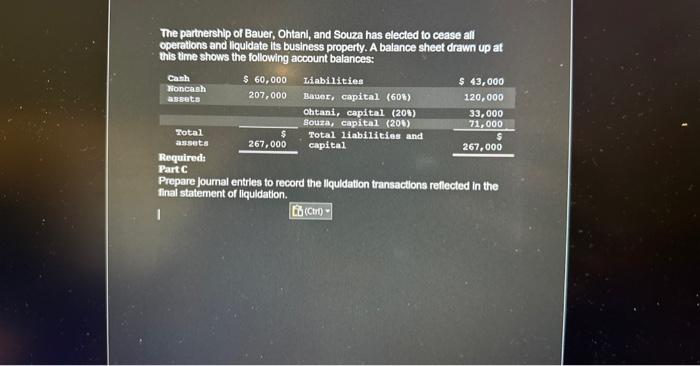

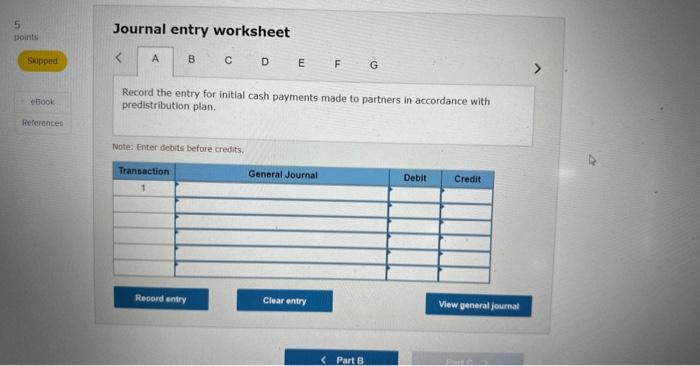

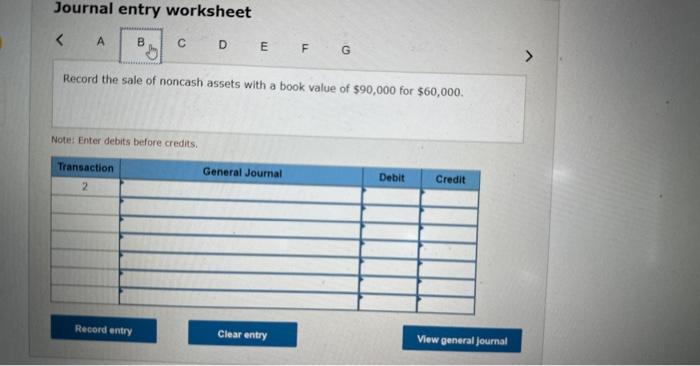

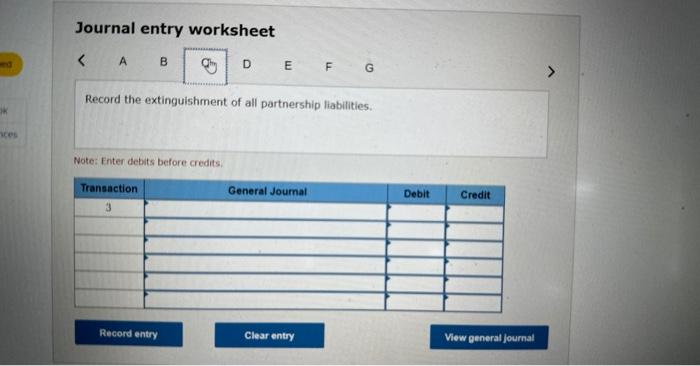

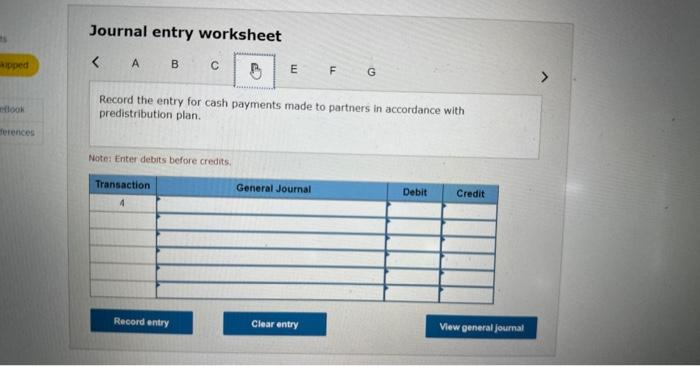

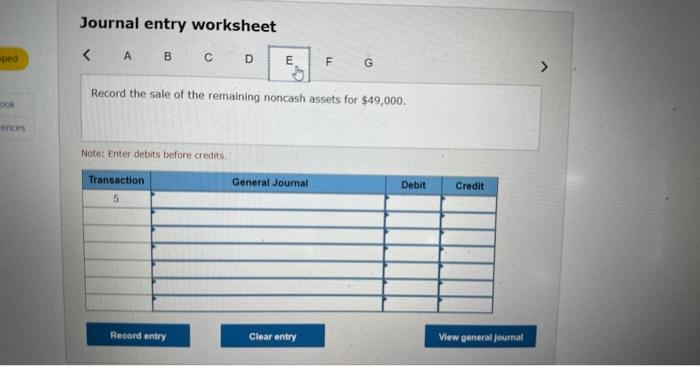

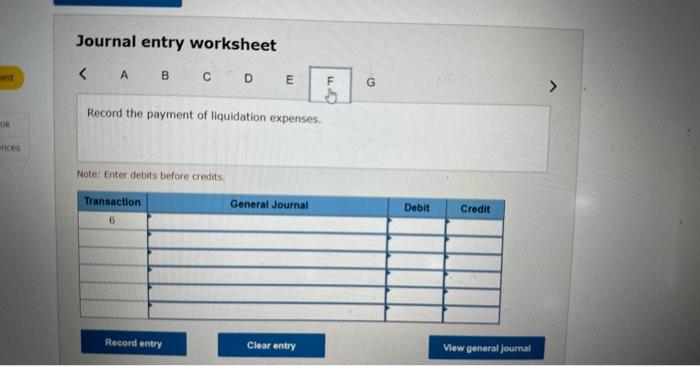

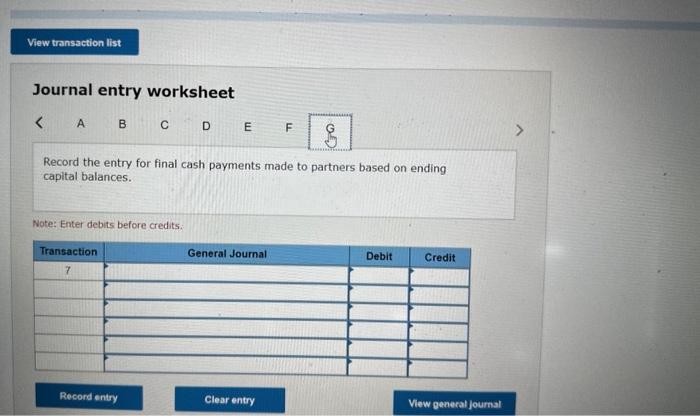

The partnership of Bauer, Ohtanl, and Souza has elected to cease aff operatlons and lilquidate its business property. A balance sheet drawn up at Journal entry worksheet C G Record the sale of the remaining noncash assets for $49,000. Note: Enter debits before credits. Journal entry worksheet C D E F G Record the entry for initial cash payments made to partners in accordance with predistribution plan. Note: Enter debits before credits. Journal entry worksheet EG Record the extinguishment of all partnership liabilities. Note: Enter debits before credits. Journal entry worksheet F G Record the entry for cash payments made to partners in accordance with predistribution plan. Note: Enter debits before credits. Journal entry worksheet E F G Record the sale of noncash assets with a book value of $90,000 for $60,000. Note: Enter debits before credits. Journal entry worksheet Record the entry for final cash payments made to partners based on ending capital balances. Note: Enter debits before credits. Journal entry worksheet B C D E Record the payment of liquidation expenses. Note: Enter debits before credits. The partnership of Bauer, Ohtanl, and Souza has elected to cease aff operatlons and lilquidate its business property. A balance sheet drawn up at Journal entry worksheet C G Record the sale of the remaining noncash assets for $49,000. Note: Enter debits before credits. Journal entry worksheet C D E F G Record the entry for initial cash payments made to partners in accordance with predistribution plan. Note: Enter debits before credits. Journal entry worksheet EG Record the extinguishment of all partnership liabilities. Note: Enter debits before credits. Journal entry worksheet F G Record the entry for cash payments made to partners in accordance with predistribution plan. Note: Enter debits before credits. Journal entry worksheet E F G Record the sale of noncash assets with a book value of $90,000 for $60,000. Note: Enter debits before credits. Journal entry worksheet Record the entry for final cash payments made to partners based on ending capital balances. Note: Enter debits before credits. Journal entry worksheet B C D E Record the payment of liquidation expenses. Note: Enter debits before credits