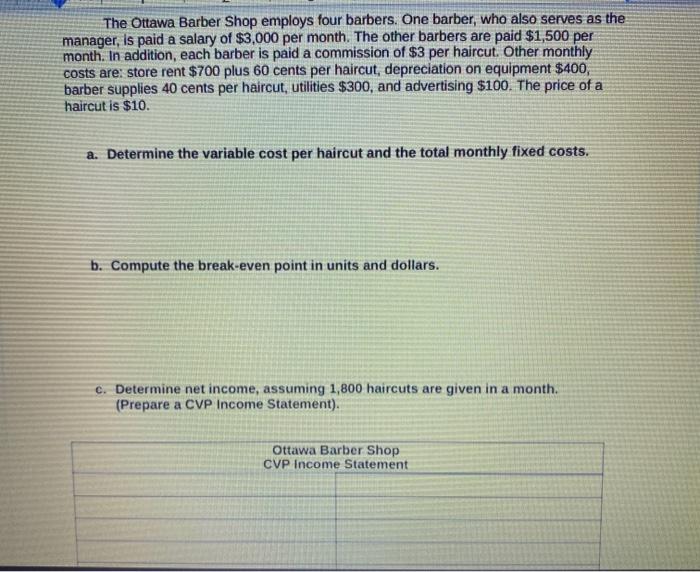

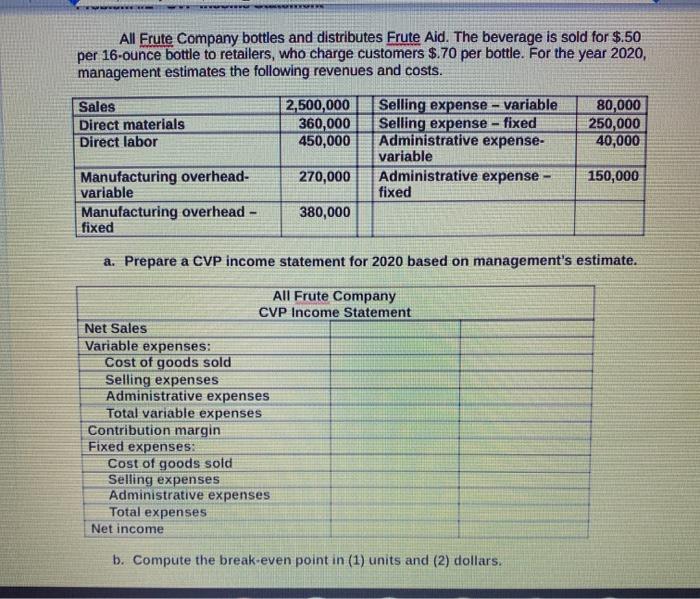

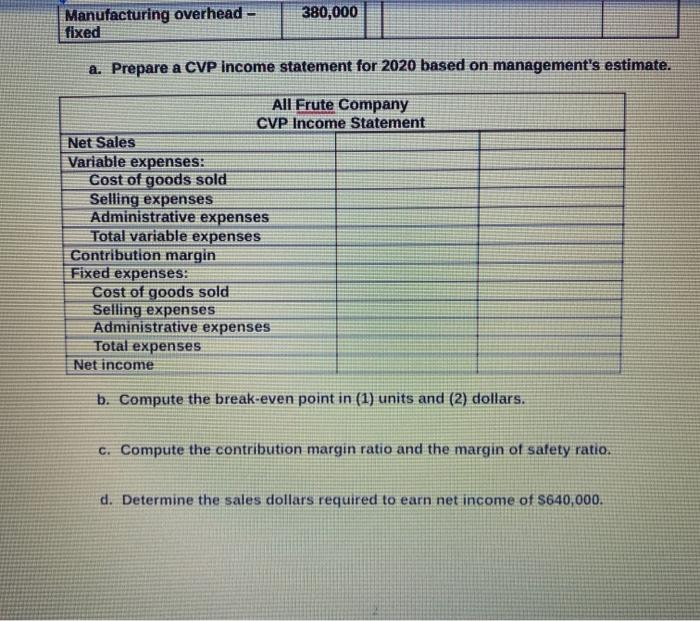

The Ottawa Barber Shop employs four barbers. One barber, who also serves as the manager, is paid a salary of $3,000 per month. The other barbers are paid $1,500 per month. In addition, each barber is paid a commission of $3 per haircut. Other monthly costs are: store rent $700 plus 60 cents per haircut, depreciation on equipment $400, barber supplies 40 cents per haircut, utilities $300, and advertising $100. The price of a haircut is $10. a. Determine the variable cost per haircut and the total monthly fixed costs. b. Compute the break-even point in units and dollars. c. Determine net income, assuming 1,800 haircuts are given in a month. (Prepare a CVP Income Statement). Ottawa Barber Shop CVP Income Statement All Frute Company bottles and distributes Frute Aid. The beverage is sold for $.50 per 16-ounce bottle to retailers, who charge customers $.70 per bottle. For the year 2020, management estimates the following revenues and costs. Sales Direct materials Direct labor 2,500,000 360,000 450,000 Selling expense - variable Selling expense - fixed Administrative expense- variable Administrative expense - fixed 80,000 250,000 40,000 270,000 150,000 Manufacturing overhead- variable Manufacturing overhead - fixed 380,000 a. Prepare a CVP income statement for 2020 based on management's estimate. All Frute Company CVP Income Statement Net Sales Variable expenses: Cost of goods sold Selling expenses Administrative expenses Total variable expenses Contribution margin Fixed expenses: Cost of goods sold Selling expenses Administrative expenses Total expenses Net income b. Compute the break-even point in (1) units and (2) dollars. 380,000 Manufacturing overhead - fixed a. Prepare a CVP Income statement for 2020 based on management's estimate. All Frute Company CVP Income Statement Net Sales Variable expenses: Cost of goods sold Selling expenses Administrative expenses Total variable expenses Contribution margin Fixed expenses: Cost of goods sold Selling expenses Administrative expenses Total expenses Net income b. Compute the break-even point in (1) units and (2) dollars. c. Compute the contribution margin ratio and the margin of safety ratio. d. Determine the sales dollars required to earn net income of S640,000