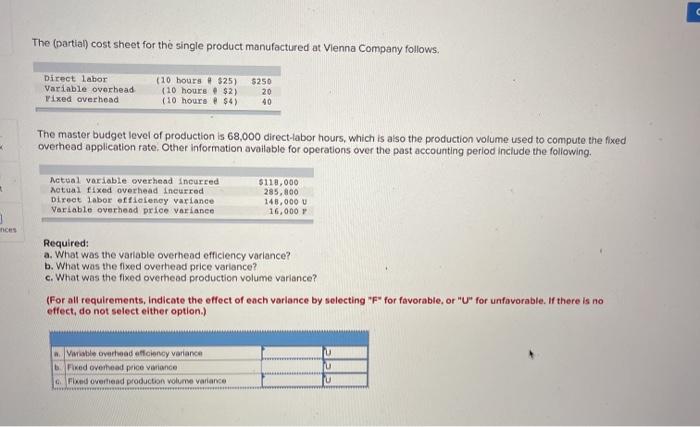

The (partial) cost sheet for the single product manufactured at Vienna Company follows. Direct labor Variable overhead Fixed overhead (10 hours . $25 (10 hours $2) (10 hours $4) $250 20 40 The master budget level of production is 68,000 direct-labor hours, which is also the production volume used to compute the fixed overhead application rate Other Information available for operations over the past accounting period include the following. 3 Actual variable overhead incurred Actual fixed overhead incurred Direct labor efficiency variance Variable overhead price variance $110,000 285,800 148,000 U 16,000 ces Required: a. What was the variable overhead efficiency variance? b. What was the fixed overhead price variance? c. What was the fixed overhead production volume variance? (For all requirements, indicate the effect of each varlance by selecting "F* for favorable, or "U" for unfavorable. If there is no effect, do not select either option) ble overhead officiency variance Fixed overhead price variance Fixed overhead production volume variance U U The (partial) cost sheet for the single product manufactured at Vienna Company follows. Direct labor Variable overhead Fixed overhead (10 hours . $25 (10 hours $2) (10 hours $4) $250 20 40 The master budget level of production is 68,000 direct-labor hours, which is also the production volume used to compute the fixed overhead application rate Other Information available for operations over the past accounting period include the following. 3 Actual variable overhead incurred Actual fixed overhead incurred Direct labor efficiency variance Variable overhead price variance $110,000 285,800 148,000 U 16,000 ces Required: a. What was the variable overhead efficiency variance? b. What was the fixed overhead price variance? c. What was the fixed overhead production volume variance? (For all requirements, indicate the effect of each varlance by selecting "F* for favorable, or "U" for unfavorable. If there is no effect, do not select either option) ble overhead officiency variance Fixed overhead price variance Fixed overhead production volume variance U U