Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The owner of a 10-year old asphalt plant is considering two alternatives: To continue with the old equipment for possibly 5 years more, at

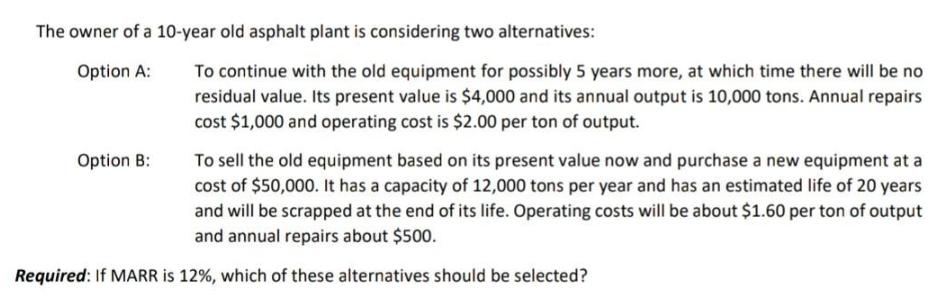

The owner of a 10-year old asphalt plant is considering two alternatives: To continue with the old equipment for possibly 5 years more, at which time there will be no residual value. Its present value is $4,000 and its annual output is 10,000 tons. Annual repairs cost $1,000 and operating cost is $2.00 per ton of output. Option A: To sell the old equipment based on its present value now and purchase a new equipment at a cost of $50,000. It has a capacity of 12,000 tons per year and has an estimated life of 20 years and will be scrapped at the end of its life. Operating costs will be about $1.60 per ton of output and annual repairs about $500. Option B: Required: If MARR is 12%, which of these alternatives should be selected?

Step by Step Solution

★★★★★

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

NPV OF OPTION A YEAR PARTICULARS CASH FLOW DF 12 PV 0 Sale valu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started