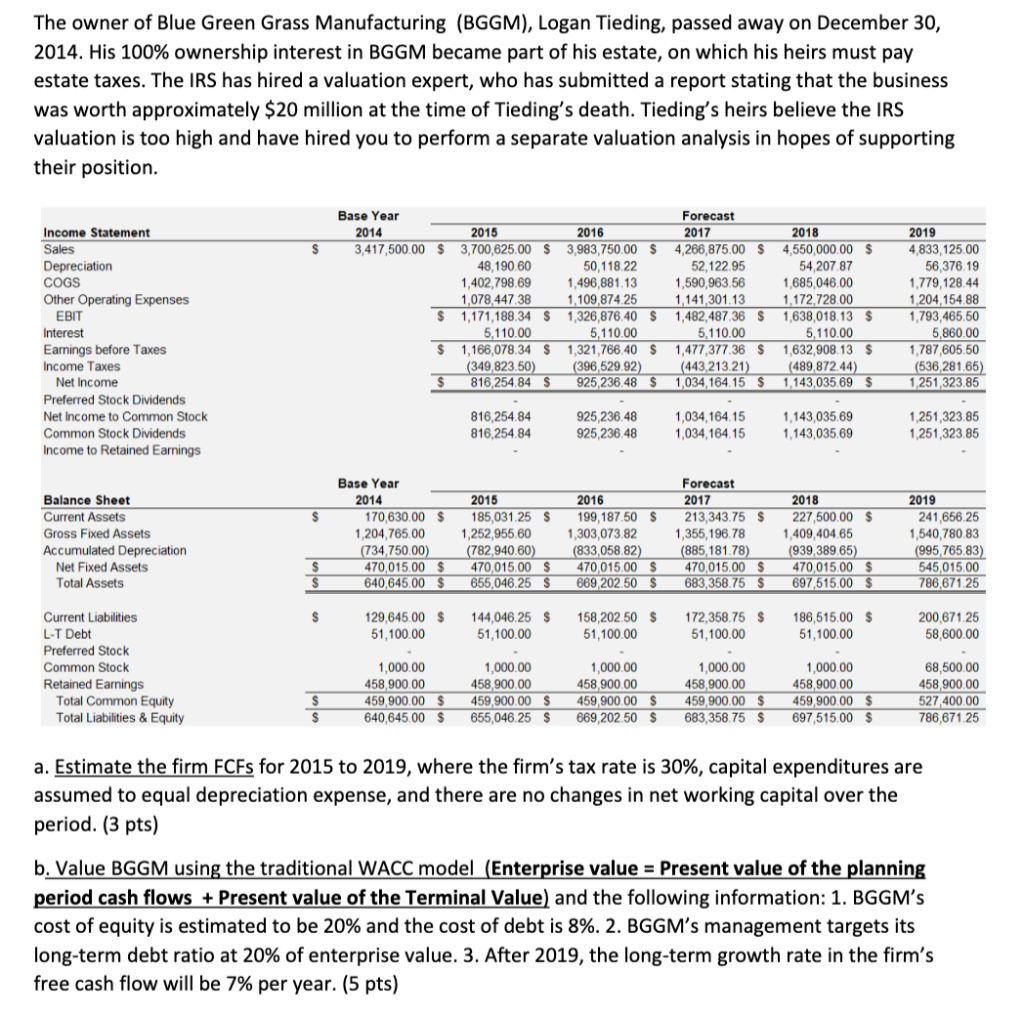

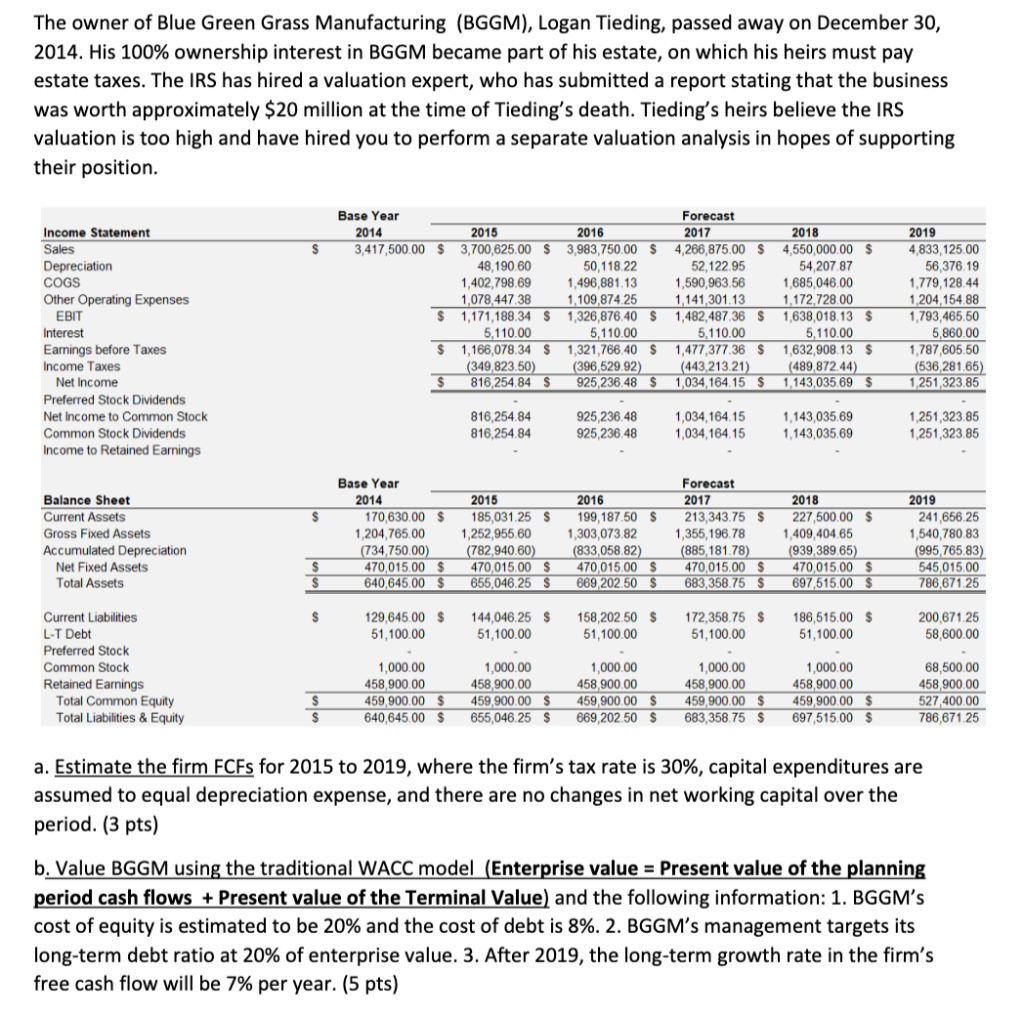

The owner of Blue Green Grass Manufacturing (BGGM), Logan Tieding, passed away on December 30, 2014. His 100% ownership interest in BGGM became part of his estate, on which his heirs must pay estate taxes. The IRS has hired a valuation expert, who has submitted a report stating that the business was worth approximately $20 million at the time of Tieding's death. Tieding's heirs believe the IRS valuation is too high and have hired you to perform a separate valuation analysis in hopes of supporting their position. $ Income Statement Sales Depreciation COGS Other Operating Expenses EBIT Base Year 2014 2015 3,417,500.00 $ 3,700,625.00 $ 48,190.60 1,402,798.69 1,078.44738 $ 1,171,188.34 $ 5.110.00 $ 1,166,078.34 $ (349,823.50) s 816.254.84 $ 2016 3,983,750.00 $ 50,118.22 1,496,881.13 1,109.874 25 1,326,876.40 S 5,110.00 1,321,766.40 $ (396,529.92) 925,236.48 Forecast 2017 4,266,875.00 $ 52,122.95 1,590,963.56 1,141,301.13 1,482,487.36 $ 5.110.00 1,477,377.36 $ (443,213.21) 1,034 164.15 $ 2018 4,550,000.00 $ 54,207 87 1,685,046.00 1,172,728.00 1,638,018.13 $ 5,110.00 1,632,908.13 $ (489,872.44) 1,143 035.69 $ 2019 4,833,125.00 56,376.19 1,779 128.44 1,204,154.88 1,793,465,50 5,860.00 1,787,605,50 (536,281.65) 1.251,323.85 Interest Earnings before Taxes Income Taxes Net Income Preferred Stock Dividends Net Income Common Stock Common Stock Dividends Income to Retained Earnings 816,254.84 816,254.84 925,236.48 925,236.48 1,034,164.15 1,034,164.15 1,143,035.69 1,143,035 69 1,251,323.85 1,251,323.85 $ Balance Sheet Current Assets Gross Fixed Assets Accumulated Depreciation Net Fixed Assets Total Assets Base Year 2014 170,630.00 $ 1,204,765.00 (734,750.00) 470,015.00 $ 640,645.00 $ 2015 185,031.25 $ 1,252,955,60 (782,940.60) 470,015.00 $ 655,046.25 $ 2016 199.187.50 $ 1,303,073.82 (833,058.82) 470,015.00 $ 669,202.50 $ Forecast 2017 213,343.75 S 1,355,196.78 (885,181.78) 470,015.00 $ 683,358.75 $ 2018 227,500.00 $ 1,409,404.65 (939,389.65) 470 015 00 697,515.00 $ 2019 241,656.25 1,540,780.83 (995,765.83) 545,015.00 786,671 25 $ } $ 129,645.00 $ 51,100.00 144,046,25 $ 51,100.00 158,202.50 $ 51,100.00 172,358.75 $ 51,100.00 186,515.00 $ 51,100.00 200,671.25 58,600.00 Current Liabilities L-T Debt Preferred Stock Common Stock Retained Earnings Total Common Equity Total Liabilities & Equity 1,000.00 458,900.00 459,900.00 $ 640,645.00 $ 1,000.00 458,900.00 459,900.00 $ 655,046,25 $ 1,000.00 458,900.00 459,900.00 669,202.50 $ 1,000.00 458,900.00 459,900.00 $ 683,358.75 $ 1,000.00 458 900.00 459,900.00 $ 697,515.00 $ 68,500.00 458,900.00 527 400.00 786,671.25 a. Estimate the firm FCFs for 2015 to 2019, where the firm's tax rate is 30%, capital expenditures are assumed to equal depreciation expense, and there are no changes in net working capital over the period. (3 pts) b. Value BGGM using the traditional WACC model (Enterprise value = Present value of the planning period cash flows + Present value of the Terminal Value) and the following information: 1. BGGM's cost of equity is estimated to be 20% and the cost of debt is 8%. 2. BGGM's management targets its long-term debt ratio at 20% of enterprise value. 3. After 2019, the long-term growth rate in the firm's free cash flow will be 7% per year. (5 pts)