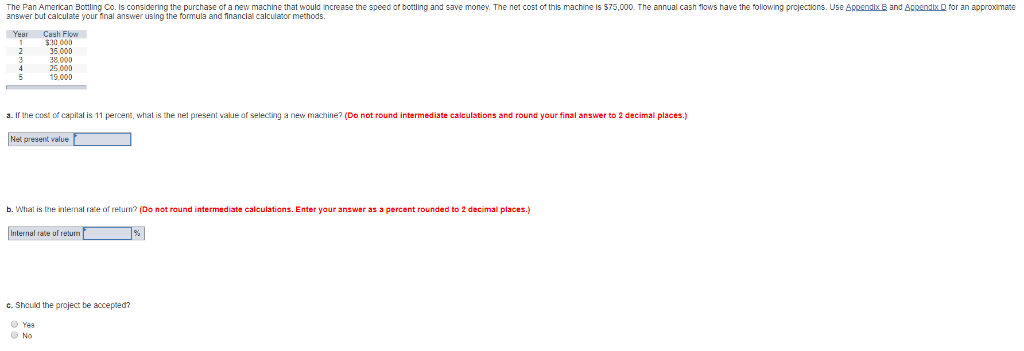

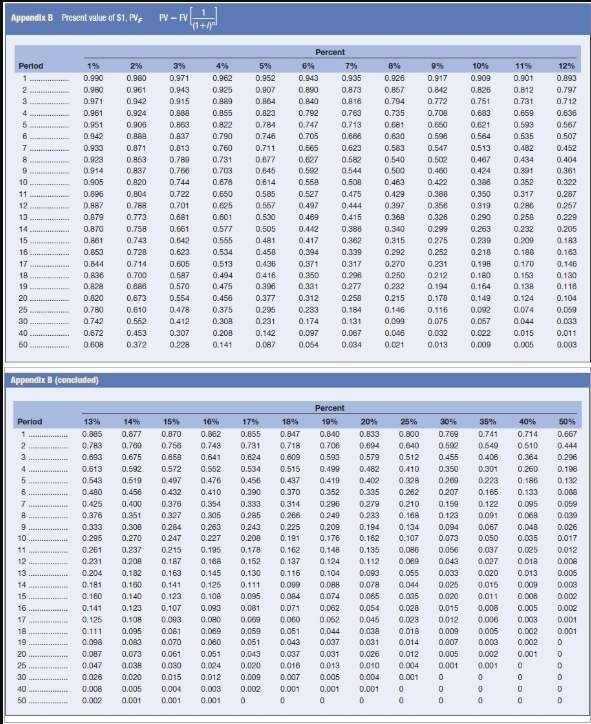

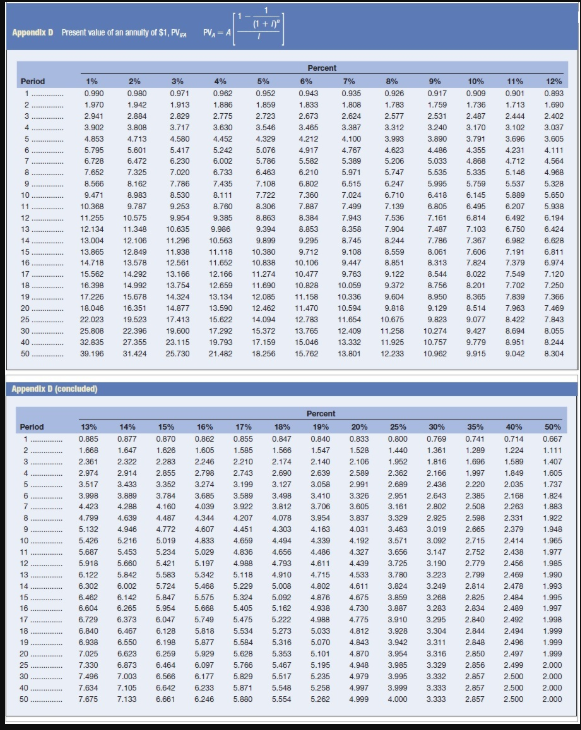

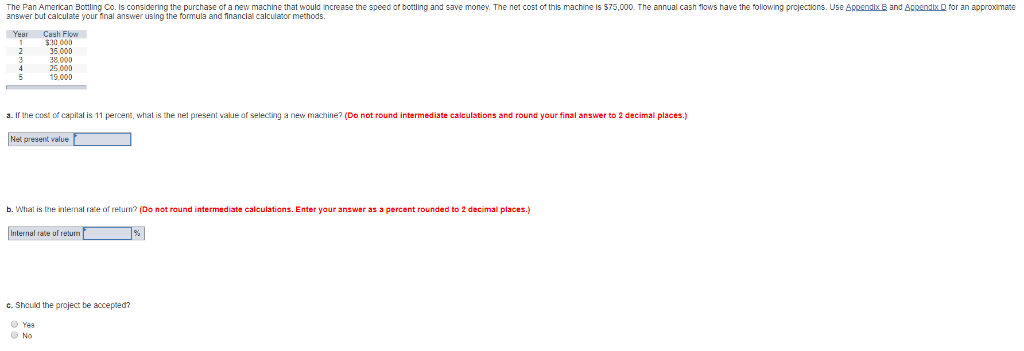

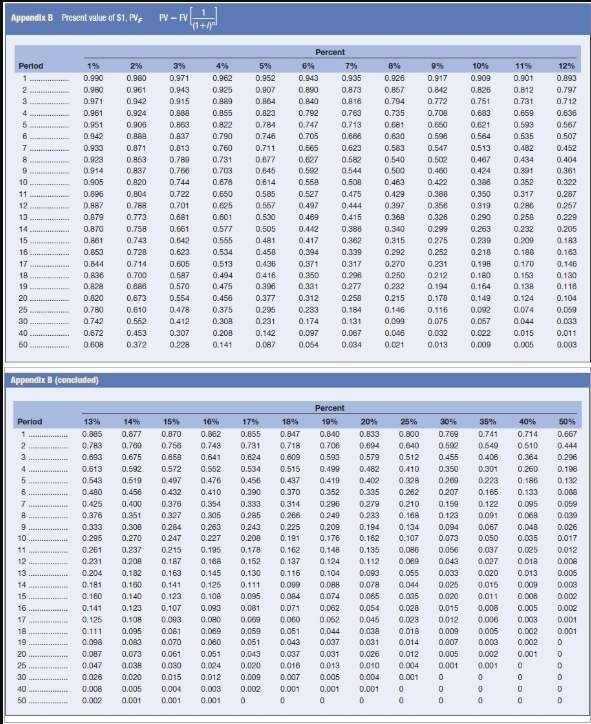

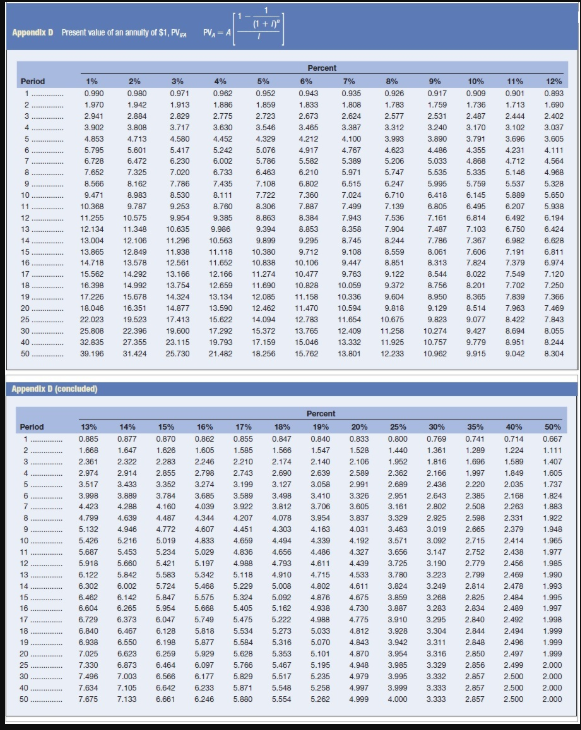

The Pan American Bottling Co. is considering the purchase of a new machine that would increase the speed of bottling and save money. The net cost of this machine is $75,000. The annual cash flows have the following projections. Use Appendix answer but calculate your final answer using the formula and financial calculator methods. and Appendix D for an approximate Cash Flow $30 000 35.000 25 000 19.000 a. If the cost of capital is 11 percent, what is the nel present value of selecting a new machine? (Do not round intermediate calculations and round your final answer to 2 decimal places.) Net present value b. What is the internal rate of return? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Internal tale of return c. Should the project be accepted? Yee O No Appendix B Present value of S1, PVE PV- Period 12% 0.893 0.797 0.712 10% 0.909 0.826 0.751 0.683 0.621 0.564 0.513 0.467 0.424 0.500 9% 0.917 0,842 0.772 0.708 0.650 0.598 0.547 0.502 0.460 0.422 0.388 0.356 192939495% 0.990 0.980 0,971 0.962 0.952 0.9800.961 0.943 0.925 0.907 0.971 0.942 0.915 0.889 0.884 0.961 0.924 0.368 0.855 0.823 0.951 0.906 0.863 0.822 0.784 0.942 0.889 0.837 0.790 0.746 0.933 0.871 0.813 0 .760 0.711 0.923 0863 0.789 0.731 0.677 0.914 0.897 0.786 0.703 0.645 0.905 0.820 0.744 0.678 0.614 0.896 0.804 0.722 0.650 0.585 0.887 0.788 0.701 0.95 0.567 0.879 0.773 0.681 0.601 05 0.870 0.750 0.661 0.577 0.881 0.743 0.342 0.555 0.481 0.850 0.720 0.623 0.534 0.456 0,644 0.714 0.605 0.513 0.436 0.838 0.700 0.57 0.494 0.418 D.829 O BAR 0.570 0.475 0.398 0.820 0.873 0.456 0.377 0.780 0.610 0.478 0.375 0295 0.742 0.562 0.412 0.308 0.672 0.453 0.307 0.200 0 .142 0.608 0.372 0.228 0.141 0.087 0.388 Percent 6% 7% 0.943 0.935 0.890 0.873 0.840 0.816 0.792 0.763 0.747 0.713 0.705 0.686 0.665 0.623 0.627 0.582 0.592 0.544 0.550 0.527 0.475 0.497 0.444 0.469 0.415 0.442 0.388 0.417 0.382 0.394 0.3390 0.371 0.317 0.350 0.296 0.331 0.277 0.312 0.250 0.283 0.174 0.131 0.097 0.067 0.054 0.034 8% 0.926 0.857 0.794 0.785 0.681 0.630 0.583 0.540 0.500 0.463 0.429 0.397 0.368 0.340 0.315 .292 0.270 0.250 0.232 0.215 0.145 0.099 0.046 0.021 11% 0.901 0.812 0.731 0.659 0.593 0.535 0.482 0.434 0.991 0.352 0.317 0286 0.250 0.25 0.232 0.209 0.188 0.170 0.153 0.138 0.124 0.074 0.044 0.015 0.005 0226 0 505 0.350 0.319 0.290 0.263 0.239 0.218 0.198 0.180 0.164 0.149 0.092 0.067 0.022 0.009 0.299 0.275 0.252 0.231 0212 0.194 0.178 0.116 0.075 0.032 0.013 0.636 0.567 0507 0.452 0.404 0.361 0.322 0.287 0.257 0.229 0.205 0.183 0.163 0.146 0.130 0.116 0.104 0.059 0.033 0.011 0.003 0.554 0.184 0.231 Appendix B (concluded) Period 0 40% 0.714 0.510 0.364 0.260 0.18 0.133 0,095 0.068 0.043 0.005 0 0 13% 0.885 0.783 0.693 0.613 0.543 0.400 0.425 0.376 0.333 0.295 0.251 0.231 0.204 0.181 0.160 0.141 0.125 0.111 0.098 0.087 0.047 0.028 0.006 0.002 0.025 14% 0.877 0.709 0.675 0.592 0.519 0.456 0.400 0.351 0.308 0.270 0.237 0.208 0.182 0.160 0.140 0.123 0.108 0.095 0.002 0,073 0.038 0.020 0,005 0.001 15% 0.870 0.756 0.658 0.572 0.497 0.432 0.375 0.327 0.284 0.247 0215 0.187 0.163 0.141 0.123 0.107 .093 0.061 0.070 0.061 0.030 0,015 0,004 0.001 16% 0.862 0.743 0.841 0.552 0.478 0.410 0.354 0.305 0.283 0.227 0.195 0.188 0.145 0.125 0.106 0.093 0.080 0.089 0.00 0,051 0,004 0.012 0.003 0.001 17% 0.855 0.781 0.624 0.534 0.456 0.290 0.333 0.285 0.243 0.208 0.178 .152 0.130 0.111 0.095 0.081 0.069 0.059 0.051 0.043 0.020 0,009 0.002 0 Percent 18% 19% 0.847 0,340 0.718 0 .706 0.609 0.593 .515 0.499 0.437 0.419 0.370 0.352 0.3140 .296 0.286 0.249 0.225 0.209 .191 0176 0.162 0.148 0.137 0.124 .116 0.104 0.099 0.088 0.084 0.074 0.071 0.062 0.060 0.062 0.051 0.044 0.043 0.037 0.037 0.001 0.016 0 .013 0.007 0.005 0.001 0.001 0 0 0 20% 0.833 0.694 0.579 0.482 0.400 0.335 0279 .233 0.194 0.162 0.135 0.112 0.093 0.078 0.065 0.054 0.045 0.028 0.031 0.026 0.010 0.004 0.001 0 25% 0.800 0.540 0.512 0.410 0.328 0.262 0.210 0.168 0.134 0.107 0.086 0.089 0.055 0.044 0.035 0,028 .023 0.018 0.014 0.012 0004 0.001 0 0 50% 0.667 0.444 0.296 0.198 0.132 0028 0,059 0.039 0.026 0.017 0.012 0.000 0.005 0.005 0.002 0.002 0.001 0.001 30% 0.769 0 0.592 0.455 0 350 0.289 0 0.207 0.1590 0.123 0,094 0.073 0.056 0.043 0.033 0.025 0.020 0 0,015 0.012 0.0090 0.007 0.005 0.001 0 0 0 35% .741 0.549 0.406 0.301 .223 0.165 .122 0.091 0.067 0.050 0.037 0.027 0.020 0,015 .011 0.008 0.006 .005 0.003 0.002 0.001 0 0 0 0 0 0 0 0.018 0.013 0,009 .008 0.005 0.003 0.002 0.002 0.001 0 0 0 0 0 Appendix D Present value of an annuity of $1, PV, PVA Period 4% 0.002 1.686 2.775 3% 0,971 1913 2.629 3.717 4.580 5.417 6.230 8% 0.926 1.783 2.577 3.312 9% 0.917 1.750 2.531 3240 3.890 3.993 5795 4,452 5.242 6.002 8.733 7,435 7020 8.111 1% 2% 0.990 0.980 1.970 1,942 2.941 2 .884 3.902 3.808 4.853 4.713 5.601 6.728 6.472 7.6527 325 8.566 8162 9.471 6.983 10.388 9.787 11 255 10.575 1924 11 348 13.004 12.106 13.865 12.849 14718 13.578 15.562 14292 16.398 14.992 17 225 15.678 18.046 16.351 22.023 19.522 25.80B 22 396 32.835 27.355 39.195 31,424 7.786 2.530 9.253 9.954 10.635 11.296 11.938 12.561 13.166 13.754 14.324 14.877 17.413 19.600 23.115 25.730 5% 0.062 1.859 2.723 3.546 4.329 5.076 5.786 6.463 7,108 7.722 8.308 8.663 9.394 9.899 10.380 10.63 11.274 11.690 12.085 12.462 14.094 15.372 17.159 18.250 8.780 9.385 9.908 10.563 11.118 11.552 12.166 12.659 13.134 13.590 15.2 17 292 19.793 21,482 8.384 Percent 6% 7% 0.0143 0 .936 1.833 1 808 2.673 2.624 3.485 3.387 4.212 4,100 4.917 4.767 5.562 5.369 62 6.971 6.802 6,515 7.024 7.409 7.943 8.053 9.295 8.745 9.712 9.108 10.105 9.447 10.477 9.763 10.828 10.059 11.158 10.336 11.470 10.594 12.783 13.765 12.409 15.046 13.332 15.752 1 3.801 5.206 5,033 5.7475 .536 6 247 5.995 6.418 7.139 .806 7.536 7.1616 7.904 7.407 8.244 7.786 8.5598 .061 8.851 8.313 9.122 8.544 9372 8.756 9.604 8.950 9.018 9.129 10.675 9.823 9 11 258 10.274 11.925 10.757 12 239 10.982 10% 11% 12% 0.909 0.901 0.993 1.736 1.713 1.690 2.487 2.444 2.402 3.170 3102 3.037 3.791 3.696 3.605 4.231 4. 111 4.868 4.712 4.564 5.3355 148 4.988 5.759 5.537 5.328 6.145 5.809 5.650 1.495 8.207 5338 .814 6.492 6.194 7.103 6.750 6.424 7.367 6.982 B 628 7.606 7.1916.811 7.824 7379 6.974 3.022 7 549 7.120 8201 7.702 7.250 8.305 7839 7 366 8.514 7.963 7.469 .077 8.422 7.843 9.427 8.694 8.055 9.779 8 .951 244 9.915 9.042 304 Appendix D (concluded) Period 0 13% 0.885 1.868 2.361 2.974 3.517 3.998 4.423 1 1 2 50% 0.667 1.111 1.407 1.605 1.737 1824 1.883 3 3 2 3.954 1922 4 2 14% 0.877 1.647 2322 2.914 3.433 3.889 4.288 4.639 4946 4.946 5.216 5.453 5.680 5.842 6.002 8.142 1 4 6.2655 6.373 6.467 6.550 6.629 6.873 7.003 7.105 7.133 5.132 5.426 5,687 5.918 5.122 6.302 8.482 6.604 6.729 6.840 15% 16% 0.670 0.862 1.628 1.605 2.283 2246 2.855 2.798 3.352 3.274 3.784 3.685 4.160 4 .039 4.487 4,344 4.772 4,807 5.0194.833 5.234 5,029 5.421 5 .197 5.583 5342 5.724 5.468 5.847 5 .576 ,964 5.686 6.047 5.749 6.128 5.818 6.198 5.877 6.259 5.929 6.464 6.097 8.568 8 .177 6.642 6233 6.661 6 .246 17% 0.855 1.586 2210 2.743 3.199 .589 3.922 4.207 4.451 4.659 4.836 4.99 5.118 5.229 5.324 5.405 5.475 5.534 5.584 5.628 5.766 5.829 5.871 5.600 Parcent 18% 19% 20% .847 0.840 0.833 1.568 1.547 1.528 2.174 2.140 2 106 2.690 2.639 2.589 .127 3.068 2.99 3.498 3.410 3325 3.812 3.706 3.605 4,078 3.837 4.303 4031 4,494 43394.192 ,656 4.486 4.327 4.793 4.811 4.439 4,910 4.715 4.533 .008 4.611 5.092 4.876 4.675 5.1624 .938 4730 5.222 4 988 4.775 5.273 4.812 5.318 5.070 4.843 5.953 5101 4.870 5.467 5.195 4.948 5.517 6.235 4.979 5.548 5.258 4.997 5.554 5.262 4.999 2 0.800 1.440 1,962 2.362 2.699 2.951 3.181 3.329 3.463 3.571 3.656 3.725 3,780 3.024 3.859 3.287 3.910 3.928 3.942 3.954 3.985 3.995 3.999 4.000 35% 0.741 1.299 .096 .997 .220 2.385 2.508 2.598 2.885 2.715 .752 2.779 2.799 2.814 2.825 2.834 2.840 2.844 2.848 2.850 .856 2.857 .857 2.857 0.769 1.361 1.816 2.166 2.438 2 543 .802 2.925 3.019 3.090 3.147 3.190 3 223 3.249 3.288 3203 3 295 3.304 3.311 3316 3.329 3.332 3.333 3.333 40% 0.714 1.224 1,589 1.849 2.035 2,168 2.283 2.331 2.379 2.414 2.438 .458 2.469 2.478 2.484 2.489 2.492 2.494 2.498 2.497 2.499 2.500 2.500 2.500 5 4.802 1.948 1.9965 1.977 1.985 1990 1993 1.995 1.997 1.998 1.999 1.999 1.999 2.000 2.000 2.000 2.000 5.033 2 7.025 7.330 7.496 7.634 7.675 2