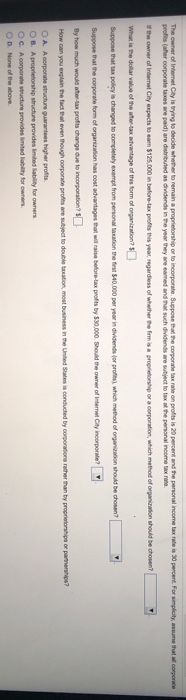

The owner of Internet City is trying to decide whether to remain a proprietorship or to incorporate Suppose that the corporate tax rate on profits is 20 percent and the personal income tax rate is 30 percent. For implicity, anume that corporate profits her corporate taxes are paid) are distributed as dividends in the year they are cared and such dividends are subject to tax at the personal income tax one the owner of Internet City expects to earn $125,000 in before tax protests year, regardless of whether the firm is a proprietorship or a corporation, which method of organization should be chosen? What is the dollar value of the stor tax advantage of this form of organisation Suppose that tax policy is changed to completely exempt from personation the first 540.000 per year individends for prote), which method of organization should be chosen? Suppose that the corporate form of organization has cost advantages that will it before tax profits by 530,000. Should the owner of internal Cay incorporate? By how much would wher-tax profits change due to incorporation? How can you explain the fact that even though corporate profits are subject to double tation, most business in the Unted is conducted by corporations rather than by proprietorship or partnership? O A A corporate structure guarantees higher profits OB. A proprietorship structure provides imited liability for owners OC. A corporate structure provides limited liability for owners OD. None of the above The owner of Internet City is trying to decide whether to remain a proprietorship or to incorporate Suppose that the corporate tax rate on profits is 20 percent and the personal income tax rate is 30 percent. For implicity, anume that corporate profits her corporate taxes are paid) are distributed as dividends in the year they are cared and such dividends are subject to tax at the personal income tax one the owner of Internet City expects to earn $125,000 in before tax protests year, regardless of whether the firm is a proprietorship or a corporation, which method of organization should be chosen? What is the dollar value of the stor tax advantage of this form of organisation Suppose that tax policy is changed to completely exempt from personation the first 540.000 per year individends for prote), which method of organization should be chosen? Suppose that the corporate form of organization has cost advantages that will it before tax profits by 530,000. Should the owner of internal Cay incorporate? By how much would wher-tax profits change due to incorporation? How can you explain the fact that even though corporate profits are subject to double tation, most business in the Unted is conducted by corporations rather than by proprietorship or partnership? O A A corporate structure guarantees higher profits OB. A proprietorship structure provides imited liability for owners OC. A corporate structure provides limited liability for owners OD. None of the above