Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The options on the stock of the Nestle (Malaysia) Berhad have the following input values: Spot price of the underlying asset RM55 Option's exercise or

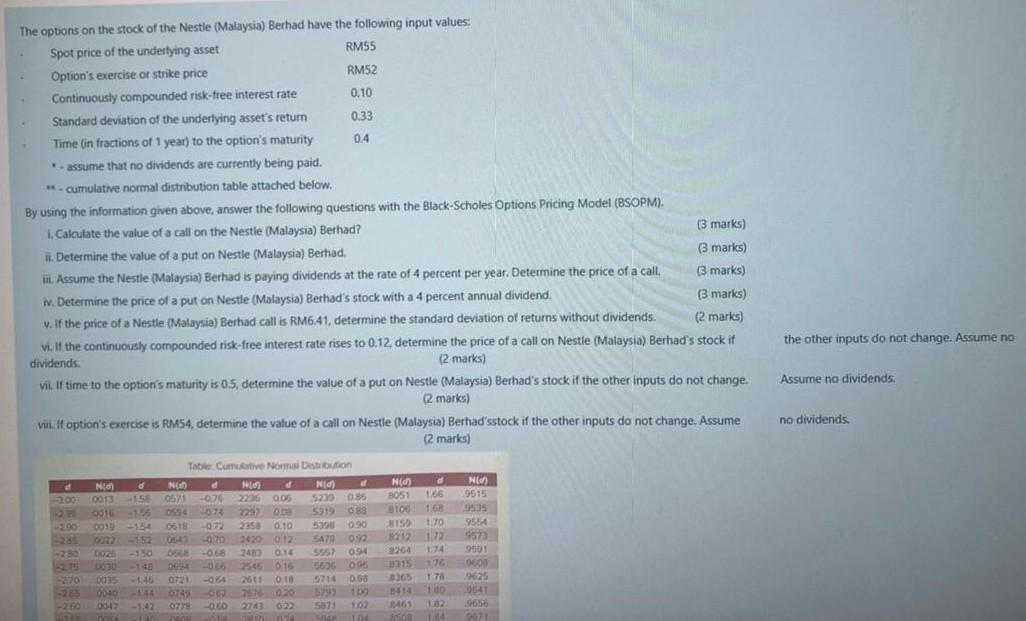

The options on the stock of the Nestle (Malaysia) Berhad have the following input values: Spot price of the underlying asset RM55 Option's exercise or strike price RM52 Continuously compounded risk-free interest rate 0.10 Standard deviation of the underlying asset's return 0.33 Time in fractions of 1 year) to the option's maturity 0.4 - assume that no dividends are currently being paid. - cumulative normal distribution table attached below. By using the information given above, answer the following questions with the Black-Scholes Options Pricing Model (BSOPM). 1. Calculate the value of a call on the Nestle (Malaysia) Berhad? (3 marks) I. Determine the value of a put on Nestle (Malaysia) Berhad, (3 marks) it. Assume the Nestle (Malaysia) Berhad is paying dividends at the rate of 4 percent per year. Determine the price of a call, (3 marks) v. Determine the price of a put on Nestle (Malaysia) Berhad's stock with a 4 percent annual dividend. (3 marks) V. If the price of a Nestle (Malaysia) Berhad call is RM6.41, determine the standard deviation of returns without dividends. (2 marks) vi. If the continuously compounded risk-free interest rate rises to 0.12, determine the price of a call on Nestle (Malaysia) Berhad's stock if dividends (2 marks) Vit. If time to the option's maturity is 0.5, determine the value of a put on Nestle (Malaysia) Berhad's stock if the other inputs do not change. (2 marks) the other inputs do not change. Assume no Assume no dividends. no dividends. vii. If option's exercise is RM54, determine the value of a call on Nestle (Malaysia) Berhad'sstock if the other inputs do not change. Assume (2 marks) Table Cute Normal Distribution NE NO NIU . NIM) 200 0012 -15 0571 -070 OOD 5235 036 2237 OD 5919 088 001 -154 0613 072 2350 0.10 090 - 152 064 0.70 2420 012 547 0020 50 -06 0.14 55 094 52150030 -14 OG 2546 0.16 5606 OG 270 0035 -1.46 072 OBA 2611 010 5714 osa 25 0000140743 5793 -142 0778 000 2743 5873 102 th LTD NI d 05 166 Brod 16 1.70 72 72 174 17 365 176 3414 10 1461 102 184 N 9515 9535 9554 6573 9501 0001 9541 5696 067

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started