Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Parent Company PC acquired 100% of Subsidiary SA shares for 250. One reason the parent agreed to pay more than the book value

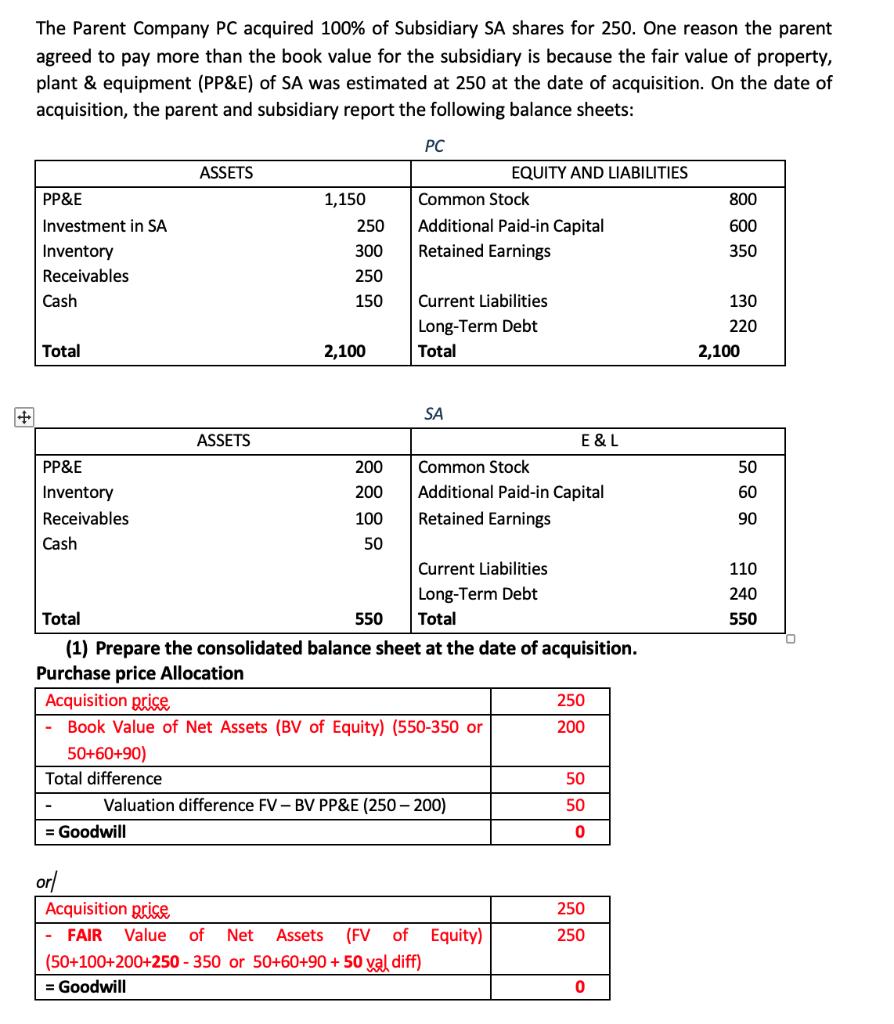

The Parent Company PC acquired 100% of Subsidiary SA shares for 250. One reason the parent agreed to pay more than the book value for the subsidiary is because the fair value of property, plant & equipment (PP&E) of SA was estimated at 250 at the date of acquisition. On the date of acquisition, the parent and subsidiary report the following balance sheets: PP&E Investment in SA Inventory Receivables Cash Total PP&E Inventory Receivables Cash 50+60+90) Total difference ASSETS = Goodwill or ASSETS 1,150 250 300 250 150 = Goodwill 2,100 200 200 100 50 550 PC Common Stock Additional Paid-in Capital Retained Earnings Current Liabilities Long-Term Debt Total SA Total Total (1) Prepare the consolidated balance sheet at the date of acquisition. Purchase price Allocation Acquisition price - Book Value of Net Assets (BV of Equity) (550-350 or EQUITY AND LIABILITIES Common Stock Additional Paid-in Capital Retained Earnings Current Liabilities Long-Term Debt Valuation difference FV-BV PP&E (250-200) Acquisition price - FAIR Value of Net Assets (FV of Equity) (50+100+200+250-350 or 50+60+90 + 50 val diff) E & L 250 200 50 50 0 250 250 0 800 600 350 130 220 2,100 50 60 90 110 240 550

Step by Step Solution

★★★★★

3.49 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER Consolidated Balance Sheet at Date of Acquisition Note The following formul...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started