Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The partnership accounts of Guess, Jag and Levis are shown below as of December 31, 2019. Profits and losses are shared 50%; 30%; and

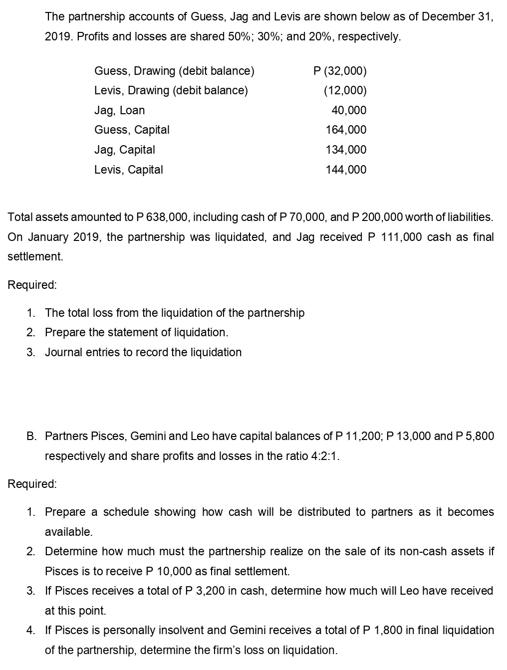

The partnership accounts of Guess, Jag and Levis are shown below as of December 31, 2019. Profits and losses are shared 50%; 30%; and 20%, respectively. Guess, Drawing (debit balance) Levis, Drawing (debit balance) Jag, Loan Guess, Capital Jag, Capital Levis, Capital P (32,000) (12,000) Required: 1. The total loss from the liquidation of the partnership 2. Prepare the statement of liquidation. 3. Journal entries to record the liquidation 40,000 164,000 134,000 144,000 Total assets amounted to P 638,000, including cash of P 70,000, and P 200,000 worth of liabilities. On January 2019, the partnership was liquidated, and Jag received P 111,000 cash as final settlement. B. Partners Pisces, Gemini and Leo have capital balances of P 11,200; P 13,000 and P 5,800 respectively and share profits and losses in the ratio 4:2:1. Required: 1. Prepare a schedule showing how cash will be distributed to partners as it becomes available. 2. Determine how much must the partnership realize on the sale of its non-cash assets if Pisces is to receive P 10,000 as final settlement. 3. If Pisces receives a total of P 3,200 in cash, determine how much will Leo have received at this point. 4. If Pisces is personally insolvent and Gemini receives a total of P 1,800 in final liquidation of the partnership, determine the firm's loss on liquidation.

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

PART A 1The total loss from the liquidation of the partnership Total Assets P638000 Less Total Liabilities P200000 Net Assets P438000 Guesss Share 50 050 Levis Share 20 020 Total Share 70 070 Guesss s...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started