Answered step by step

Verified Expert Solution

Question

1 Approved Answer

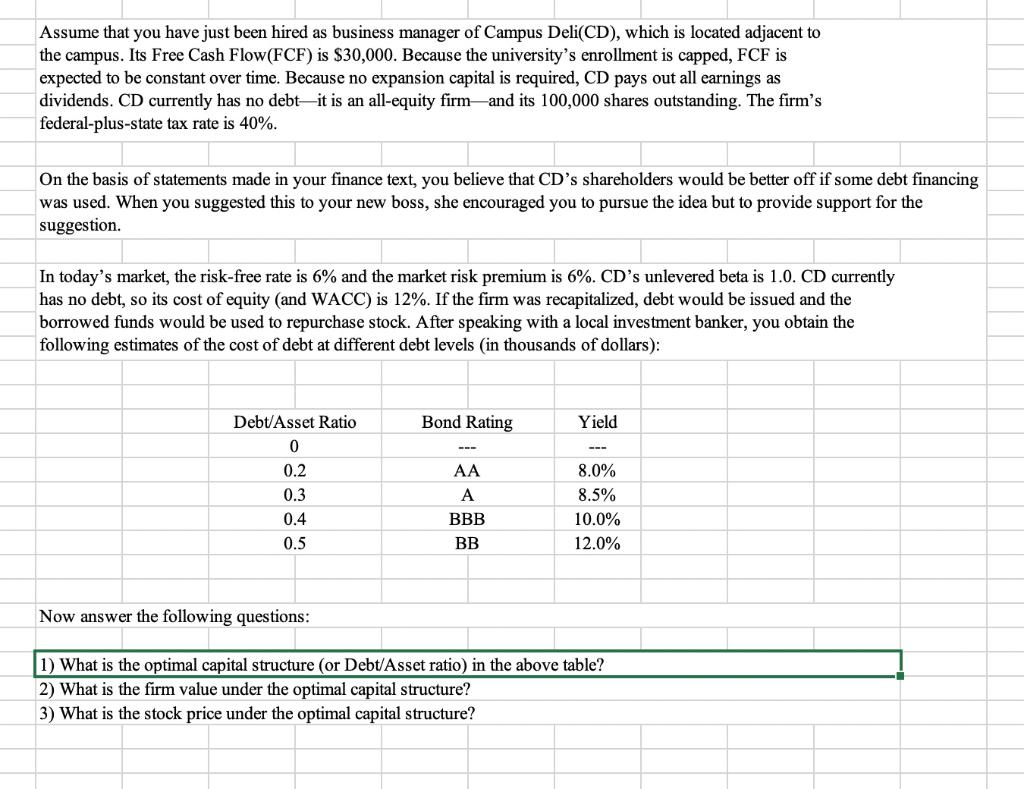

The optimal combination of debt and equity is achieved when the marginal benefit of tax shield equals the marginal cost of default risk, where the

The optimal combination of debt and equity is achieved when the marginal benefit of tax shield equals the marginal cost of default risk, where the wealth of equity holders is maximized. The attached excel file contains the background of a firm and available funding sources. Please use the relevant information to find the optimal capital structure and solve other related questions.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started