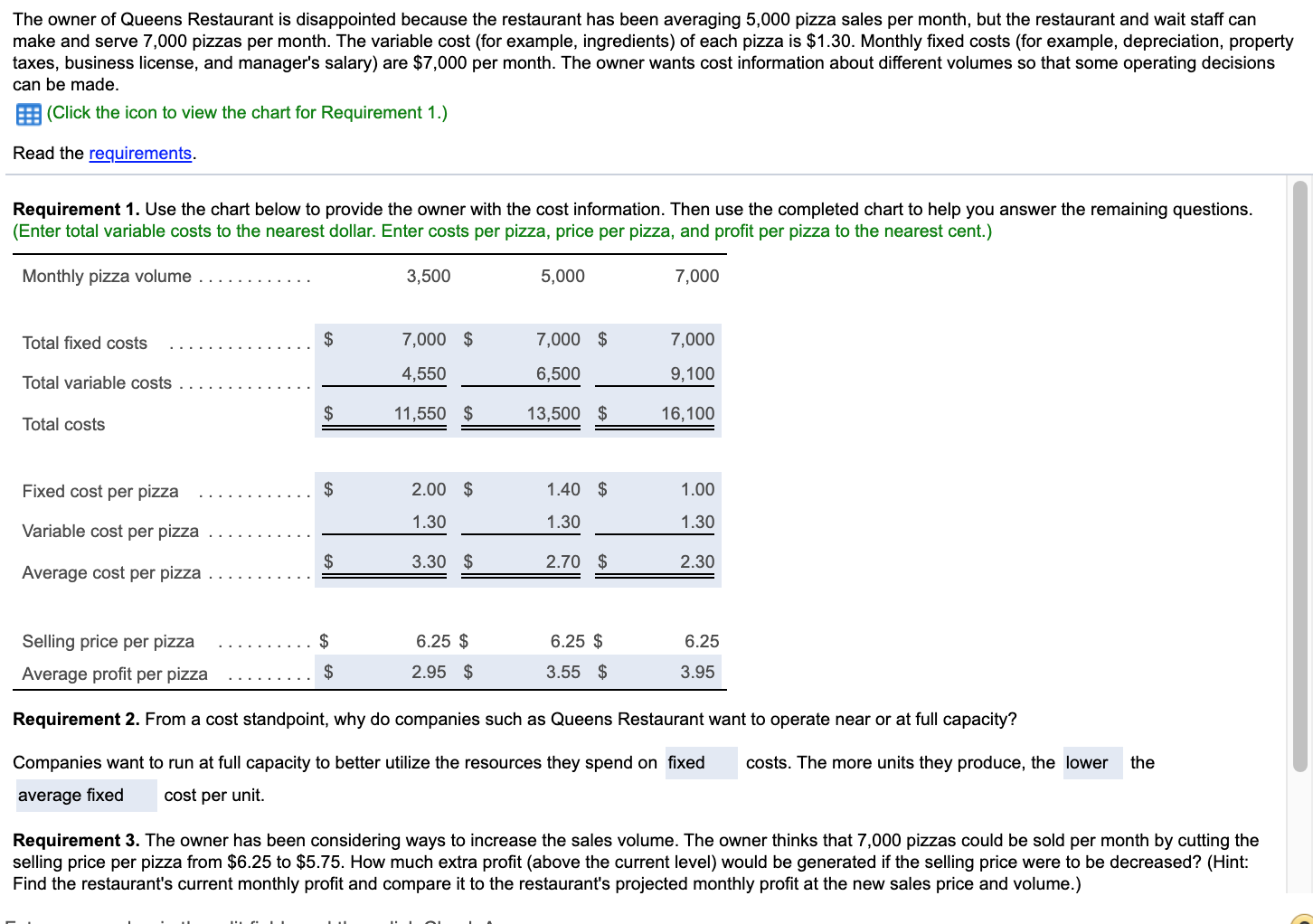

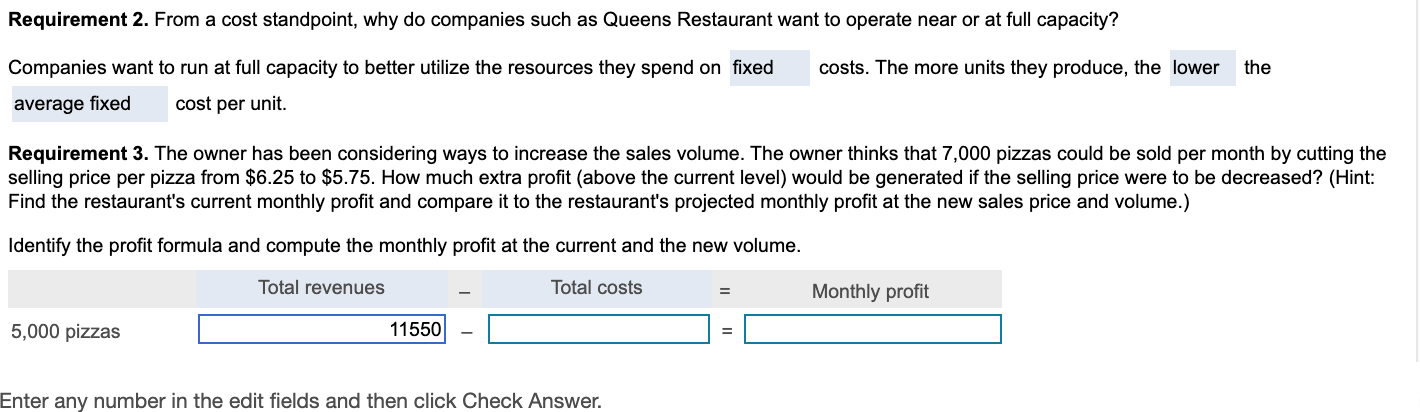

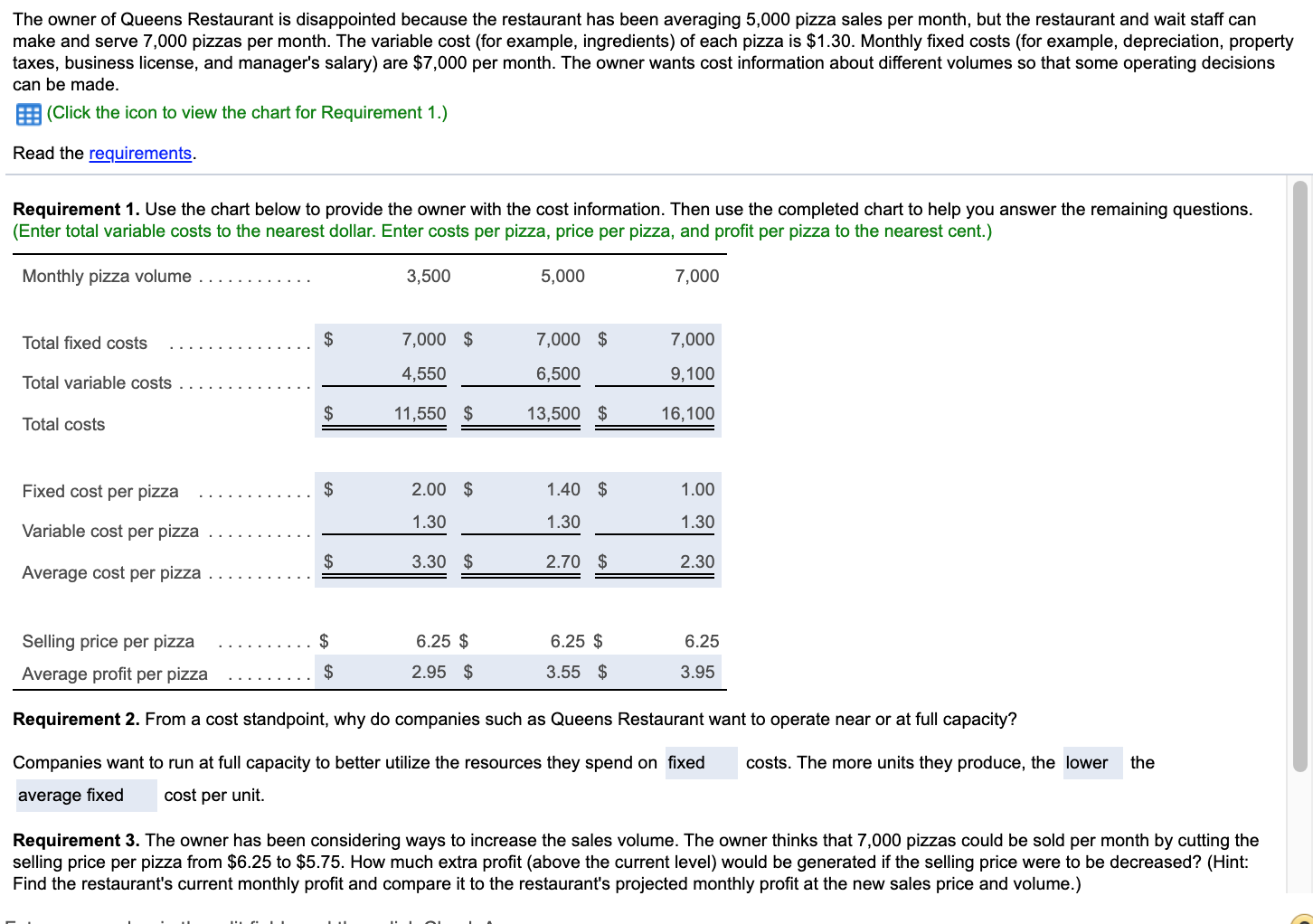

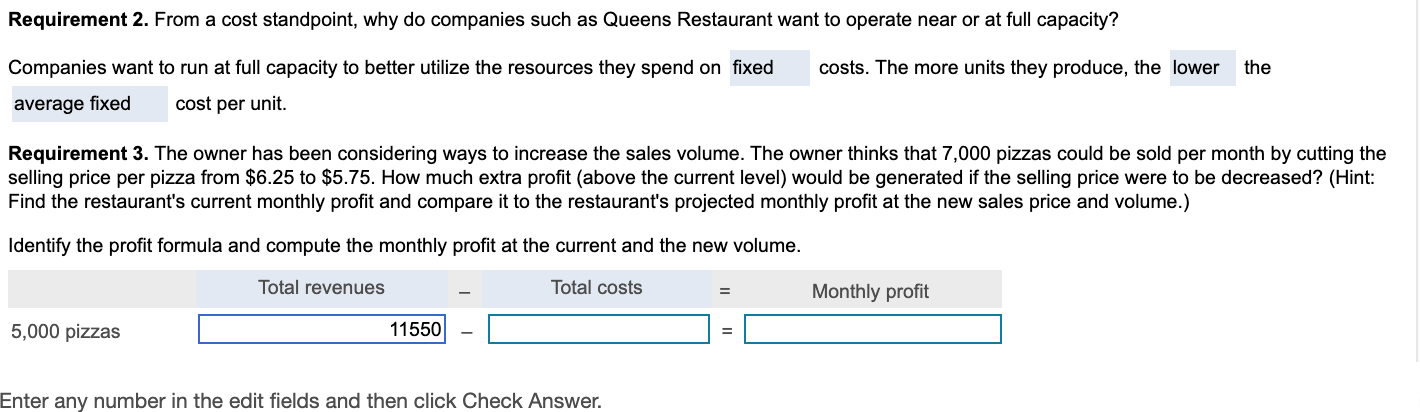

The owner of Queens Restaurant is disappointed because the restaurant has been averaging 5,000 pizza sales per month, but the restaurant and wait staff can make and serve 7,000 pizzas per month. The variable cost (for example, ingredients) of each pizza is $1.30. Monthly fixed costs (for example, depreciation, property taxes, business license, and manager's salary) are $7,000 per month. The owner wants cost information about different volumes so that some operating decisions can be made. (Click the icon to view the chart for Requirement 1.) Read the requirements. Requirement 1. Use the chart below to provide the owner with the cost information. Then use the completed chart to help you answer the remaining questions. (Enter total variable costs to the nearest dollar. Enter costs per pizza, price per pizza, and profit per pizza to the nearest cent.) Monthly pizza volume 3,500 5,000 7,000 Total fixed costs $ 7,000 $ 7,000 $ 7,000 Total variable costs 4,550 6,500 9,100 $ 11,550 $ 13,500 $ 16,100 Total costs Fixed cost per pizza $ 2.00 $ 1.40 $ 1.00 1.30 1.30 1.30 Variable cost per pizza $ 3.30 $ 2.70 $ 2.30 Average cost per pizza Selling price per pizza $ 6.25 $ 6.25 $ 6.25 Average profit per pizza $ 2.95 $ 3.55 $ 3.95 Requirement 2. From a cost standpoint, why do companies such as Queens Restaurant want to operate near or at full capacity? costs. The more units they produce, the lower the Companies want to run at full capacity to better utilize the resources they spend on fixed average fixed cost per unit. Requirement 3. The owner has been considering ways to increase the sales volume. The owner thinks that 7,000 pizzas could be sold per month by cutting the selling price per pizza from $6.25 to $5.75. How much extra profit (above the current level) would be generated if the selling price were to be decreased? (Hint: Find the restaurant's current monthly profit and compare it to the restaurant's projected monthly profit at the new sales price and volume.) Requirement 2. From a cost standpoint, why do companies such as Queens Restaurant want to operate near or at full capacity? costs. The more units they produce, the lower the Companies want to run at full capacity to better utilize the resources they spend on fixed average fixed cost per unit. Requirement 3. The owner has been considering ways to increase the sales volume. The owner thinks that 7,000 pizzas could be sold per month by cutting the selling price per pizza from $6.25 to $5.75. How much extra profit (above the current level) would be generated if the selling price were to be decreased? (Hint: Find the restaurant's current monthly profit and compare it to the restaurant's projected monthly profit at the new sales price and volume.) Identify the profit formula and compute the monthly profit at the current and the new volume. Total revenues Total costs Monthly profit 5,000 pizzas 11550 Enter any number in the edit fields and then click Check