Question

The Orange is considering building a 1,200 million plant to manufacture coffee grinders. ORANGE expects operating profits (EBITDA) of 290 million per year for the

The Orange is considering building a 1,200 million plant to manufacture coffee grinders. ORANGE expects operating profits (EBITDA) of 290 million per year for the next 10 years. The plant will be depreciated on a straight-line basis over 10 years (assuming no salvage value for tax purposes). After 10 years, the plant will have a salvage value of 600 million (which, since it will be fully depreciated, is then taxable). The project requires 100 million in working capital at the start, which will be recovered in year 10 when the project shuts down. The corporate tax rate is 35%. All cash flows occur at the end of the year.

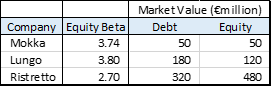

Because this is a new business area for Orange, management are uncertain about the discount rate to use. To help them in this decision, the project team collects data on the equity betas and capital structure of three companies whose entire business is manufacturing and selling coffee grinders:

- If the risk-free rate is 5%, the expected return of the market is 11% and assuming that the project is financed entirely with equity, what is the NPV of the project?

Suppose that ORANGE can finance 800 million of the cost of the plant by issuing a 10-year bond. This new debt would be associated specifically with this project and would not alter any other aspects of the firms capital structure. The bonds coupon, to be paid annually, would be set so that the bond would sell at 100% of its face value. ORANGE is advised that the yield-to-maturity on the new bond would be the same as the yield on one of OCCs existing 10-year bonds which has an annual coupon of 7% and currently sells for 87.16 for each 100 of face value.

- What is the yield-to-maturity on OCCs bond with a 7% coupon?

- What is the size of the coupon on the new bond that ORANGE will issue (for each 100 of face value)?

- What is the value of the tax shield provided by the new bond?

- What is the value of the project, including the tax shield?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started