Answered step by step

Verified Expert Solution

Question

1 Approved Answer

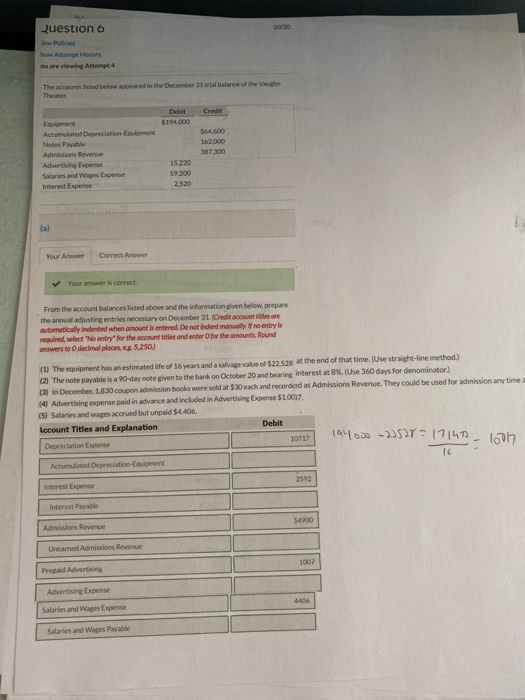

the only part i need help with is interest expense and imterest payable part. Why is the debit 2592 and credit 2592( i know that

the only part i need help with is interest expense and imterest payable part. Why is the debit 2592 and credit 2592( i know that there isn't any credit part on the picture i sent you, that was my fault)

Question 6 20/20 how Attempt History ou are viewing Attempt 4 The accounts listed below appeared in the December 31 trial balance of the Vaughn Theater Credit Debit $144,000 SMO 162.000 387 300 Lovipment Accumulated Depreciation-Coupment Notes Payable Admissions Revenue Advertising Expense Salaries and Wages Expense Interest Expense 15.220 59,200 2.520 (5) Your Awer Correct Answer Your answer is correct. From the account balances listed above and the information given below, prepare the annual adjusting entries necessary on December 31. (Credit account des are automatically indented when amount is entered. Do not indent manually no entry is required, select "No entry for the account titles and enter for the amounts. Round answers to decimal places, . 5.250) 11) The equipment has an estimated life of 16 years and a salvage value of 522.528 at the end of that time. (Use straight-line method.) (2) The note payable is a 90-day note given to the bank on October 20 and bearing interest at 8%. (Use 360 days for denominator) (3) In December, 1.830 coupon admission books were sold at $30 each and recorded as Admissions Revenue. They could be used for admission any time 14 Advertising expense paid in advance and included in Advertising Expense $1.007. (5) Salaries and wages accrued but unpaid $4,406. Iccount Titles and Explanation Debit Depreciation Expense 10717 1940-23527: 171472 loon Accumulated Depreciation Equipment 2592 Interest Expense Interest Payable 54900 Admissions Revenue Unearned Admissions Revenue 1007 Prepaid Advertising Advertising Expense Salaries and Wages Expense Salaries and Wages Payable Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started