Answered step by step

Verified Expert Solution

Question

1 Approved Answer

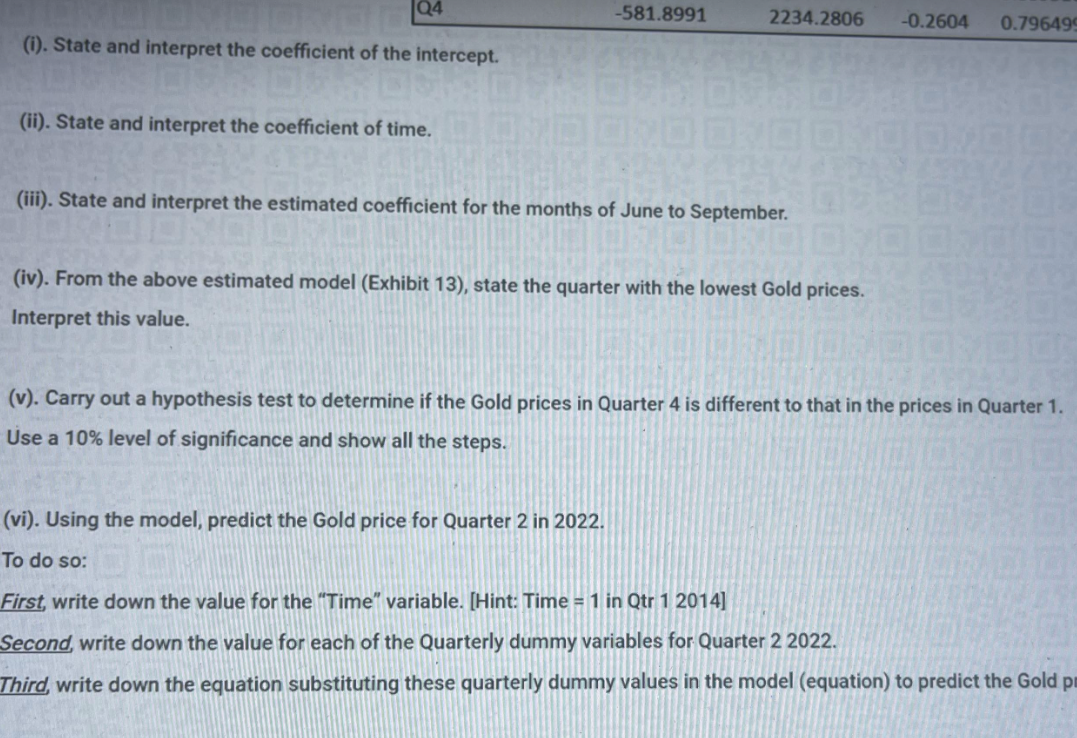

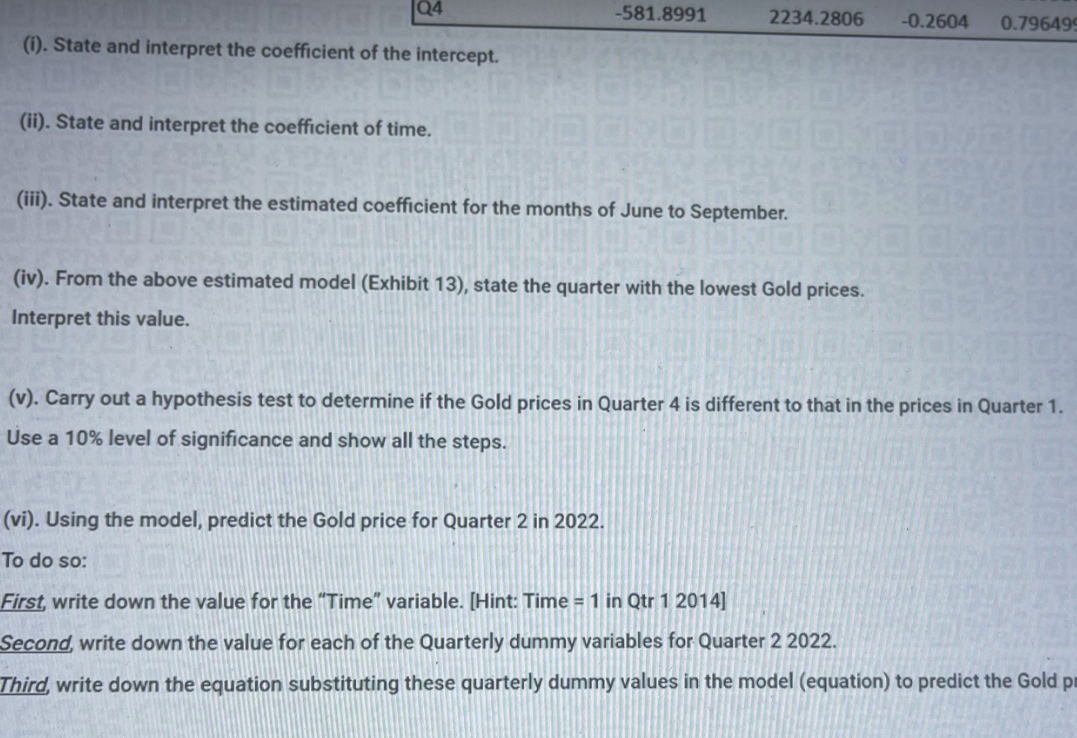

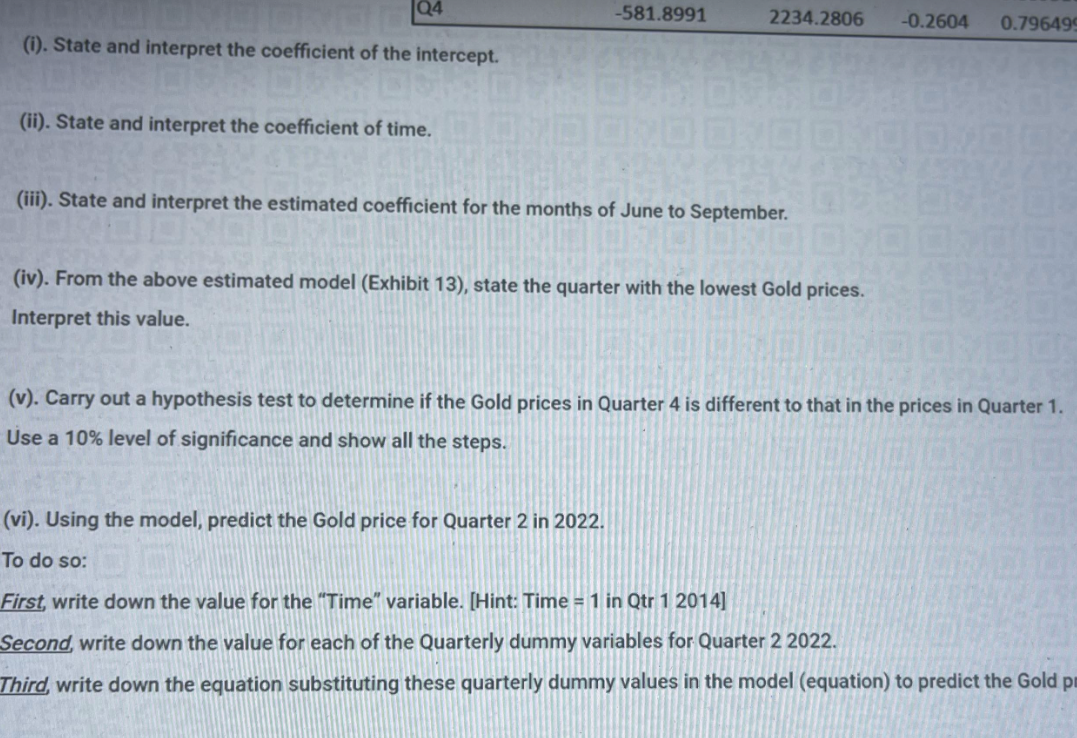

The output in exhibit 13 above shows the gold prices from Q1 2014 to Q4 2021 as a function of time and quarters. Please help

The output in exhibit 13 above shows the gold prices from Q1 2014 to Q4 2021 as a function of time and quarters.

Please help I will rate good immediately

-581.8991 2234.2806 -0.2604 0.796499 (i). State and interpret the coefficient of the intercept. 2012 (ii). State and interpret the coefficient of time. DONDOVO OKO DVOCK (iii). State and interpret the estimated coefficient for the months of June to September. (iv). From the above estimated model (Exhibit 13), state the quarter with the lowest Gold prices. Interpret this value. (v). Carry out a hypothesis test to determine if the Gold prices in Quarter 4 is different to that in the prices in Quarter 1. Use a 10% level of significance and show all the steps. DDS (vi). Using the model, predict the Gold price for Quarter 2 in 2022. DA To do so: First, write down the value for the "Time" variable. [Hint: Time = 1 in Qtr 1 2014] Second, write down the value for each of the Quarterly dummy variables for Quarter 2 2022. Third, write down the equation substituting these quarterly dummy values in the model (equation) to predict the Gold pr -581.8991 2234.2806 -0.2604 0.796499 (i). State and interpret the coefficient of the intercept. 2012 (ii). State and interpret the coefficient of time. DONDOVO OKO DVOCK (iii). State and interpret the estimated coefficient for the months of June to September. (iv). From the above estimated model (Exhibit 13), state the quarter with the lowest Gold prices. Interpret this value. (v). Carry out a hypothesis test to determine if the Gold prices in Quarter 4 is different to that in the prices in Quarter 1. Use a 10% level of significance and show all the steps. DDS (vi). Using the model, predict the Gold price for Quarter 2 in 2022. DA To do so: First, write down the value for the "Time" variable. [Hint: Time = 1 in Qtr 1 2014] Second, write down the value for each of the Quarterly dummy variables for Quarter 2 2022. Third, write down the equation substituting these quarterly dummy values in the model (equation) to predict the Gold pr -581.8991 2234.2806 -0.2604 0.796499 (i). State and interpret the coefficient of the intercept. 2012 (ii). State and interpret the coefficient of time. DONDOVO OKO DVOCK (iii). State and interpret the estimated coefficient for the months of June to September. (iv). From the above estimated model (Exhibit 13), state the quarter with the lowest Gold prices. Interpret this value. (v). Carry out a hypothesis test to determine if the Gold prices in Quarter 4 is different to that in the prices in Quarter 1. Use a 10% level of significance and show all the steps. DDS (vi). Using the model, predict the Gold price for Quarter 2 in 2022. DA To do so: First, write down the value for the "Time" variable. [Hint: Time = 1 in Qtr 1 2014] Second, write down the value for each of the Quarterly dummy variables for Quarter 2 2022. Third, write down the equation substituting these quarterly dummy values in the model (equation) to predict the Gold pr -581.8991 2234.2806 -0.2604 0.796499 (i). State and interpret the coefficient of the intercept. 2012 (ii). State and interpret the coefficient of time. DONDOVO OKO DVOCK (iii). State and interpret the estimated coefficient for the months of June to September. (iv). From the above estimated model (Exhibit 13), state the quarter with the lowest Gold prices. Interpret this value. (v). Carry out a hypothesis test to determine if the Gold prices in Quarter 4 is different to that in the prices in Quarter 1. Use a 10% level of significance and show all the steps. DDS (vi). Using the model, predict the Gold price for Quarter 2 in 2022. DA To do so: First, write down the value for the "Time" variable. [Hint: Time = 1 in Qtr 1 2014] Second, write down the value for each of the Quarterly dummy variables for Quarter 2 2022. Third, write down the equation substituting these quarterly dummy values in the model (equation) to predict the Gold pr -581.8991 2234.2806 -0.2604 0.796499 (i). State and interpret the coefficient of the intercept. 2012 (ii). State and interpret the coefficient of time. DONDOVO OKO DVOCK (iii). State and interpret the estimated coefficient for the months of June to September. (iv). From the above estimated model (Exhibit 13), state the quarter with the lowest Gold prices. Interpret this value. (v). Carry out a hypothesis test to determine if the Gold prices in Quarter 4 is different to that in the prices in Quarter 1. Use a 10% level of significance and show all the steps. DDS (vi). Using the model, predict the Gold price for Quarter 2 in 2022. DA To do so: First, write down the value for the "Time" variable. [Hint: Time = 1 in Qtr 1 2014] Second, write down the value for each of the Quarterly dummy variables for Quarter 2 2022. Third, write down the equation substituting these quarterly dummy values in the model (equation) to predict the Gold pr -581.8991 2234.2806 -0.2604 0.796499 (i). State and interpret the coefficient of the intercept. 2012 (ii). State and interpret the coefficient of time. DONDOVO OKO DVOCK (iii). State and interpret the estimated coefficient for the months of June to September. (iv). From the above estimated model (Exhibit 13), state the quarter with the lowest Gold prices. Interpret this value. (v). Carry out a hypothesis test to determine if the Gold prices in Quarter 4 is different to that in the prices in Quarter 1. Use a 10% level of significance and show all the steps. DDS (vi). Using the model, predict the Gold price for Quarter 2 in 2022. DA To do so: First, write down the value for the "Time" variable. [Hint: Time = 1 in Qtr 1 2014] Second, write down the value for each of the Quarterly dummy variables for Quarter 2 2022. Third, write down the equation substituting these quarterly dummy values in the model (equation) to predict the Gold prStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started