Question

The owner also asked you several questions which he would like you to respond 1- He has asked if Clear Vent can use ASPE as

The owner also asked you several questions which he would like you to respond

1- He has asked if Clear Vent can use ASPE as the accounting framework. Is it acceptable and why? He wants to know what the different options are and what you recommend.

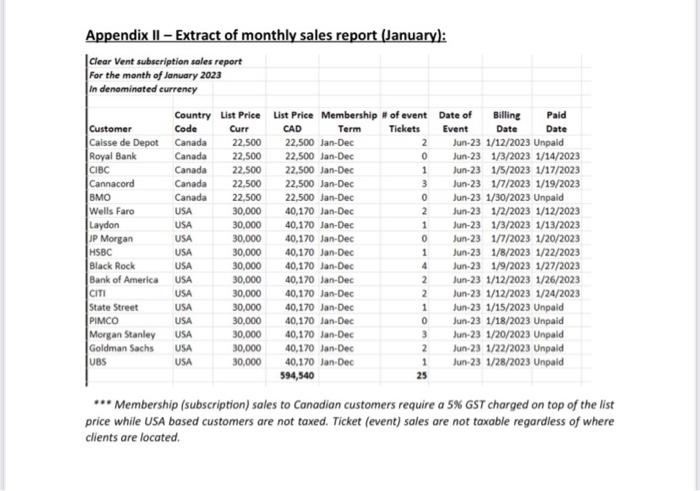

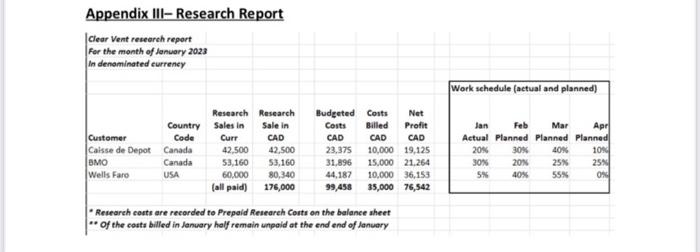

2- The owner asked you to explain what revenue recogniton principles most appropriately guide Clear Vent with respect to how it will report each of its revenue streams.

3- He has also asked you to explain how each of the revenue streams are journalized when clients are invoiced and how and when they will be reported as revenue. He is particularly interested in the balance of Deferred Revenue and has asked you to identify each component of the balance separately based on the revenue streams (see excel file).

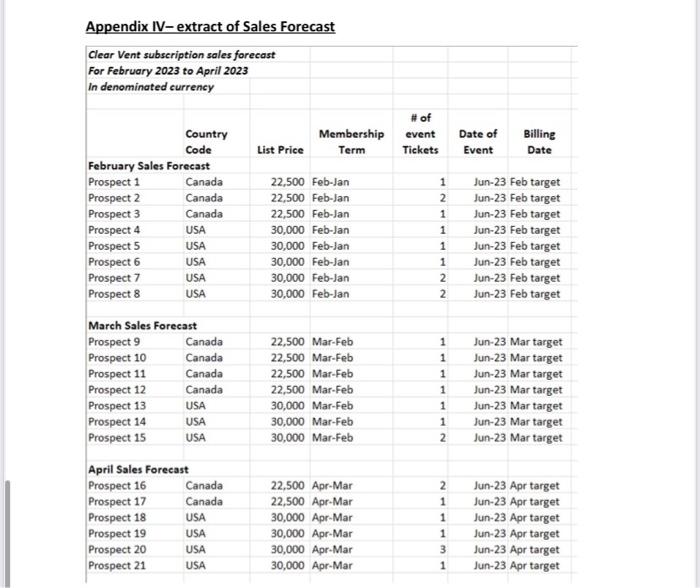

4- The owner presented you with an updated sales forecast for the next 3 months (Appendix IV) and asked you to provide a revenue projection (by revenue stream) for 2023 based on the assumpton that all the deals will close as forecasted. Importantly, he is looking to understand;

- How the sales will translate to revenue in fiscal 2023 so he can better evaluate the

business.

- How they will track versus the 2023 budget if all sales come in as forecasted. The budget

extract is included in the excel file in tab V. Note Research revenue is not budgeted

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started