The Organizational and Operational Plans references the possible benefits and risks of forming a strategic alliance. After research on Starbucks' financial statements from 2020, What would be the risks of forming a strategic alliance in terms of Starbuck's profitability ratios? Which of those five ratios (return on total assets, return on shareholders' equity, return on common equity, operating profit margin, or net profit margin) is most likely to reveal immediate information for analysis of the alliance's effectiveness?

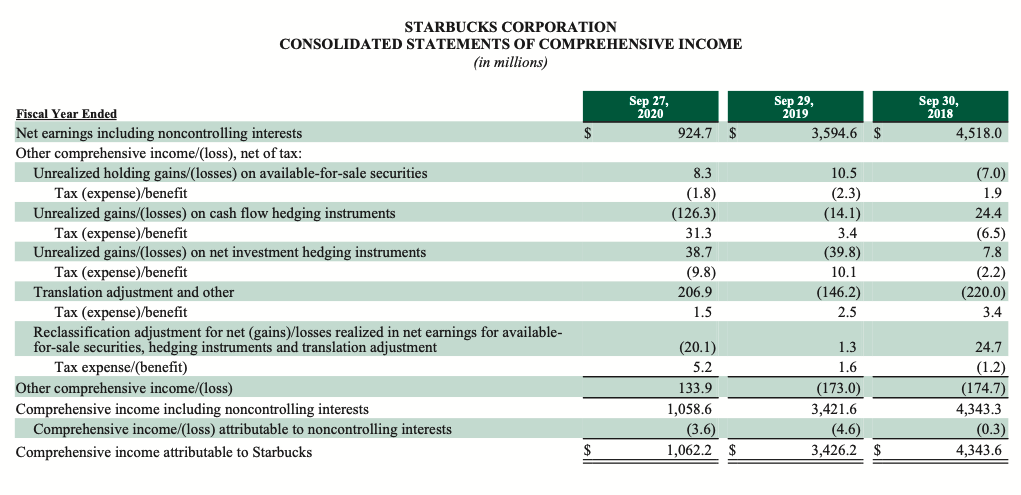

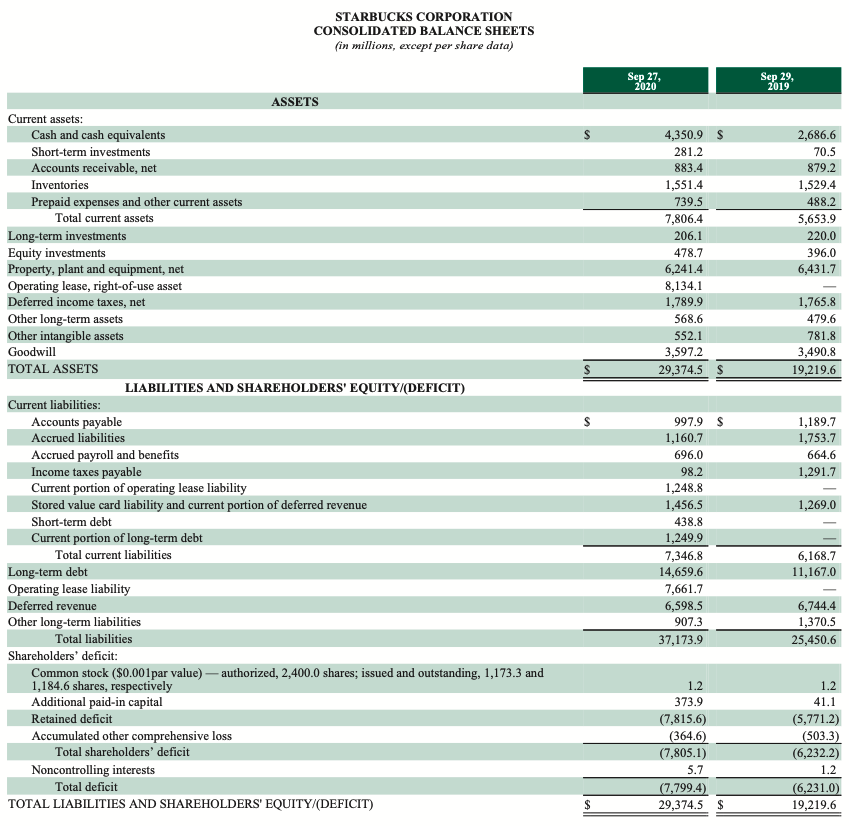

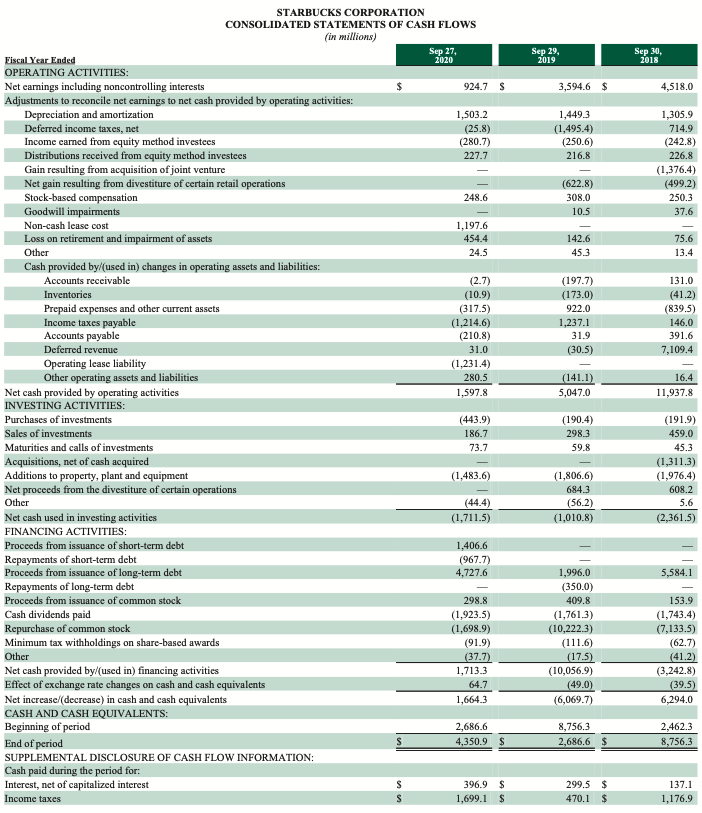

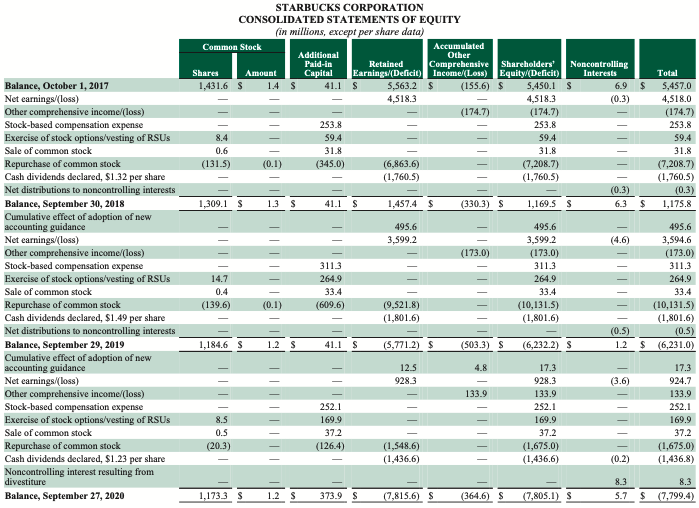

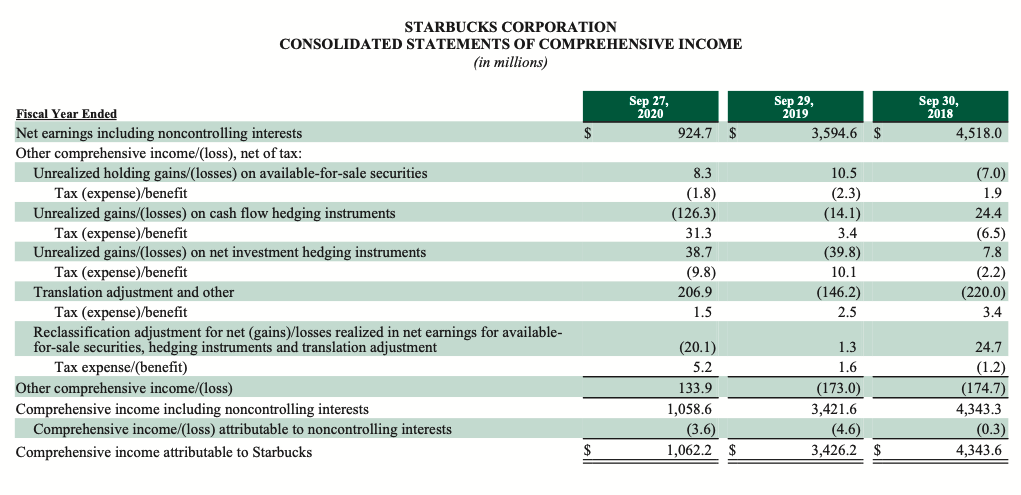

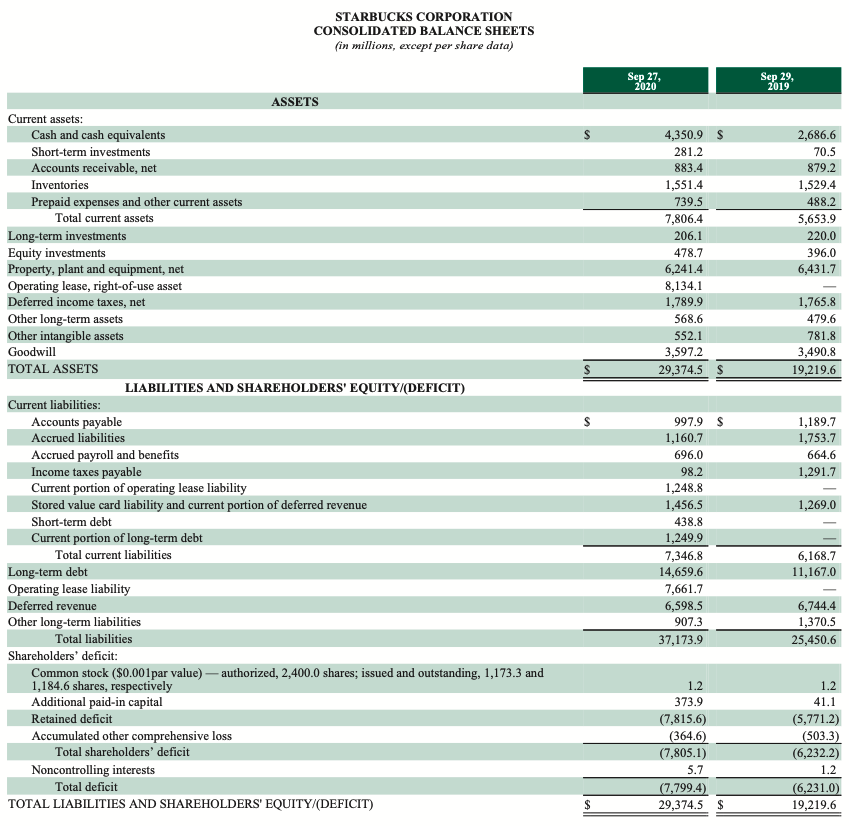

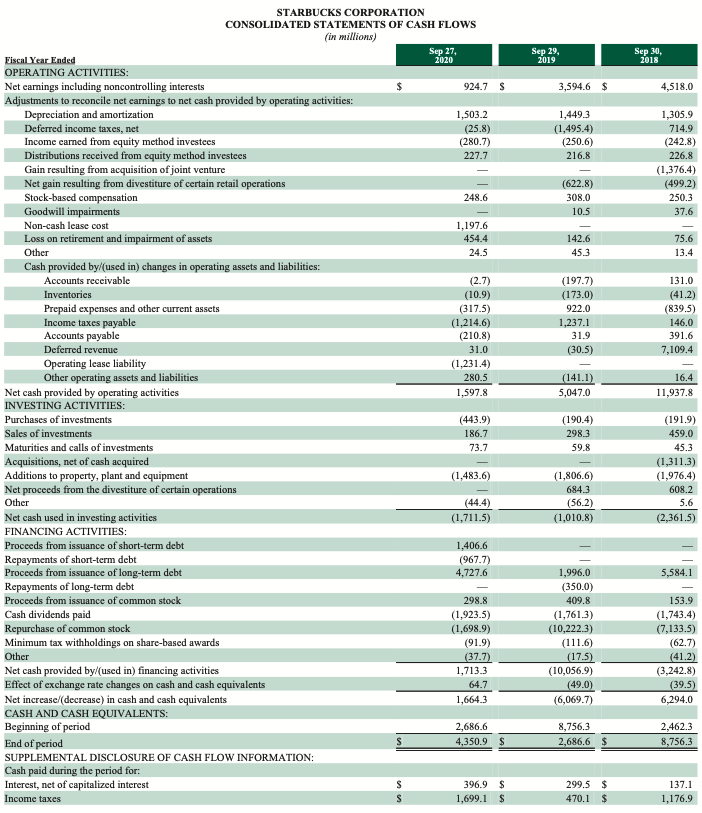

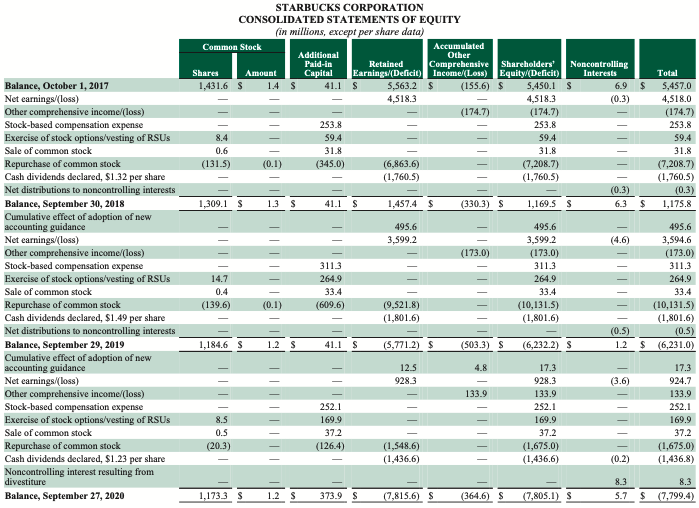

Item 8. Financial Statements and Supplementary Data STARBUCKS CORPORATION CONSOLIDATED STATEMENTS OF EARNINGS (in millions, except per share data) Sep 27, 2020 Sep 29, 2019 Sep 30, 2018 S 19,164.6 $ 2,327.1 2,026.3 23,518.0 7,694.9 10,764.0 430.3 1,431.3 1,679.6 278.7 22,278.8 Fiscal Year Ended Net revenues: Company-operated stores Licensed stores Other Total net revenues Product and distribution costs Store operating expenses Other operating expenses Depreciation and amortization expenses General and administrative expenses Restructuring and impairments Total operating expenses Income from equity investees Operating income Gain resulting from acquisition of joint venture Net gain resulting from divestiture of certain operations Interest income and other, net Interest expense Earnings before income taxes Income tax expense Net earnings including noncontrolling interests Net loss attributable to noncontrolling interests Net earnings attributable to Starbucks Earnings per share - basic Earnings per share-diluted Weighted average shares outstanding: Basic Diluted 21,544.4 $ 2,875.0 2,089.2 26,508.6 8,526.9 10,493.6 371.0 1,377.3 1,824.1 135.8 22,728.7 298.0 4,077.9 322.5 1,561.7 19,690.3 2,652.2 2,377.0 24,719.5 7,930.7 9,472.2 554.9 1,247.0 1,708.2 224.4 21,137.4 301.2 3,883.3 1,376.4 499.2 191.4 (170.3) 5,780.0 1,262.0 4,518.0 (0.3) 4,518.3 3.27 3.24 39.7 (437.0) 1,164.4 239.7 924.7 (3.6) 928.3 $ 0.79 $ 0.79 $ 622.8 96.5 (331.0) 4,466.2 871.6 3,594.6 (4.6) 3,599.2 2.95 2.92 $ $ $ 1,221.2 1,172.8 1,181.8 1,382.7 1,394.6 1,233.2 STARBUCKS CORPORATION CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (in millions) Sep 27, 2020 Sep 29, 2019 Sep 30, 2018 4,518.0 924.7 $ 3,594.6 $ Fiscal Year Ended Net earnings including noncontrolling interests Other comprehensive income/(loss), net of tax: Unrealized holding gains/(losses) on available-for-sale securities Tax (expense)/benefit Unrealized gains/(losses) on cash flow hedging instruments Tax (expense)/benefit Unrealized gains/(losses) on net investment hedging instruments Tax (expense)/benefit Translation adjustment and other Tax (expense)/benefit Reclassification adjustment for net (gains)/losses realized in net earnings for available- for-sale securities, hedging instruments and translation adjustment Tax expense/(benefit) Other comprehensive income/loss) Comprehensive income including noncontrolling interests Comprehensive income/loss) attributable to noncontrolling interests Comprehensive income attributable to Starbucks 8.3 (1.8) (126.3) 31.3 38.7 (9.8) 206.9 1.5 10.5 (2.3) (14.1) 3.4 (39.8) 10.1 (146.2) 2.5 (7.0) 1.9 24.4 (6.5) 7.8 (2.2) (220.0) 3.4 24.7 (1.2) (20.1) 5.2 133.9 1,058.6 (3.6) 1,062.2 1.3 1.6 (173.0) 3,421.6 (4.6) 3,426.2 $ (174.7) 4,343.3 (0.3) 4,343.6 $ STARBUCKS CORPORATION CONSOLIDATED BALANCE SHEETS (in millions, except per share data) Sep 27, 2020 Sep 29, 2019 S 4,350.9 $ 281.2 883.4 1,551.4 739.5 7,806.4 206.1 478.7 6,241.4 8,134.1 1,789.9 568.6 552.1 3,597.2 29,374.5 s 2,686.6 70.5 879.2 1,529.4 488.2 5,653.9 220.0 396.0 6,431.7 1,765.8 479.6 781.8 3,490.8 19,219.6 $ ASSETS Current assets: Cash and cash equivalents Short-term investments Accounts receivable, net Inventories Prepaid expenses and other current assets Total current assets Long-term investments Equity investments Property, plant and equipment, net Operating lease, right-of-use asset Deferred income taxes, net Other long-term assets Other intangible assets Goodwill TOTAL ASSETS LIABILITIES AND SHAREHOLDERS' EQUITY/(DEFICIT) Current liabilities: Accounts payable Accrued liabilities Accrued payroll and benefits Income taxes payable Current portion of operating lease liability Stored value card liability and current portion of deferred revenue Short-term debt Current portion of long-term debt Total current liabilities Long-term debt Operating lease liability Deferred revenue Other long-term liabilities Total liabilities Shareholders' deficit: Common stock ($0.001par value) - authorized, 2,400.0 shares; issued and outstanding, 1,173.3 and 1,184.6 shares, respectively Additional paid-in capital Retained deficit Accumulated other comprehensive loss Total shareholders' deficit Noncontrolling interests Total deficit TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY/(DEFICIT) 1,189.7 1,753.7 664.6 1,291.7 1,269.0 997.9 $ 1,160.7 696.0 98.2 1,248.8 1,456.5 438.8 1,249.9 7,346.8 14,659.6 7,661.7 6,598.5 907.3 37,173.9 6,168.7 11,167.0 6,744.4 1,370.5 25,450.6 1.2 373.9 (7,815.6) (364.6) (7,805.1) 5.7 (7.799.4) 29,374.5 $ 1.2 41.1 (5,771.2) (503.3) (6,232.2) 1.2 (6,231.0) 19,219.6 $ Sep 29, 2019 Sep 30, 2018 3,594.6 $ 4,518.0 1,449.3 (1,495.4) (250.6) 216.8 1,305.9 714.9 (242.8) 226.8 (1,376.4) (499.2) 250.3 (622.8) 308.0 10.5 37.6 142.6 45.3 75.6 13.4 (197.7) (173.0) 922.0 1,237.1 31.9 (30.5) 131.0 (41.2) (839.5) 146.0 391.6 7,109.4 (141.1) 5,047.0 16.4 11,937.8 STARBUCKS CORPORATION CONSOLIDATED STATEMENTS OF CASH FLOWS (in millions) Sep 27, Fiscal Year Ended 2020 OPERATING ACTIVITIES: Net earnings including noncontrolling interests 924.7 S Adjustments to reconcile net carnings to net cash provided by operating activities: Depreciation and amortization 1,503.2 Deferred income taxes, net (25.8) Income carned from equity method investees (280.7) Distributions received from equity method investees 227.7 Gain resulting from acquisition of joint venture Net gain resulting from divestiture of certain retail operations Stock-based compensation 248.6 Goodwill impairments Non-cash lease cost 1,197.6 Loss on retirement and impairment of assets 454.4 Other 24.5 Cash provided by/(used in) changes in operating assets and liabilities: Accounts receivable (2.7) Inventories (10.9) Prepaid expenses and other current assets (317.5) Income taxes payable (1,214.6) Accounts payable (210.8) Deferred revenue 31.0 Operating lease liability (1,231.4) Other operating assets and liabilities 280.5 Net cash provided by operating activities 1,597.8 INVESTING ACTIVITIES: Purchases of investments (443.9) Sales of investments 186.7 Maturities and calls of investments 73.7 Acquisitions, net of cash acquired Additions to property, plant and equipment (1,483.6) Net proceeds from the divestiture of certain operations Other (44.4) Net cash used in investing activities (1,711.5) FINANCING ACTIVITIES: Proceeds from issuance of short-term debt 1,406.6 Repayments of short-term debt (967.7) Proceeds from issuance of long-term debt 4,727.6 Repayments of long-term debt Proceeds from issuance of common stock 298.8 Cash dividends paid (1,923.5) Repurchase of common stock (1,698.9) Minimum tax withholdings on share-based awards 91.9) Other (37.7) Net cash provided by/(used in) financing activities 1,713.3 Effect of exchange rate changes on cash and cash equivalents 64.7 Net increase/(decrease) in cash and cash equivalents 1,664.3 CASH AND CASH EQUIVALENTS: Beginning of period 2,686.6 End of period 4,350.9 $ SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION: Cash paid during the period for: Interest, net of capitalized interest 396.9 $ Income taxes 1,699.1 $ (190.4) 298.3 59.8 (1,806.6) 684.3 (56.2) (1,010.8) (191.9) 459.0 45.3 (1,311.3) (1,976.4) 608.2 5.6 (2,361.5) 5,584.1 1,996.0 (350.0) 409.8 (1,761.3) (10,222.3) (111.6) (17.5) (10,056.9) (49.0) (6,069.7) 153.9 (1,743.4) (7,133.5) (62.7) (41.2) (3,242.8) (39.5) 6,294.0 8,756.3 2,686.6 $ 2,462.3 8,756.3 S S S 299.5 470.1 $ $ 137.1 1,176.9 $ STARBUCKS CORPORATION CONSOLIDATED STATEMENTS OF EQUITY (in millions, except per share data) Common Stock Accumulated Additional Other Paid-in Retained Comprehensive Shareholders Noncontrolling Shares Amount Capital Earnings/(Deficit) Income (Loss) Equity (Deficit) Interests 1,431.6 S 1.4 S 41.1 S 5,563.2 $ (155.6) $ 5,450.1 S 6.9 4,518.3 4,518.3 (0.3) (174.7) (174.7) 253.8 253.8 8.4 59.4 59.4 0.6 31.8 31.8 (131.5) (0.1) (345.0) (6,863.6) (7,208.7) (1,760.5) (1,760.5) (0.3) 1,309.15 1.3 S 41.1 S 1,457.4 $ (330.3) S 1,169.5 S 6.3 Total 5,457.0 4,518.0 (174.7) 253.8 59.4 31.8 (7,208.7) (1,760.5) (0.3) 1,175.8 $ 495.6 3,599.2 (173.0) Balance, October 1, 2017 Net earnings/(Loss) Other comprehensive income (loss) Stock-based compensation expense Exercise of stock options/vesting of RSUS Sale of common stock Repurchase of common stock Cash dividends declared, $1.32 per share Net distributions to noncontrolling interests Balance, September 30, 2018 Cumulative effect of adoption of new accounting guidance Net earnings(loss) Other comprehensive income (loss) Stock-based compensation expense Exercise of stock options/vesting of RSUS Sale of common stock Repurchase of common stock Cash dividends declared, $1.49 per share Net distributions to noncontrolling interests Balance, September 29, 2019 Cumulative effect of adoption of new accounting guidance Net earnings/loss) Other comprehensive income/(loss) Stock-based compensation expense Exercise of stock options/vesting of RSUS Sale of common stock Repurchase of common stock Cash dividends declared, $1.23 per share Noncontrolling interest resulting from divestiture Balance, September 27, 2020 14.7 0.4 (139.6) 3113 264.9 33.4 (609.6) 495.6 3,599.2 (173.0) 311.3 264.9 33.4 (10,131.5) (1,801.6) 495.6 (4.6) 3,594.6 (173.0) 311.3 264.9 33.4 (10,131.5) (1,801.6) (0.5) (0.5) 1.2 $ (6,231.0) (0.1) (9.521.8) (1,801.6) 1,184.6 S 1.2 S 41.1 S (5,771.2) $ (503.3) S (6,232.2) S 4.8 12.5 9283 (3.6) | 133.9 252.1 169.9 37.2 (126.4) 8.5 0.5 (20.3) 17.3 928.3 133.9 252.1 169.9 37.2 (1,675.0) (1,436.6) IIIII 17.3 924.7 133.9 252.1 169.9 37.2 (1,675.0) (1,436.8) (1,548.6) (1.436.6) (0.2) 8.3 8.3 (7,799.4) 1,1733 S 1.2 S 373.9 $ (7,815.6) S (364.6) S (7,805.1) S 5.7 Item 8. Financial Statements and Supplementary Data STARBUCKS CORPORATION CONSOLIDATED STATEMENTS OF EARNINGS (in millions, except per share data) Sep 27, 2020 Sep 29, 2019 Sep 30, 2018 S 19,164.6 $ 2,327.1 2,026.3 23,518.0 7,694.9 10,764.0 430.3 1,431.3 1,679.6 278.7 22,278.8 Fiscal Year Ended Net revenues: Company-operated stores Licensed stores Other Total net revenues Product and distribution costs Store operating expenses Other operating expenses Depreciation and amortization expenses General and administrative expenses Restructuring and impairments Total operating expenses Income from equity investees Operating income Gain resulting from acquisition of joint venture Net gain resulting from divestiture of certain operations Interest income and other, net Interest expense Earnings before income taxes Income tax expense Net earnings including noncontrolling interests Net loss attributable to noncontrolling interests Net earnings attributable to Starbucks Earnings per share - basic Earnings per share-diluted Weighted average shares outstanding: Basic Diluted 21,544.4 $ 2,875.0 2,089.2 26,508.6 8,526.9 10,493.6 371.0 1,377.3 1,824.1 135.8 22,728.7 298.0 4,077.9 322.5 1,561.7 19,690.3 2,652.2 2,377.0 24,719.5 7,930.7 9,472.2 554.9 1,247.0 1,708.2 224.4 21,137.4 301.2 3,883.3 1,376.4 499.2 191.4 (170.3) 5,780.0 1,262.0 4,518.0 (0.3) 4,518.3 3.27 3.24 39.7 (437.0) 1,164.4 239.7 924.7 (3.6) 928.3 $ 0.79 $ 0.79 $ 622.8 96.5 (331.0) 4,466.2 871.6 3,594.6 (4.6) 3,599.2 2.95 2.92 $ $ $ 1,221.2 1,172.8 1,181.8 1,382.7 1,394.6 1,233.2 STARBUCKS CORPORATION CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (in millions) Sep 27, 2020 Sep 29, 2019 Sep 30, 2018 4,518.0 924.7 $ 3,594.6 $ Fiscal Year Ended Net earnings including noncontrolling interests Other comprehensive income/(loss), net of tax: Unrealized holding gains/(losses) on available-for-sale securities Tax (expense)/benefit Unrealized gains/(losses) on cash flow hedging instruments Tax (expense)/benefit Unrealized gains/(losses) on net investment hedging instruments Tax (expense)/benefit Translation adjustment and other Tax (expense)/benefit Reclassification adjustment for net (gains)/losses realized in net earnings for available- for-sale securities, hedging instruments and translation adjustment Tax expense/(benefit) Other comprehensive income/loss) Comprehensive income including noncontrolling interests Comprehensive income/loss) attributable to noncontrolling interests Comprehensive income attributable to Starbucks 8.3 (1.8) (126.3) 31.3 38.7 (9.8) 206.9 1.5 10.5 (2.3) (14.1) 3.4 (39.8) 10.1 (146.2) 2.5 (7.0) 1.9 24.4 (6.5) 7.8 (2.2) (220.0) 3.4 24.7 (1.2) (20.1) 5.2 133.9 1,058.6 (3.6) 1,062.2 1.3 1.6 (173.0) 3,421.6 (4.6) 3,426.2 $ (174.7) 4,343.3 (0.3) 4,343.6 $ STARBUCKS CORPORATION CONSOLIDATED BALANCE SHEETS (in millions, except per share data) Sep 27, 2020 Sep 29, 2019 S 4,350.9 $ 281.2 883.4 1,551.4 739.5 7,806.4 206.1 478.7 6,241.4 8,134.1 1,789.9 568.6 552.1 3,597.2 29,374.5 s 2,686.6 70.5 879.2 1,529.4 488.2 5,653.9 220.0 396.0 6,431.7 1,765.8 479.6 781.8 3,490.8 19,219.6 $ ASSETS Current assets: Cash and cash equivalents Short-term investments Accounts receivable, net Inventories Prepaid expenses and other current assets Total current assets Long-term investments Equity investments Property, plant and equipment, net Operating lease, right-of-use asset Deferred income taxes, net Other long-term assets Other intangible assets Goodwill TOTAL ASSETS LIABILITIES AND SHAREHOLDERS' EQUITY/(DEFICIT) Current liabilities: Accounts payable Accrued liabilities Accrued payroll and benefits Income taxes payable Current portion of operating lease liability Stored value card liability and current portion of deferred revenue Short-term debt Current portion of long-term debt Total current liabilities Long-term debt Operating lease liability Deferred revenue Other long-term liabilities Total liabilities Shareholders' deficit: Common stock ($0.001par value) - authorized, 2,400.0 shares; issued and outstanding, 1,173.3 and 1,184.6 shares, respectively Additional paid-in capital Retained deficit Accumulated other comprehensive loss Total shareholders' deficit Noncontrolling interests Total deficit TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY/(DEFICIT) 1,189.7 1,753.7 664.6 1,291.7 1,269.0 997.9 $ 1,160.7 696.0 98.2 1,248.8 1,456.5 438.8 1,249.9 7,346.8 14,659.6 7,661.7 6,598.5 907.3 37,173.9 6,168.7 11,167.0 6,744.4 1,370.5 25,450.6 1.2 373.9 (7,815.6) (364.6) (7,805.1) 5.7 (7.799.4) 29,374.5 $ 1.2 41.1 (5,771.2) (503.3) (6,232.2) 1.2 (6,231.0) 19,219.6 $ Sep 29, 2019 Sep 30, 2018 3,594.6 $ 4,518.0 1,449.3 (1,495.4) (250.6) 216.8 1,305.9 714.9 (242.8) 226.8 (1,376.4) (499.2) 250.3 (622.8) 308.0 10.5 37.6 142.6 45.3 75.6 13.4 (197.7) (173.0) 922.0 1,237.1 31.9 (30.5) 131.0 (41.2) (839.5) 146.0 391.6 7,109.4 (141.1) 5,047.0 16.4 11,937.8 STARBUCKS CORPORATION CONSOLIDATED STATEMENTS OF CASH FLOWS (in millions) Sep 27, Fiscal Year Ended 2020 OPERATING ACTIVITIES: Net earnings including noncontrolling interests 924.7 S Adjustments to reconcile net carnings to net cash provided by operating activities: Depreciation and amortization 1,503.2 Deferred income taxes, net (25.8) Income carned from equity method investees (280.7) Distributions received from equity method investees 227.7 Gain resulting from acquisition of joint venture Net gain resulting from divestiture of certain retail operations Stock-based compensation 248.6 Goodwill impairments Non-cash lease cost 1,197.6 Loss on retirement and impairment of assets 454.4 Other 24.5 Cash provided by/(used in) changes in operating assets and liabilities: Accounts receivable (2.7) Inventories (10.9) Prepaid expenses and other current assets (317.5) Income taxes payable (1,214.6) Accounts payable (210.8) Deferred revenue 31.0 Operating lease liability (1,231.4) Other operating assets and liabilities 280.5 Net cash provided by operating activities 1,597.8 INVESTING ACTIVITIES: Purchases of investments (443.9) Sales of investments 186.7 Maturities and calls of investments 73.7 Acquisitions, net of cash acquired Additions to property, plant and equipment (1,483.6) Net proceeds from the divestiture of certain operations Other (44.4) Net cash used in investing activities (1,711.5) FINANCING ACTIVITIES: Proceeds from issuance of short-term debt 1,406.6 Repayments of short-term debt (967.7) Proceeds from issuance of long-term debt 4,727.6 Repayments of long-term debt Proceeds from issuance of common stock 298.8 Cash dividends paid (1,923.5) Repurchase of common stock (1,698.9) Minimum tax withholdings on share-based awards 91.9) Other (37.7) Net cash provided by/(used in) financing activities 1,713.3 Effect of exchange rate changes on cash and cash equivalents 64.7 Net increase/(decrease) in cash and cash equivalents 1,664.3 CASH AND CASH EQUIVALENTS: Beginning of period 2,686.6 End of period 4,350.9 $ SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION: Cash paid during the period for: Interest, net of capitalized interest 396.9 $ Income taxes 1,699.1 $ (190.4) 298.3 59.8 (1,806.6) 684.3 (56.2) (1,010.8) (191.9) 459.0 45.3 (1,311.3) (1,976.4) 608.2 5.6 (2,361.5) 5,584.1 1,996.0 (350.0) 409.8 (1,761.3) (10,222.3) (111.6) (17.5) (10,056.9) (49.0) (6,069.7) 153.9 (1,743.4) (7,133.5) (62.7) (41.2) (3,242.8) (39.5) 6,294.0 8,756.3 2,686.6 $ 2,462.3 8,756.3 S S S 299.5 470.1 $ $ 137.1 1,176.9 $ STARBUCKS CORPORATION CONSOLIDATED STATEMENTS OF EQUITY (in millions, except per share data) Common Stock Accumulated Additional Other Paid-in Retained Comprehensive Shareholders Noncontrolling Shares Amount Capital Earnings/(Deficit) Income (Loss) Equity (Deficit) Interests 1,431.6 S 1.4 S 41.1 S 5,563.2 $ (155.6) $ 5,450.1 S 6.9 4,518.3 4,518.3 (0.3) (174.7) (174.7) 253.8 253.8 8.4 59.4 59.4 0.6 31.8 31.8 (131.5) (0.1) (345.0) (6,863.6) (7,208.7) (1,760.5) (1,760.5) (0.3) 1,309.15 1.3 S 41.1 S 1,457.4 $ (330.3) S 1,169.5 S 6.3 Total 5,457.0 4,518.0 (174.7) 253.8 59.4 31.8 (7,208.7) (1,760.5) (0.3) 1,175.8 $ 495.6 3,599.2 (173.0) Balance, October 1, 2017 Net earnings/(Loss) Other comprehensive income (loss) Stock-based compensation expense Exercise of stock options/vesting of RSUS Sale of common stock Repurchase of common stock Cash dividends declared, $1.32 per share Net distributions to noncontrolling interests Balance, September 30, 2018 Cumulative effect of adoption of new accounting guidance Net earnings(loss) Other comprehensive income (loss) Stock-based compensation expense Exercise of stock options/vesting of RSUS Sale of common stock Repurchase of common stock Cash dividends declared, $1.49 per share Net distributions to noncontrolling interests Balance, September 29, 2019 Cumulative effect of adoption of new accounting guidance Net earnings/loss) Other comprehensive income/(loss) Stock-based compensation expense Exercise of stock options/vesting of RSUS Sale of common stock Repurchase of common stock Cash dividends declared, $1.23 per share Noncontrolling interest resulting from divestiture Balance, September 27, 2020 14.7 0.4 (139.6) 3113 264.9 33.4 (609.6) 495.6 3,599.2 (173.0) 311.3 264.9 33.4 (10,131.5) (1,801.6) 495.6 (4.6) 3,594.6 (173.0) 311.3 264.9 33.4 (10,131.5) (1,801.6) (0.5) (0.5) 1.2 $ (6,231.0) (0.1) (9.521.8) (1,801.6) 1,184.6 S 1.2 S 41.1 S (5,771.2) $ (503.3) S (6,232.2) S 4.8 12.5 9283 (3.6) | 133.9 252.1 169.9 37.2 (126.4) 8.5 0.5 (20.3) 17.3 928.3 133.9 252.1 169.9 37.2 (1,675.0) (1,436.6) IIIII 17.3 924.7 133.9 252.1 169.9 37.2 (1,675.0) (1,436.8) (1,548.6) (1.436.6) (0.2) 8.3 8.3 (7,799.4) 1,1733 S 1.2 S 373.9 $ (7,815.6) S (364.6) S (7,805.1) S 5.7