Question

The owners of a new venture have decided to organize as a corporation. The initial equity investment is valued at $200,000 reflecting contributions of the

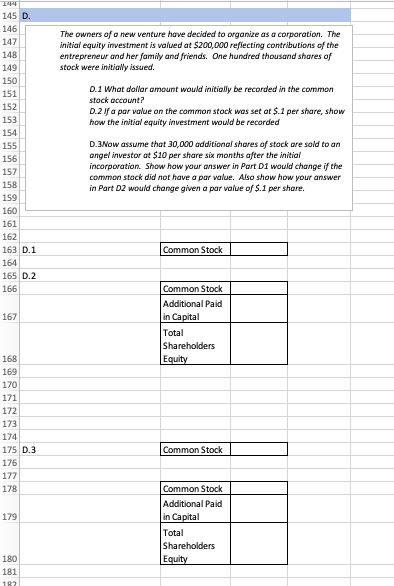

The owners of a new venture have decided to organize as a corporation. The initial equity investment is valued at $200,000 reflecting contributions of the entrepreneur and her family and friends. One hundred thousand shares of stock were initially issued. D.1 What dollar amount would initially be recorded in the common stock account? D.2 If a par value on the common stock was set at $.1 per share, show how the initial equity investment would be recorded D.3Now assume that 30,000 additional shares of stock are sold to an angel investor at $10 per share six months after the initial incorporation. Show how your answer in Part D1 would change if the common stock did not have a par value. Also show how your answer in Part D2 would change given a par value of $.1 per share.

The owners of a new venture have decided to organize as a corporation. The initial equity investment is valued at $200,000 reflecting contributions of the entrepreneur and her family and friends. One hundred thousand shares of stock were initially issued. D.1 What dollar amount would initially be recorded in the common stock account? D.2 If a par value on the common stock was set at $.1 per share, show how the initial equity investment would be recorded D.3Now assume that 30,000 additional shares of stock are sold to an angel investor at $10 per share six months after the initial incorporation. Show how your answer in Part D1 would change if the common stock did not have a par value. Also show how your answer in Part D2 would change given a par value of $.1 per share.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started