Answered step by step

Verified Expert Solution

Question

1 Approved Answer

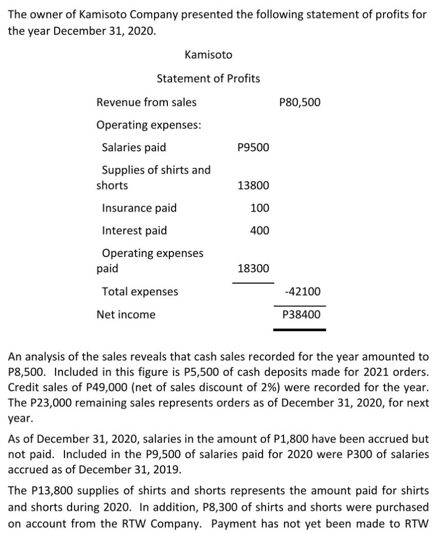

The owner of Kamisoto Company presented the following statement of profits for the year December 31, 2020. Kamisoto Statement of Profits Revenue from sales

The owner of Kamisoto Company presented the following statement of profits for the year December 31, 2020. Kamisoto Statement of Profits Revenue from sales P80,500 Operating expenses: Salaries paid P9500 Supplies of shirts and shorts 13800 Insurance paid 100 Interest paid 400 Operating expenses paid 18300 Total expenses -42100 Net income P38400 An analysis of the sales reveals that cash sales recorded for the year amounted to P8,500. Included in this figure is P5,500 of cash deposits made for 2021 orders. Credit sales of P49,000 (net of sales discount of 2%) were recorded for the year. The P23,000 remaining sales represents orders as of December 31, 2020, for next year. As of December 31, 2020, salaries in the amount of P1,800 have been accrued but not paid. Included in the P9,500 of salaries paid for 2020 were P300 of salaries accrued as of December 31, 2019. The P13,800 supplies of shirts and shorts represents the amount paid for shirts and shorts during 2020. In addition, P8,300 of shirts and shorts were purchased on account from the RTW Company. Payment has not yet been made to RTW Company, and consequently Mr. Sotosan, the owner, did not include this amount in the statement of profits. On January 1, 2020, P2,100 of shirts and shorts were on hand. The supply of shirts and shorts on December 31, 2020, was P400. On December 1, 2020, the insurance policy expired. The previous policy was paid in advance on December 1, 2019, for the 12-month period covering December 1, 2019, to November 30, 2020. The rate was P90 per month. Commencing December 1, 2020, Mr. Sotosan elected to pay the insurance premiums on a monthly basis. In addition to the P400 interest paid, P1,600 of interest was accrued on December 31, 2020. The following items were included in Operating Expenses: Advertising Expense (deposit for next year's placement on newspaper), P3,200; Utilities Expense (P200 accrued from 2019 while the company still owes P150 for 2020 bills) P1,700; Rent Expense for 2 years, P4,800; and Store Property Tax Expense, P3,600. The company delivery van was bought for P25,000 (salvage value is P2,000) on July 7, 2020, and the annual depreciation rate of 15% is unrecorded. Required: Prepare a multi-step income statement for the year ended December 31, 2020. All selling, administrative and general expenses will be under operating expense. Close the temporary accounts. Prepare a post-closing trial balance.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started