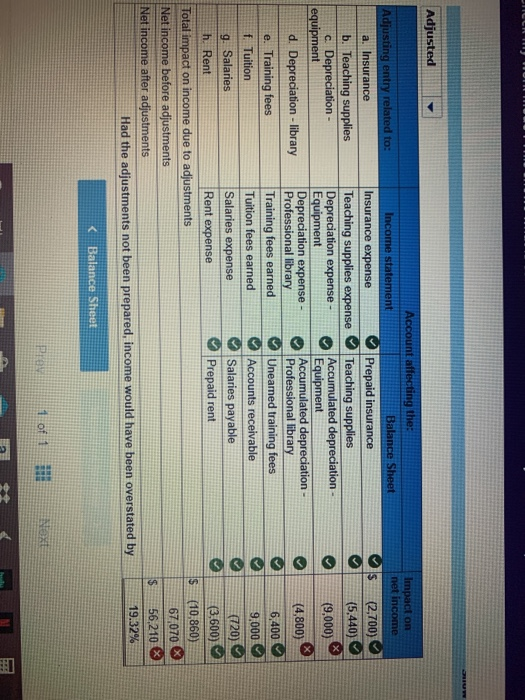

the parenthesis means is the Negative sign ( - )

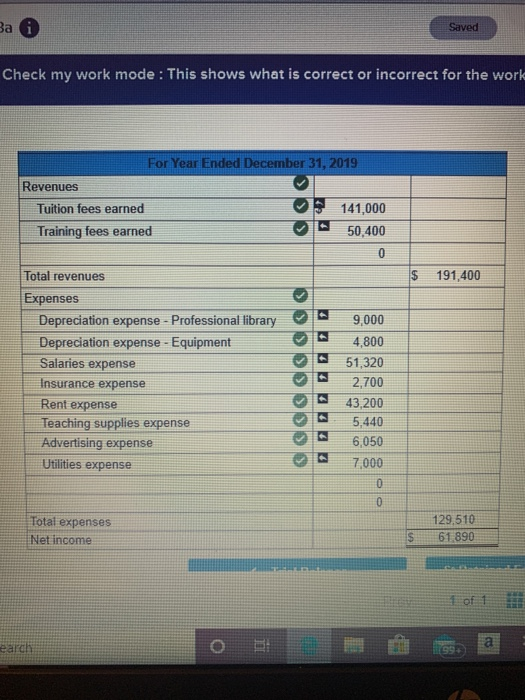

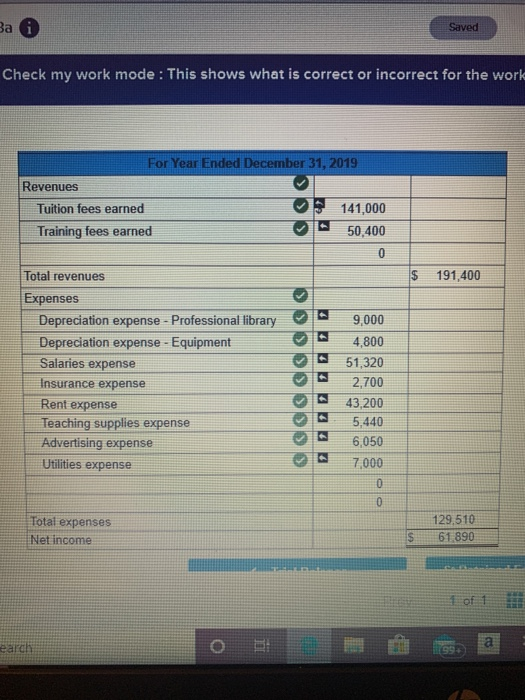

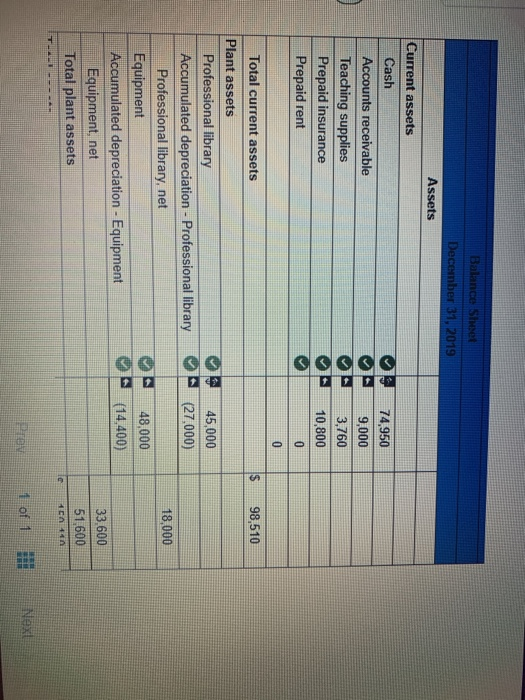

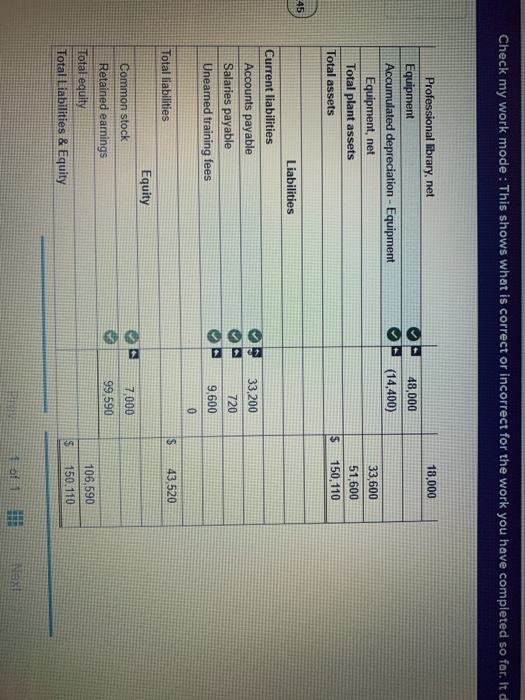

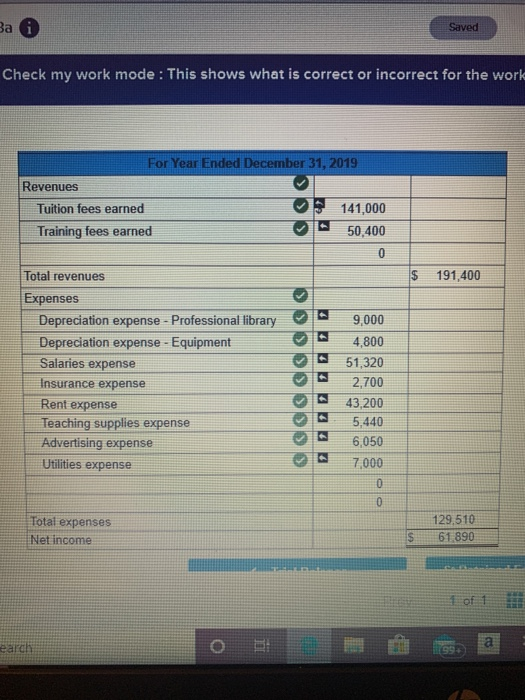

Saved Check my work mode : This shows what is correct or incorrect for the work For Year Ended December 31, 2019 Revenues Tuition fees earned 141,000 Training fees earned 50,400 $ 191,400 Total revenues Expenses Depreciation expense - Professional library Depreciation expense - Equipment Salaries expense Insurance expense Rent expense Teaching supplies expense Advertising expense Utilities expense EEEE 9,000 4,800 51,320 2.700 43,200 5,440 6,050 7.000 Total expenses Net income 129,510 61.890 Parch Balance Sheet December 31, 2019 Assets Current assets Cash Accounts receivable Teaching supplies Prepaid insurance Prepaid rent 74,950 9,000 3,760 10,800 98,510 45,000 (27,000) Total current assets Plant assets Professional library Accumulated depreciation - Professional library Professional library, net Equipment Accumulated depreciation - Equipment Equipment, net Total plant assets 18,000 48,000 (14.400) 33.600 51,600 CA 1 of 1 H Nex Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It 18,000 Professional library, net Equipment Accumulated depreciation - Equipment Equipment, net Total plant assets Total assets 48,000 (14,400) 33,600 51,600 150.110 Liabilities Current liabilities Accounts payable Salaries payable Unearned training fees 33,200 720 9,600 43.520 Total liabilities Equity Common stock Retained earnings Total equity Total Liabilities & Equity 7.000 99,590 106,590 150.110 Impact on net income (2,700) (5.440) (9,000) (4,800) Adjusted Accou it affecting the: Adjusting entry related to: Income statement Balance Sheet a. Insurance Insurance expense Prepaid insurance b. Teaching supplies Teaching supplies expense Teaching supplies Depreciation - Depreciation expense- Accumulated depreciation equipment Equipment Equipment Depreciation expense - Accumulated depreciation - d. Depreciation - library Professional library Professional library e. Training fees Training fees earned Unearned training fees f. Tuition Tuition fees earned Accounts receivable g. Salaries Salaries expense Salaries payable h. Rent Rent expense Prepaid rent Total impact on income due to adjustments Net income before adjustments Net income after adjustments Had the adjustments not been prepared, income would have been overstated by 6,400 9,000 (120) (3,600) (10,860) 67 070 X 56.210 % 19.32%