Answered step by step

Verified Expert Solution

Question

1 Approved Answer

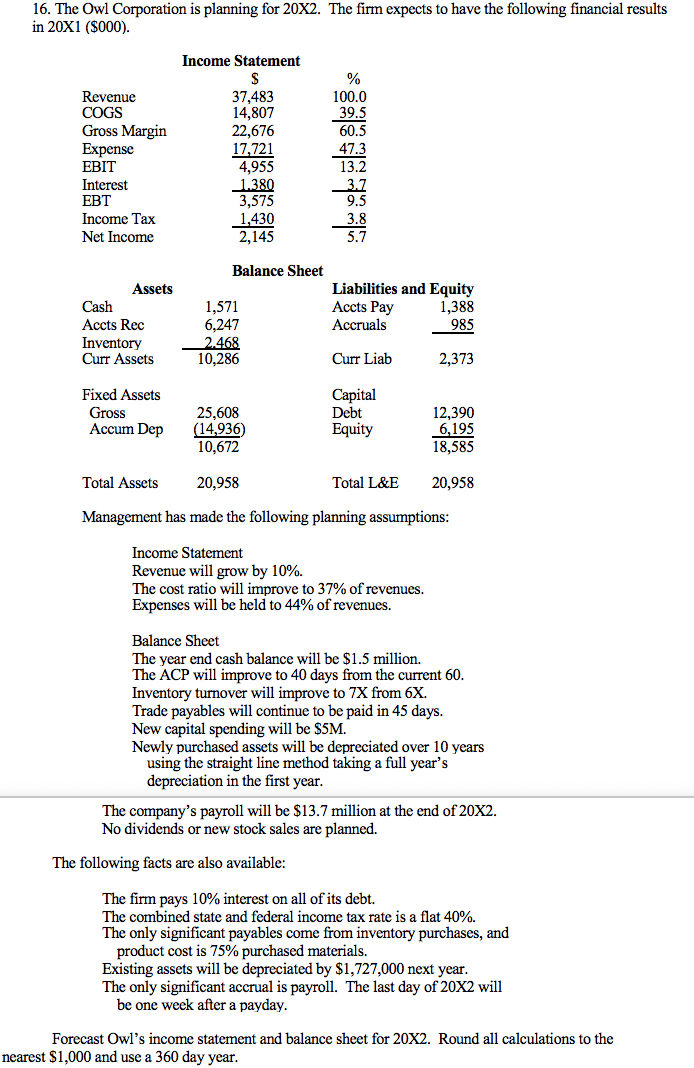

The Owl Corporation is planning for 2 0 x 2 . The firm expects to have the following financial results in 2 0 X 1

The Owl Corporation is planning for The firm expects to have the following financial results

in X$

Income Statement

Balance Sheet

Assets

Cash

Accts Rec

Inventory

Curr Assets

Fixed Assets

Gross

Accum Dep

Total Assets

Liabilities and Equity

Accts Pay

Accruals

Curr Liab

Capital

Debt

Equity

Total L&E

Management has made the following planning assumptions:

Income Statement

Revenue will grow by

The cost ratio will improve to of revenues.

Expenses will be held to of revenues.

Balance Sheet

The year end cash balance will be $ million.

The ACP will improve to days from the current

Inventory turnover will improve to from

Trade payables will continue to be paid in days.

New capital spending will be $

Newly purchased assets will be depreciated over years

using the straight line method taking a full year's

depreciation in the first year.

The company's payroll will be $ million at the end of

No dividends or new stock sales are planned.

The following facts are also available:

The firm pays interest on all of its debt.

The combined state and federal income tax rate is a flat

The only significant payables come from inventory purchases, and

product cost is purchased materials.

Existing assets will be depreciated by $ next year.

The only significant accrual is payroll. The last day of will

be one week after a payday.

Forecast Owl's income statement and balance sheet for X Round all calculations to the

nearest $ and use a day year.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started