Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Palms is a not-for-profit, family-oriented health club. The club's board of directors is developing plans to acquire more equipment and expand club facilities. The

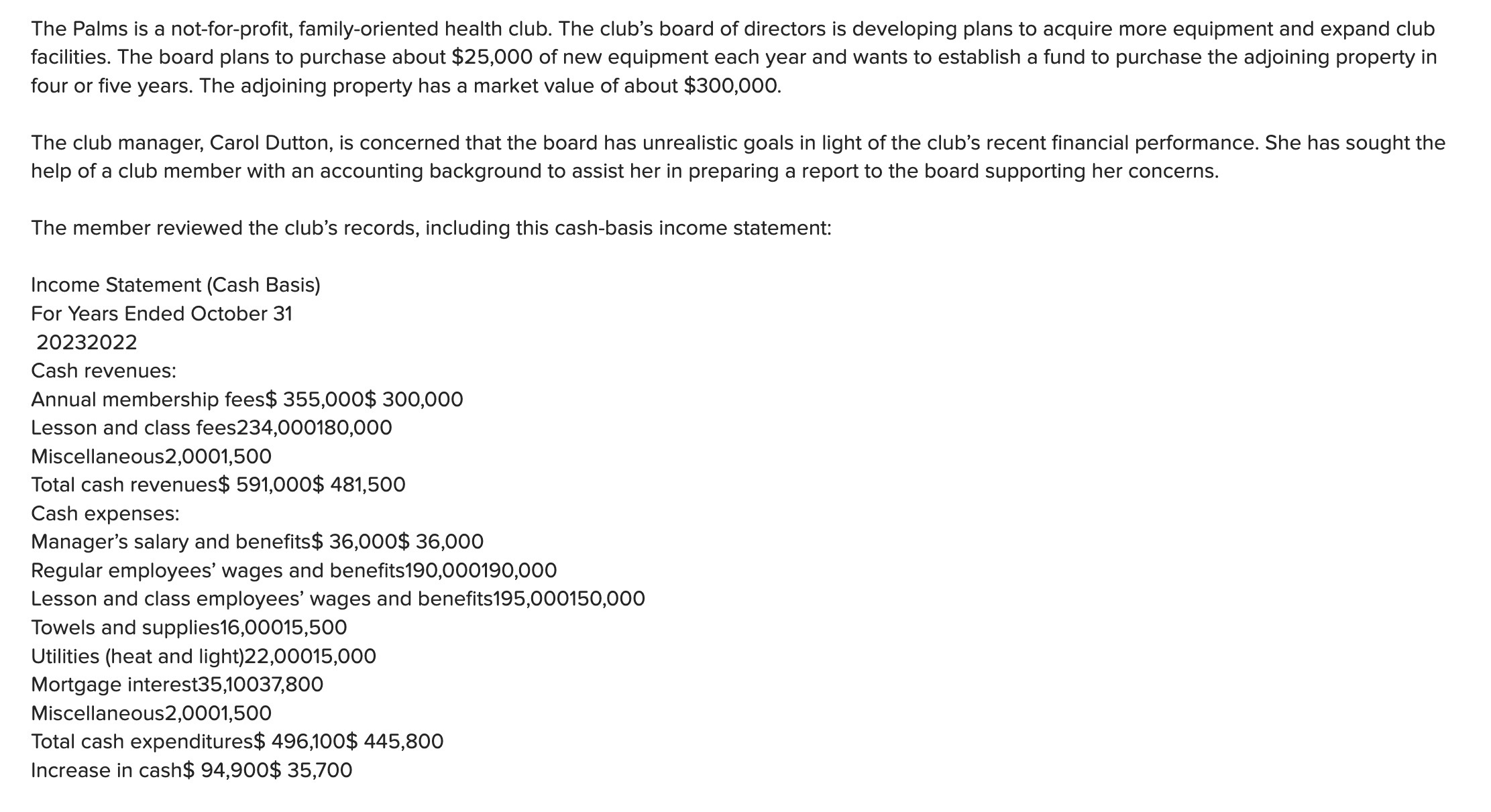

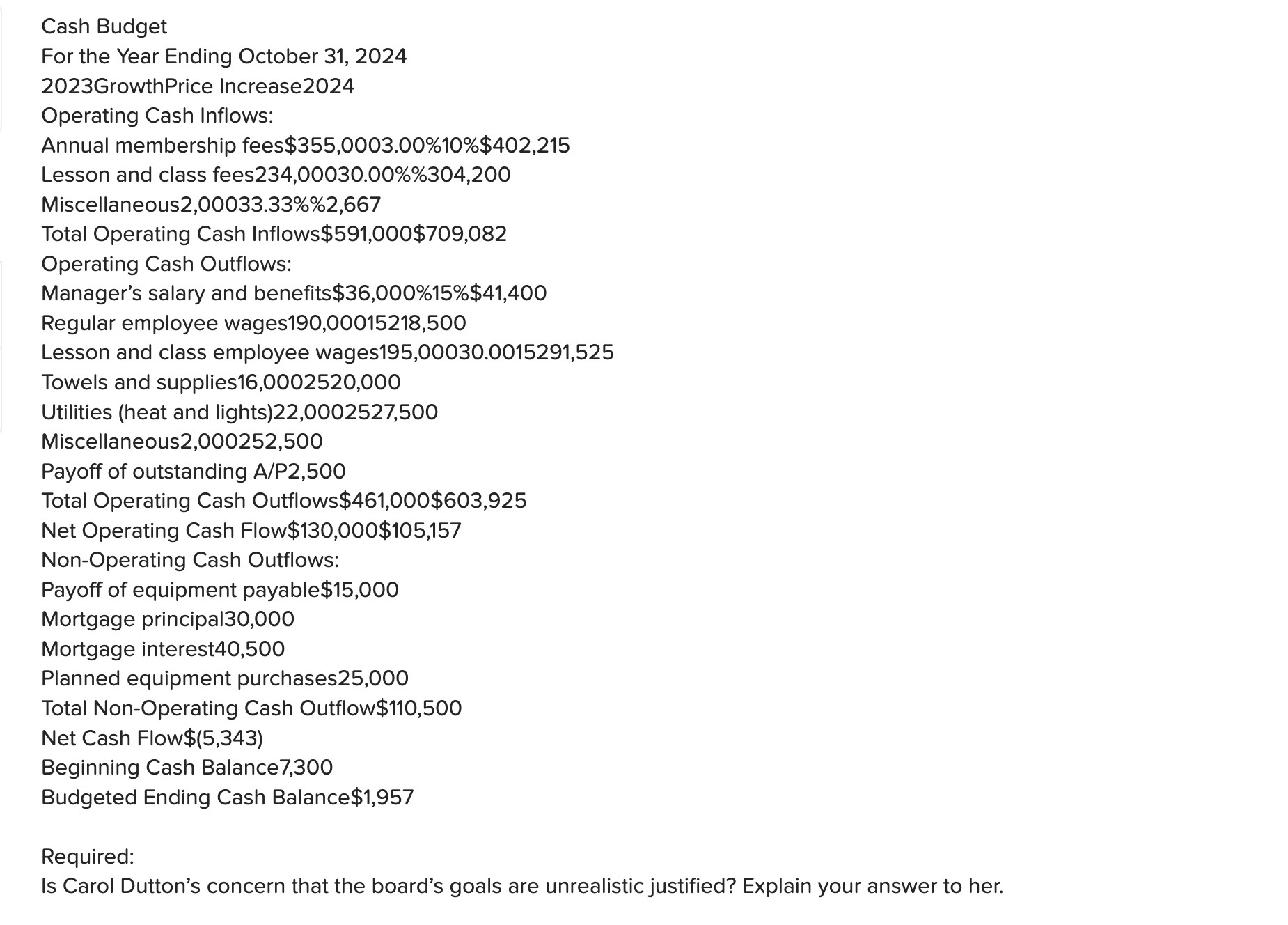

The Palms is a not-for-profit, family-oriented health club. The club's board of directors is developing plans to acquire more equipment and expand club facilities. The board plans to purchase about $25,000 of new equipment each year and wants to establish a fund to purchase the adjoining property in four or five years. The adjoining property has a market value of about $300,000. The club manager, Carol Dutton, is concerned that the board has unrealistic goals in light of the club's recent financial performance. She has sought the help of a club member with an accounting background to assist her in preparing a report to the board supporting her concerns. The member reviewed the club's records, including this cash-basis income statement: Income Statement (Cash Basis) For Years Ended October 31 20232022 Cash revenues: Annual membership fees $355,000$300,000 Lesson and class fees 234,000180,000 Miscellaneous2,0001,500 Total cash revenues $591,000$481,500 Cash expenses: Manager's salary and benefits $36,000$36,000 Regular employees' wages and benefits190,000190,000 Lesson and class employees' wages and benefits195,000150,000 Towels and supplies16,00015,500 Utilities (heat and light)22,00015,000 Mortgage interest 35,10037,800 Miscellaneous2,0001,500 Total cash expenditures $496,100$445,800 Increase in cash $44,900$35,700 Cash Budget For the Year Ending October 31, 2024 2023GrowthPrice Increase 2024 Operating Cash Inflows: Annual membership fees $355,0003.00%10%$402,215 Lesson and class fees 234,00030.00%%304,200 Miscellaneous2,00033.33\%\%2,667 Total Operating Cash Inflows $591,000$709,082 Operating Cash Outflows: Manager's salary and benefits $36,000%15%$41,400 Regular employee wages190,00015218,500 Lesson and class employee wages195,00030.0015291,525 Towels and supplies 16,0002520,000 Utilities (heat and lights)22,0002527,500 Miscellaneous2,000252,500 Payoff of outstanding A/P2,500 Total Operating Cash Outflows $461,000$603,925 Net Operating Cash Flow $130,000$105,157 Non-Operating Cash Outflows: Payoff of equipment payable $15,000 Mortgage principal30,000 Mortgage interest40,500 Planned equipment purchases 25,000 Total Non-Operating Cash Outflow $110,500 Net Cash Flow $(5,343) Beginning Cash Balance 7,300 Budgeted Ending Cash Balance\$1,957 Required: Is Carol Dutton's concern that the board's goals are unrealistic justified? Explain your answer to her

The Palms is a not-for-profit, family-oriented health club. The club's board of directors is developing plans to acquire more equipment and expand club facilities. The board plans to purchase about $25,000 of new equipment each year and wants to establish a fund to purchase the adjoining property in four or five years. The adjoining property has a market value of about $300,000. The club manager, Carol Dutton, is concerned that the board has unrealistic goals in light of the club's recent financial performance. She has sought the help of a club member with an accounting background to assist her in preparing a report to the board supporting her concerns. The member reviewed the club's records, including this cash-basis income statement: Income Statement (Cash Basis) For Years Ended October 31 20232022 Cash revenues: Annual membership fees $355,000$300,000 Lesson and class fees 234,000180,000 Miscellaneous2,0001,500 Total cash revenues $591,000$481,500 Cash expenses: Manager's salary and benefits $36,000$36,000 Regular employees' wages and benefits190,000190,000 Lesson and class employees' wages and benefits195,000150,000 Towels and supplies16,00015,500 Utilities (heat and light)22,00015,000 Mortgage interest 35,10037,800 Miscellaneous2,0001,500 Total cash expenditures $496,100$445,800 Increase in cash $44,900$35,700 Cash Budget For the Year Ending October 31, 2024 2023GrowthPrice Increase 2024 Operating Cash Inflows: Annual membership fees $355,0003.00%10%$402,215 Lesson and class fees 234,00030.00%%304,200 Miscellaneous2,00033.33\%\%2,667 Total Operating Cash Inflows $591,000$709,082 Operating Cash Outflows: Manager's salary and benefits $36,000%15%$41,400 Regular employee wages190,00015218,500 Lesson and class employee wages195,00030.0015291,525 Towels and supplies 16,0002520,000 Utilities (heat and lights)22,0002527,500 Miscellaneous2,000252,500 Payoff of outstanding A/P2,500 Total Operating Cash Outflows $461,000$603,925 Net Operating Cash Flow $130,000$105,157 Non-Operating Cash Outflows: Payoff of equipment payable $15,000 Mortgage principal30,000 Mortgage interest40,500 Planned equipment purchases 25,000 Total Non-Operating Cash Outflow $110,500 Net Cash Flow $(5,343) Beginning Cash Balance 7,300 Budgeted Ending Cash Balance\$1,957 Required: Is Carol Dutton's concern that the board's goals are unrealistic justified? Explain your answer to her Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started