3 Marks) (b) Do you recommend Penn Crop to change the current credit policy? If yes, what is the value of such policy, then? (2 Marks)