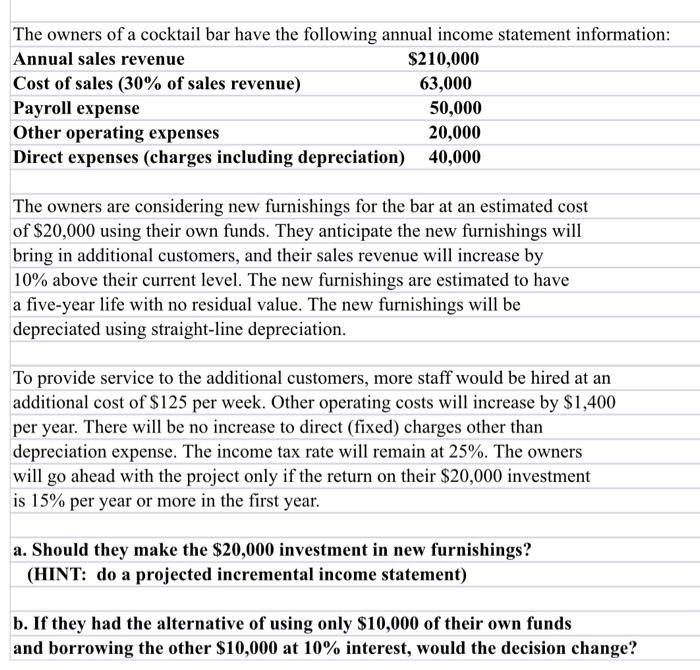

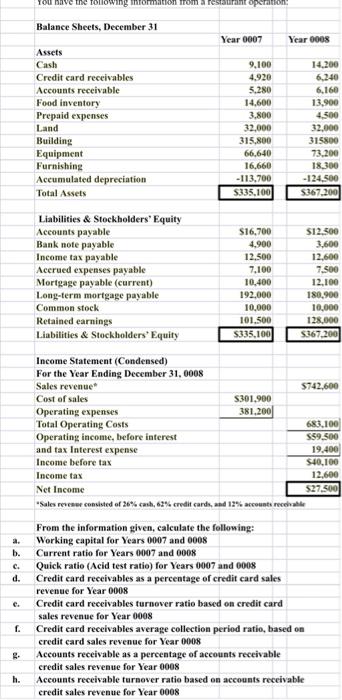

The owners of a cocktail bar have the following annual income statement information: Annual sales revenue $210,000 Cost of sales (30% of sales revenue) 63,000 Payroll expense 50,000 Other operating expenses 20,000 Direct expenses (charges including depreciation) 40,000 The owners are considering new furnishings for the bar at an estimated cost of $20,000 using their own funds. They anticipate the new furnishings will bring in additional customers, and their sales revenue will increase by 10% above their current level. The new furnishings are estimated to have a five-year life with no residual value. The new furnishings will be depreciated using straight-line depreciation. To provide service to the additional customers, more staff would be hired at an additional cost of $125 per week. Other operating costs will increase by $1,400 per year. There will be no increase to direct (fixed) charges other than depreciation expense. The income tax rate will remain at 25%. The owners will go ahead with the project only if the return on their $20,000 investment is 15% per year or more in the first year. a. Should they make the $20,000 investment in new furnishings? (HINT: do a projected incremental income statement) b. If they had the alternative of using only $10,000 of their own funds and borrowing the other $10,000 at 10% interest, would the decision change? The following information from a restaurant opcration Balance Sheets, December 31 Year 0007 Year 2008 Assets Cash Credit card receivables Accounts receivable Food Inventory Prepaid expenses Land Building Equipment Furnishing Accumulated depreciation Total Assets 9.100 4.920 5.280 14,600 3.800 32,000 315,800 66.640 16,660 -113,700 S335.100 14.200 6.2.40 6.160 13,900 4,500 32.000 315800 73.200 18,300 -124,500 $367-2001 Liabilities & Stockholders' Equity Accounts payable $16,700 $12.500 Banknote payable 4.900 3.600 Income tax payable 12.500 12.600 Accrued expenses payable 7,100 7.500 Mortgage payable (current) 10.400 12.100 Long-term mortgage payable 192.000 180.900 Common stock 10.000 10,000 Retained earnings 101.500 128.000 Liabilities & Stockholders' Equity S335.100 5367.200 Income Statement (Condensed) For the Year Ending December 31, 0008 Sales revenue $742.600 Cost of sales S301,900 Operating expenses 381,200 Total Operating Costs 683.100 Operating income, before interest $59.500 and tax Interest expense 19.400 Income before tax $40,100 Income tax 12,600 Net Income $27.500 "Sales revenue consisted of 28% cash, 62% credit cards, and 12% accounts receivable From the information given, calculate the following: Working capital for Years 0007 and 0008 Current ratio for Years 0007 and 0008 Quick ratio (Acid test ratio) for Years 0007 and 0008 Credit card receivables as a percentage of credit card sales revenue for Year 0008 Credit card receivables turnover ratio based on credit card sales revenue for Year 0008 Credit card receivables average collection period ratio, based on credit card sales revenue for Year 0008 Accounts receivable as a percentage of accounts receivable credit sales revenue for Year 0008 Accounts receivable turnover ratio based on accounts receivable credit sales revenue for Year 0008 b. C. d. C. 1. h