Answered step by step

Verified Expert Solution

Question

1 Approved Answer

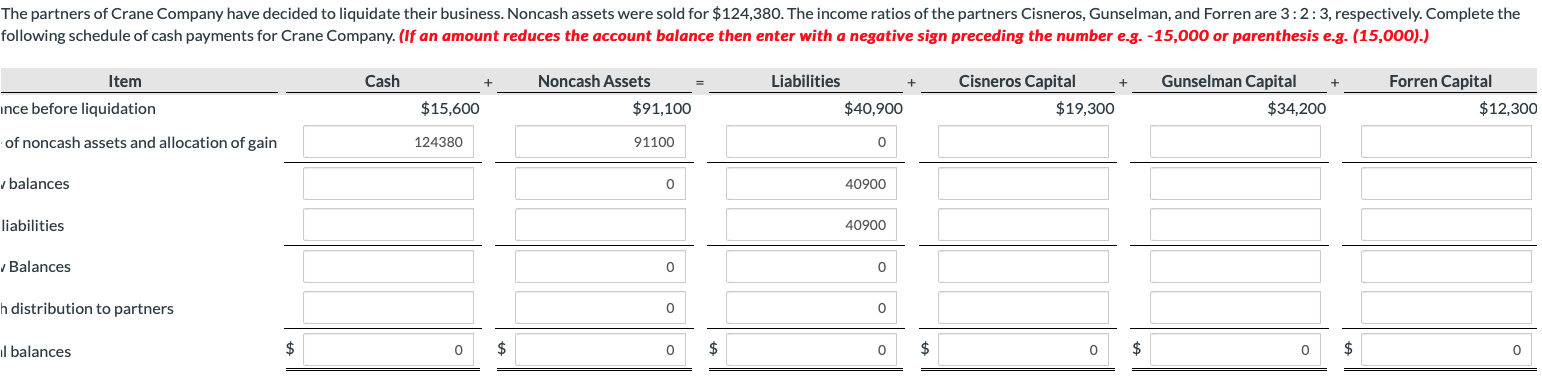

The partners of Crane Company have decided to liquidate their business. Noncash assets were sold for $124,380. The income ratios of the partners Cisneros, Gunselman,

The partners of Crane Company have decided to liquidate their business. Noncash assets were sold for $124,380. The income ratios of the partners Cisneros, Gunselman, and Forren are 3:2:3, respectively. Complete the following schedule of cash payments for Crane Company. (If an amount reduces the account balance then enter with a negative sign preceding the number e.g.-15,000 or parenthesis e.g. (15,000).) Cash Liabilities + + Item ince before liquidation + $15,600 Noncash Assets $91,100 Cisneros Capital $19,300 Gunselman Capital $34,200 Forren Capital $12,300 $40,900 of noncash assets and allocation of gain 124380 91100 v balances 40900 liabilities 40900 Balances h distribution to partners ooO il balances Balance before liquidation Sale of noncash assets and allocation of gain New balances Pay liabilities New Balances Cash distribution to partners Final balances The partners of Crane Company have decided to liquidate their business. Noncash assets were sold for $124,380. The income ratios of the partners Cisneros, Gunselman, and Forren are 3:2:3, respectively. Complete the following schedule of cash payments for Crane Company. (If an amount reduces the account balance then enter with a negative sign preceding the number e.g.-15,000 or parenthesis e.g. (15,000).) Cash Liabilities + + Item ince before liquidation + $15,600 Noncash Assets $91,100 Cisneros Capital $19,300 Gunselman Capital $34,200 Forren Capital $12,300 $40,900 of noncash assets and allocation of gain 124380 91100 v balances 40900 liabilities 40900 Balances h distribution to partners ooO il balances Balance before liquidation Sale of noncash assets and allocation of gain New balances Pay liabilities New Balances Cash distribution to partners Final balances

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started