Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 10 Between 1994 and 2005, China pegged the value of the yuan to the dollar at a fixed exchange rate of 8.28 yuan

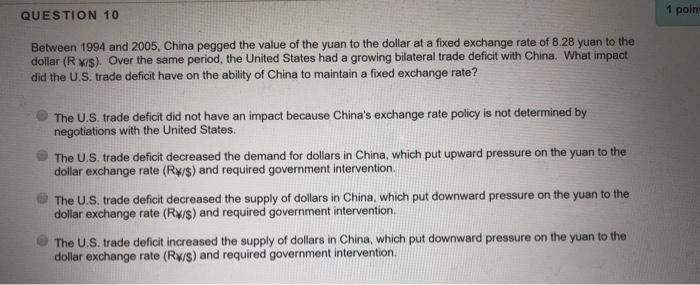

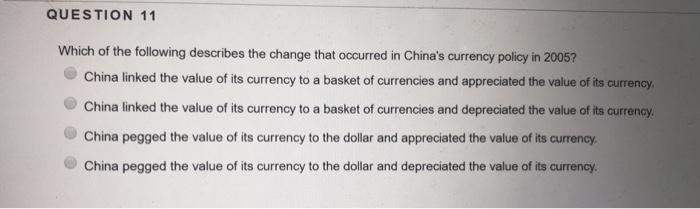

QUESTION 10 Between 1994 and 2005, China pegged the value of the yuan to the dollar at a fixed exchange rate of 8.28 yuan to the dollar (R X/$). Over the same period, the United States had a growing bilateral trade deficit with China. What impact did the U.S. trade deficit have on the ability of China to maintain a fixed exchange rate? The U.S. trade deficit did not have an impact because China's exchange rate policy is not determined by negotiations with the United States. The U.S. trade deficit decreased the demand for dollars in China, which put upward pressure on the yuan to the dollar exchange rate (Ry/s) and required government intervention. The U.S. trade deficit decreased the supply of dollars in China, which put downward pressure on the yuan to the dollar exchange rate (Ry/$) and required government intervention. The U.S. trade deficit increased the supply of dollars in China, which put downward pressure on the yuan to the dollar exchange rate (Ry/s) and required government intervention. 1 poin QUESTION 11 Which of the following describes the change that occurred in China's currency policy in 2005? China linked the value of its currency to a basket of currencies and appreciated the value of its currency. China linked the value of its currency to a basket of currencies and depreciated the value of its currency. China pegged the value of its currency to the dollar and appreciated the value of its currency. China pegged the value of its currency to the dollar and depreciated the value of its currency.

Step by Step Solution

★★★★★

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

10 B Increased level of US trade deficit depreciated the value of US dol...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started