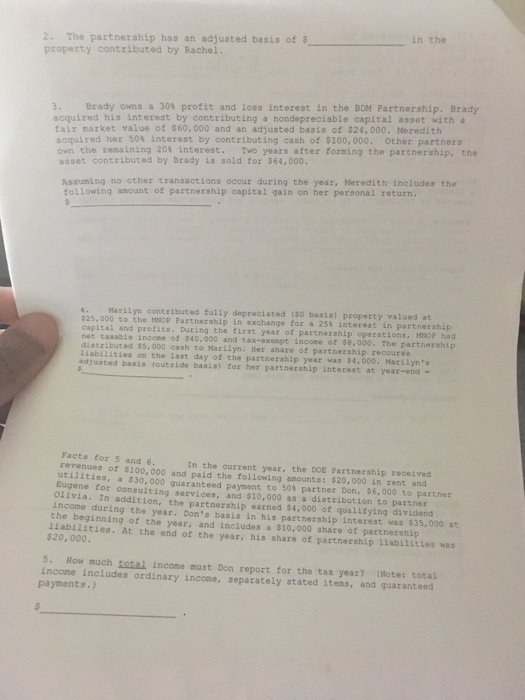

The partnership has an adjusted basis of $ _____ in the property contributed by Rachel. Brady owns a 30% profit and loss interest in the BDM Partnership. Brady acquired his interest by contributing a nondepreciable capital asset with a fair market value of $60,000 and an adjusted basis of $24,000. Meredith acquired her 50% interest by contributing cash of $100,000. Other partners own the remaining 20% interest. Two years after forming the partnership, the asset contributed by Brady is sold for $64,000. Assuming no other transactions occur during the year, Meredith includes the following amount of Partnership capital gain on her personal return. $ _____. Marilyn contributed fully depreciated ($0 basis) property valued at $25,000 to the partnership in exchange for a 25% interest in partnership capital and profits. During the first year of partnership operations, had net taxable income of $40,000 and tax-except income of $8,000. The partnership distributed $5,000 cash to Marilyn. Her share of partnership recourse liabilities on the last day of the partnership year was $4,000. Marilyn's adjusted basis (outside basis) for her partnership interest at year-end = $ _____. Facts for 5 and 6. In the current year, the DOE Partnership received revenues of $100,000 and paid the following amounts: $20,000 in rent and utilities, a $30,000 guaranteed payment to 50% Partner Don, $6,000 to partner Eugene for consulting services, and $10,000 as a distribution to partner Olivia. In addition, the partnership earned $4,000 of qualifying dividend income during the year. Don's basis in this partnership interest was $35,000 at the beginning of the year, and includes a $10,000 share of partnership liabilities. At the end of the year, his share of partnership liabilities was $20,000. How much total income must Don report for the tax year? The partnership has an adjusted basis of $ _____ in the property contributed by Rachel. Brady owns a 30% profit and loss interest in the BDM Partnership. Brady acquired his interest by contributing a nondepreciable capital asset with a fair market value of $60,000 and an adjusted basis of $24,000. Meredith acquired her 50% interest by contributing cash of $100,000. Other partners own the remaining 20% interest. Two years after forming the partnership, the asset contributed by Brady is sold for $64,000. Assuming no other transactions occur during the year, Meredith includes the following amount of Partnership capital gain on her personal return. $ _____. Marilyn contributed fully depreciated ($0 basis) property valued at $25,000 to the partnership in exchange for a 25% interest in partnership capital and profits. During the first year of partnership operations, had net taxable income of $40,000 and tax-except income of $8,000. The partnership distributed $5,000 cash to Marilyn. Her share of partnership recourse liabilities on the last day of the partnership year was $4,000. Marilyn's adjusted basis (outside basis) for her partnership interest at year-end = $ _____. Facts for 5 and 6. In the current year, the DOE Partnership received revenues of $100,000 and paid the following amounts: $20,000 in rent and utilities, a $30,000 guaranteed payment to 50% Partner Don, $6,000 to partner Eugene for consulting services, and $10,000 as a distribution to partner Olivia. In addition, the partnership earned $4,000 of qualifying dividend income during the year. Don's basis in this partnership interest was $35,000 at the beginning of the year, and includes a $10,000 share of partnership liabilities. At the end of the year, his share of partnership liabilities was $20,000. How much total income must Don report for the tax year