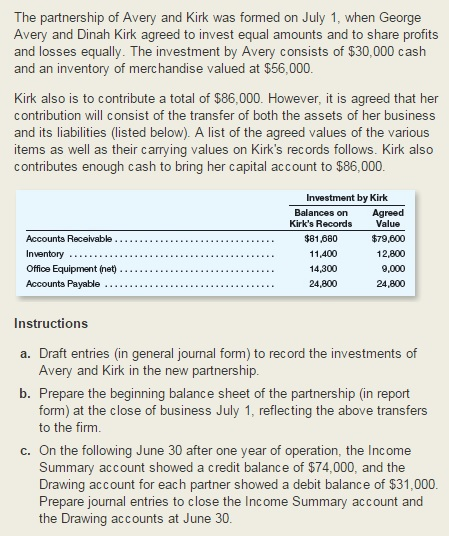

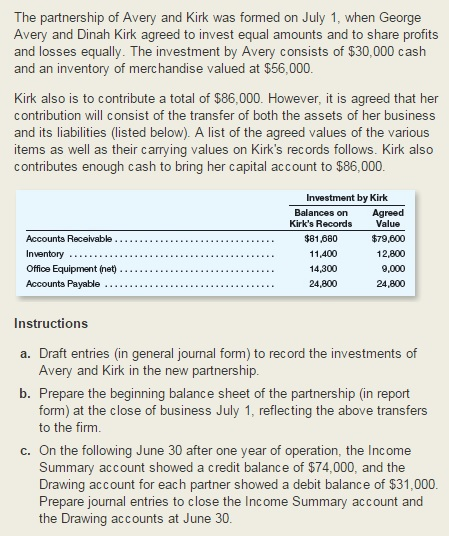

The partnership of Avery and Kirk was formed on July 1. when George Avery and Dinah Kirk agreed to invest equal amounts and to share profits and losses equally. The investment by Avery consists of $30.000 cash and an inventory of merchandise valued at $56.000. Kirk also is to contribute a total of $86.000. However, it is agreed that her contribution will consist of the transfer of both the assets of her business and its liabilities (listed below). A list of the agreed values of the various items as well as their carrying values on Kirks records follows. Kirk also contributes enough cash to bring her capital account to $86.000. Instructions a. Draft entries (in general journal form) to record the investments of Avery and Kirk in the new partnership. b. Prepare the beginning balance sheet of the partnership (in report form) at the close of business July 1. reflecting the above transfers to the firm. c. On the following June 30 after one year of operation. the Income Summary account showed a credit balance of $74.000. and the Drawing account for each partner showed a debit balance of $31.000. Prepare journal entries to close the Income Summary account and the Drawing accounts at June 30 The partnership of Avery and Kirk was formed on July 1. when George Avery and Dinah Kirk agreed to invest equal amounts and to share profits and losses equally. The investment by Avery consists of $30.000 cash and an inventory of merchandise valued at $56.000. Kirk also is to contribute a total of $86.000. However, it is agreed that her contribution will consist of the transfer of both the assets of her business and its liabilities (listed below). A list of the agreed values of the various items as well as their carrying values on Kirks records follows. Kirk also contributes enough cash to bring her capital account to $86.000. Instructions a. Draft entries (in general journal form) to record the investments of Avery and Kirk in the new partnership. b. Prepare the beginning balance sheet of the partnership (in report form) at the close of business July 1. reflecting the above transfers to the firm. c. On the following June 30 after one year of operation. the Income Summary account showed a credit balance of $74.000. and the Drawing account for each partner showed a debit balance of $31.000. Prepare journal entries to close the Income Summary account and the Drawing accounts at June 30