Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The partial trial balances of PCo. and S Co. at December 31, Year 10, were as follows: Additional Information - The investment in the shares

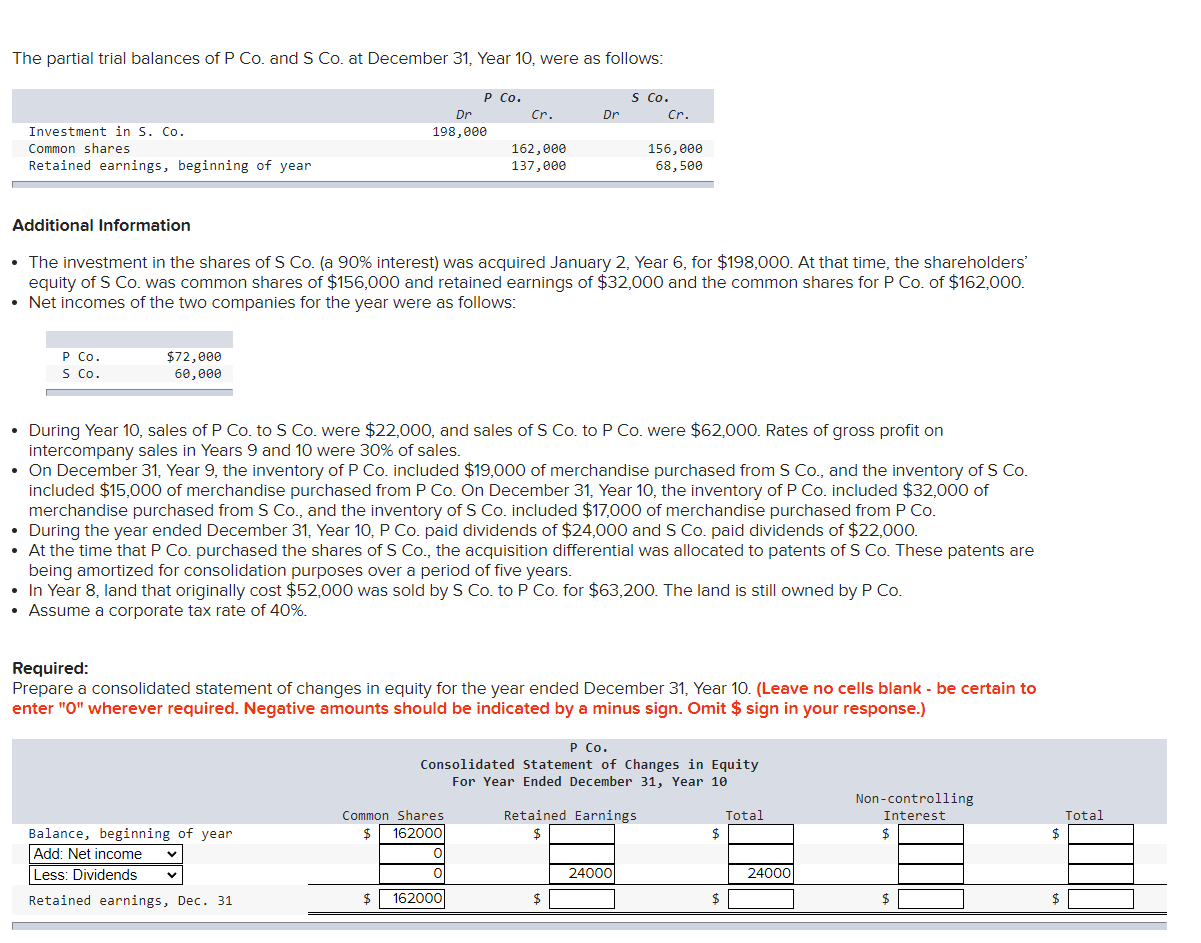

The partial trial balances of PCo. and S Co. at December 31, Year 10, were as follows: Additional Information - The investment in the shares of S Co. (a 90% interest) was acquired January 2, Year 6 , for $198,000. At that time, the shareholders' equity of S Co. was common shares of $156,000 and retained earnings of $32,000 and the common shares for P Co. of $162,000. - Net incomes of the two companies for the year were as follows: - During Year 10 , sales of P Co. to S Co. were $22,000, and sales of S Co. to P Co. were $62,000. Rates of gross profit on intercompany sales in Years 9 and 10 were 30% of sales. - On December 31, Year 9, the inventory of P Co. included $19,000 of merchandise purchased from S Co., and the inventory of S Co. included $15,000 of merchandise purchased from P Co. On December 31, Year 10, the inventory of P Co. included $32,000 of merchandise purchased from S Co., and the inventory of S Co. included $17,000 of merchandise purchased from P Co. - During the year ended December 31, Year 10, P Co. paid dividends of $24,000 and S Co. paid dividends of $22,000. - At the time that P Co. purchased the shares of S Co., the acquisition differential was allocated to patents of S Co. These patents are being amortized for consolidation purposes over a period of five years. - In Year 8, land that originally cost $52,000 was sold by S Co. to P Co. for $63,200. The land is still owned by P Co. - Assume a corporate tax rate of 40%. Required: Prepare a consolidated statement of changes in equity for the year ended December 31, Year 10. (Leave no cells blank - be certain to enter "0" wherever required. Negative amounts should be indicated by a minus sign. Omit $ sign in your response.)

The partial trial balances of PCo. and S Co. at December 31, Year 10, were as follows: Additional Information - The investment in the shares of S Co. (a 90% interest) was acquired January 2, Year 6 , for $198,000. At that time, the shareholders' equity of S Co. was common shares of $156,000 and retained earnings of $32,000 and the common shares for P Co. of $162,000. - Net incomes of the two companies for the year were as follows: - During Year 10 , sales of P Co. to S Co. were $22,000, and sales of S Co. to P Co. were $62,000. Rates of gross profit on intercompany sales in Years 9 and 10 were 30% of sales. - On December 31, Year 9, the inventory of P Co. included $19,000 of merchandise purchased from S Co., and the inventory of S Co. included $15,000 of merchandise purchased from P Co. On December 31, Year 10, the inventory of P Co. included $32,000 of merchandise purchased from S Co., and the inventory of S Co. included $17,000 of merchandise purchased from P Co. - During the year ended December 31, Year 10, P Co. paid dividends of $24,000 and S Co. paid dividends of $22,000. - At the time that P Co. purchased the shares of S Co., the acquisition differential was allocated to patents of S Co. These patents are being amortized for consolidation purposes over a period of five years. - In Year 8, land that originally cost $52,000 was sold by S Co. to P Co. for $63,200. The land is still owned by P Co. - Assume a corporate tax rate of 40%. Required: Prepare a consolidated statement of changes in equity for the year ended December 31, Year 10. (Leave no cells blank - be certain to enter "0" wherever required. Negative amounts should be indicated by a minus sign. Omit $ sign in your response.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started