Answered step by step

Verified Expert Solution

Question

1 Approved Answer

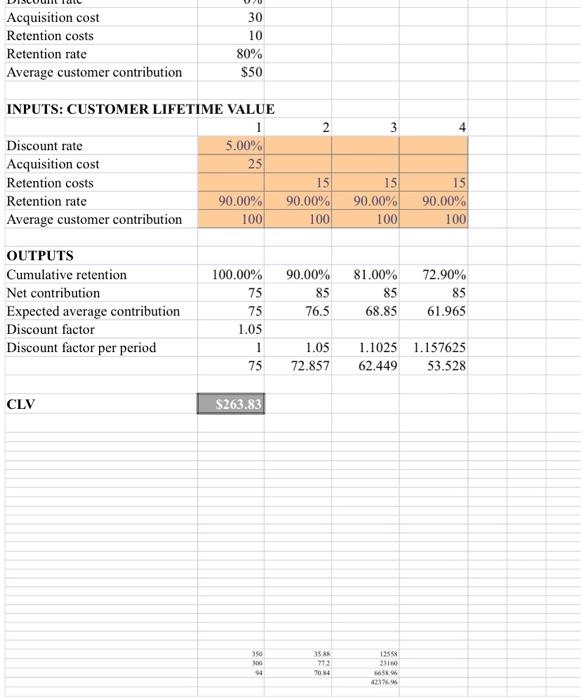

The OUTPUTS section reflects the average customer segment. You must evaluate the CLV of the proposed segment (NOTE: the parameters for the proposed segment are

The OUTPUTS section reflects the average customer segment. You must evaluate the CLV of the proposed segment (NOTE: the parameters for the proposed segment are listed in the assumptions)

1) take each of the assumptions listed at the top of the spreadsheet and plug them in to the INPUTS section of the model

2) calculate the CLV based on the assumptions

3) evaluate the answer in the OUTPUTS section

4) in a short sentence on the spreadsheet, explain whether the organization should invest in this market segment and why.

\begin{tabular}{lr} Acquisition cost & 30 \\ \hline Retention costs & 10 \\ \hline Retention rate & 80% \\ \hline Average customer contribution & $50 \end{tabular} INPUTS: CUSTOMER LIFETIME VALUE OUTPUTS \begin{tabular}{|l|r|r|r|r|} \hline Cumulative retention & 100.00% & 90.00% & 81.00% & 72.90% \\ \hline Net contribution & 75 & 85 & 85 & 85 \\ \hline Expected average contribution & 75 & 76.5 & 68.85 & 61.965 \\ \hline Discount factor & 1.05 & & & \\ \hline Discount factor per period & 1 & 1.05 & 1.1025 & 1.157625 \\ \hline & 75 & 72.857 & 62.449 & 53.528 \\ \hline \end{tabular} CLV $263.83 \begin{tabular}{lr} Acquisition cost & 30 \\ \hline Retention costs & 10 \\ \hline Retention rate & 80% \\ \hline Average customer contribution & $50 \end{tabular} INPUTS: CUSTOMER LIFETIME VALUE OUTPUTS \begin{tabular}{|l|r|r|r|r|} \hline Cumulative retention & 100.00% & 90.00% & 81.00% & 72.90% \\ \hline Net contribution & 75 & 85 & 85 & 85 \\ \hline Expected average contribution & 75 & 76.5 & 68.85 & 61.965 \\ \hline Discount factor & 1.05 & & & \\ \hline Discount factor per period & 1 & 1.05 & 1.1025 & 1.157625 \\ \hline & 75 & 72.857 & 62.449 & 53.528 \\ \hline \end{tabular} CLV $263.83

\begin{tabular}{lr} Acquisition cost & 30 \\ \hline Retention costs & 10 \\ \hline Retention rate & 80% \\ \hline Average customer contribution & $50 \end{tabular} INPUTS: CUSTOMER LIFETIME VALUE OUTPUTS \begin{tabular}{|l|r|r|r|r|} \hline Cumulative retention & 100.00% & 90.00% & 81.00% & 72.90% \\ \hline Net contribution & 75 & 85 & 85 & 85 \\ \hline Expected average contribution & 75 & 76.5 & 68.85 & 61.965 \\ \hline Discount factor & 1.05 & & & \\ \hline Discount factor per period & 1 & 1.05 & 1.1025 & 1.157625 \\ \hline & 75 & 72.857 & 62.449 & 53.528 \\ \hline \end{tabular} CLV $263.83 \begin{tabular}{lr} Acquisition cost & 30 \\ \hline Retention costs & 10 \\ \hline Retention rate & 80% \\ \hline Average customer contribution & $50 \end{tabular} INPUTS: CUSTOMER LIFETIME VALUE OUTPUTS \begin{tabular}{|l|r|r|r|r|} \hline Cumulative retention & 100.00% & 90.00% & 81.00% & 72.90% \\ \hline Net contribution & 75 & 85 & 85 & 85 \\ \hline Expected average contribution & 75 & 76.5 & 68.85 & 61.965 \\ \hline Discount factor & 1.05 & & & \\ \hline Discount factor per period & 1 & 1.05 & 1.1025 & 1.157625 \\ \hline & 75 & 72.857 & 62.449 & 53.528 \\ \hline \end{tabular} CLV $263.83

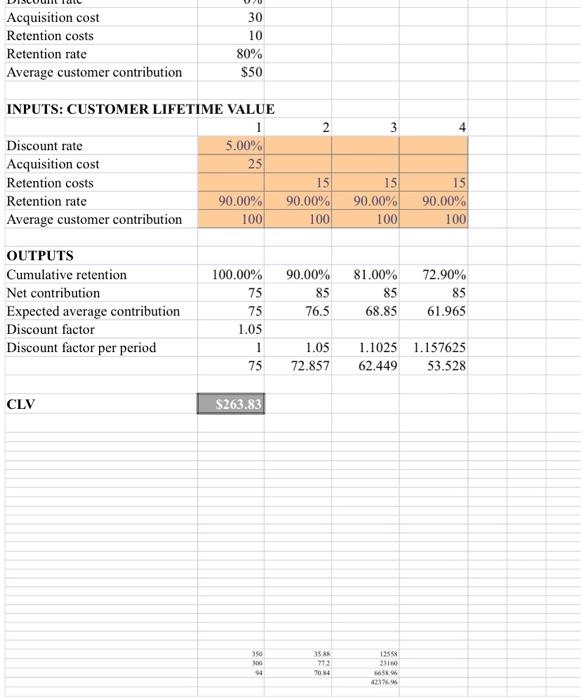

The OUTPUTS section reflects the average customer segment. You must evaluate the CLV of the proposed segment (NOTE: the parameters for the proposed segment are listed in the assumptions)

1) take each of the assumptions listed at the top of the spreadsheet and plug them in to the INPUTS section of the model

2) calculate the CLV based on the assumptions

3) evaluate the answer in the OUTPUTS section

4) in a short sentence on the spreadsheet, explain whether the organization should invest in this market segment and why.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started