Question

The partnership of Frick, Wilson, and Clarke has elected to cease all operations and liquidate its business property. A balance sheet drawn up at this

The partnership of Frick, Wilson, and Clarke has elected to cease all operations and liquidate its business property. A balance sheet drawn up at this time shows the following account balances:

| Cash | $ | 60,000 | Liabilities | $ | 43,000 | |

| Noncash assets | 201,000 | Frick, capital (60%) | 117,000 | |||

| Wilson, capital (20%) | 32,000 | |||||

| Clarke, capital (20%) | 69,000 | |||||

| Total assets | $ | 261,000 | Total liabilities and capital | $ | 261,000 | |

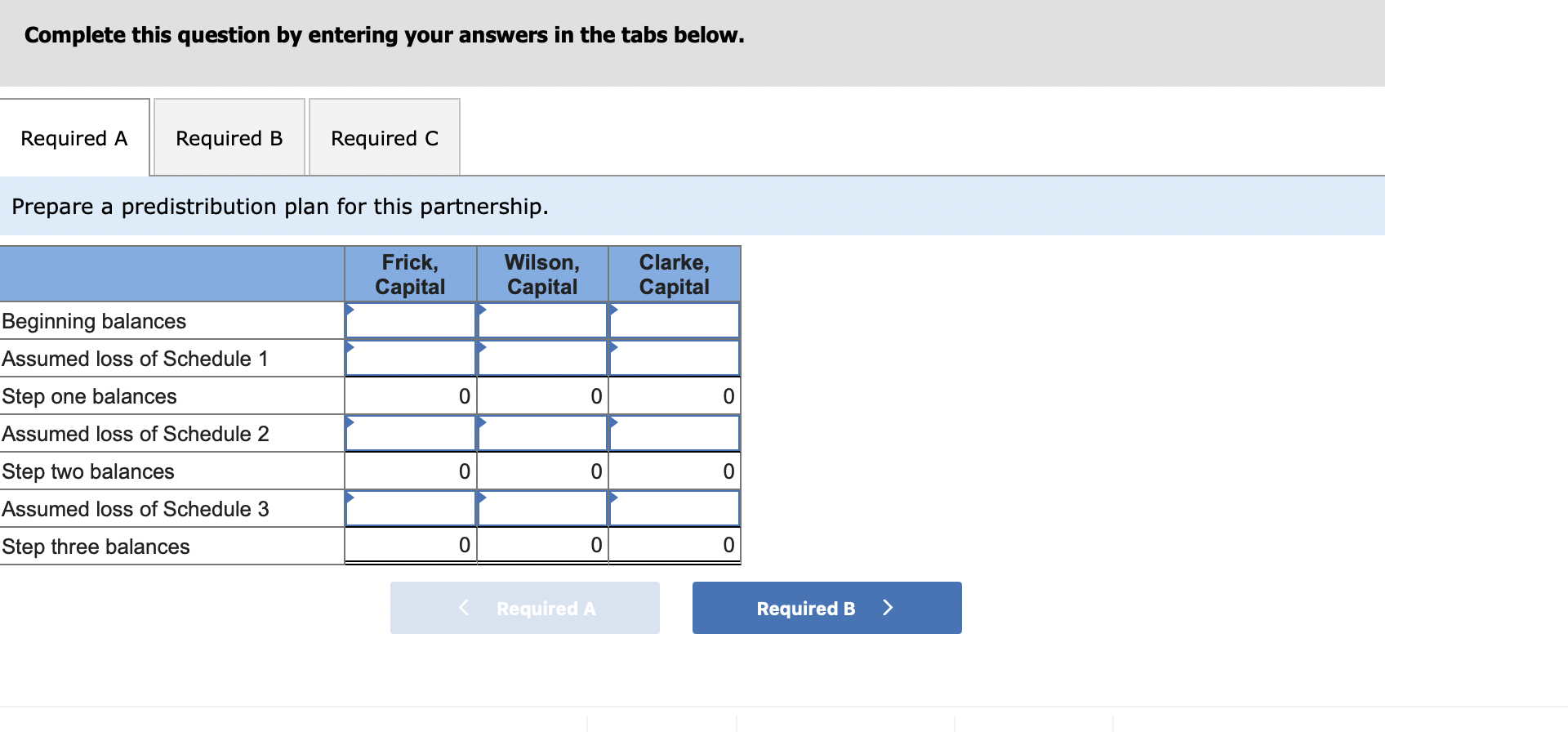

Part A

Prepare a predistribution plan for this partnership.

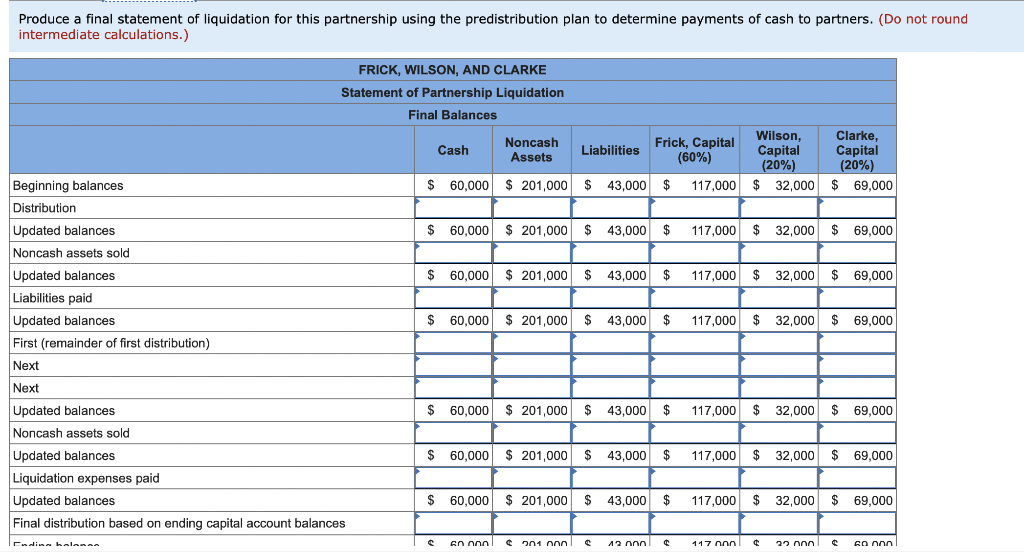

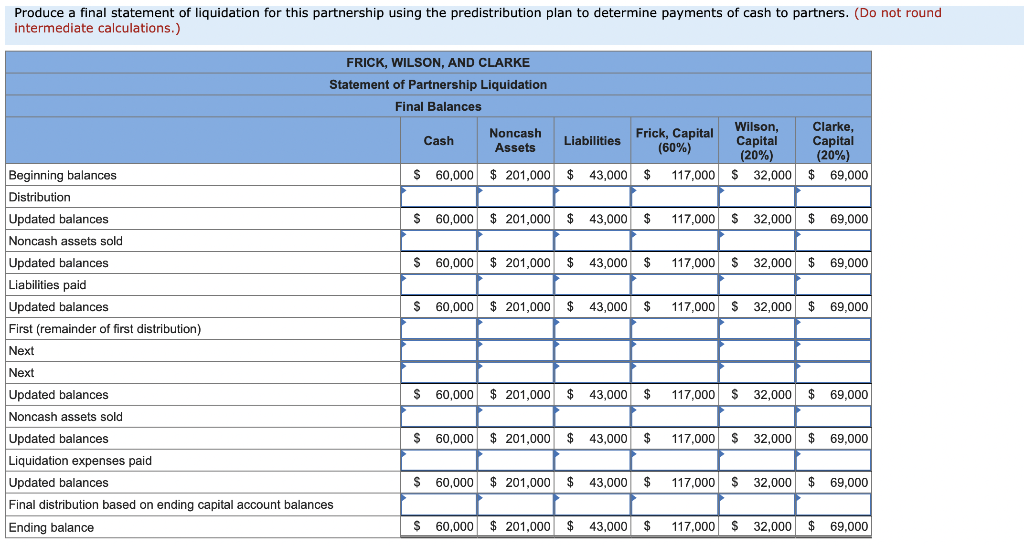

Part B

The following transactions occur in liquidating this business:

Distributed safe payments of cash immediately to the partners. Liquidation expenses of $9,000 are estimated as a basis for this computation.

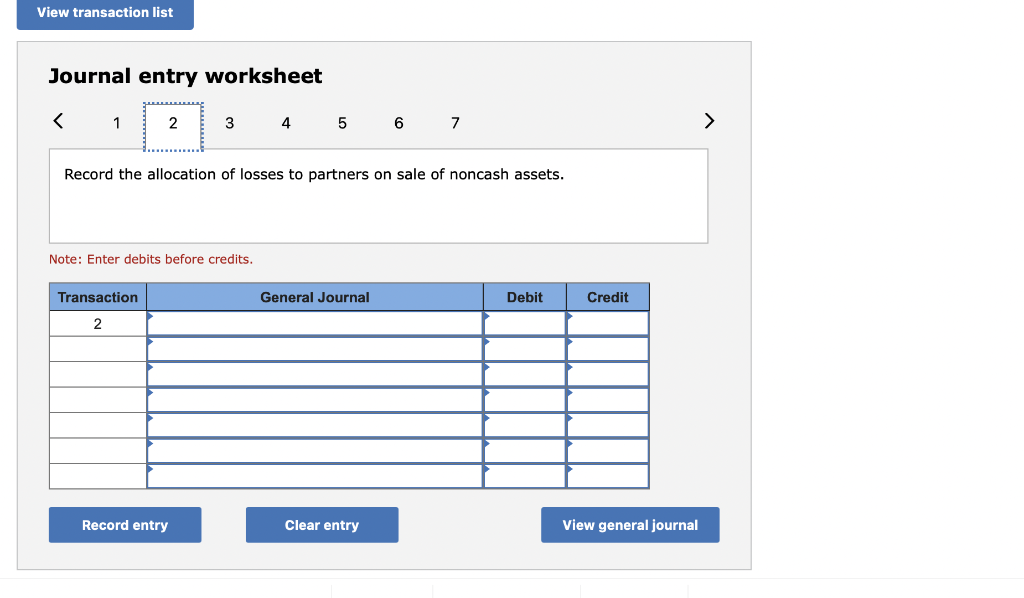

Sold noncash assets with a book value of $88,000 for $60,000.

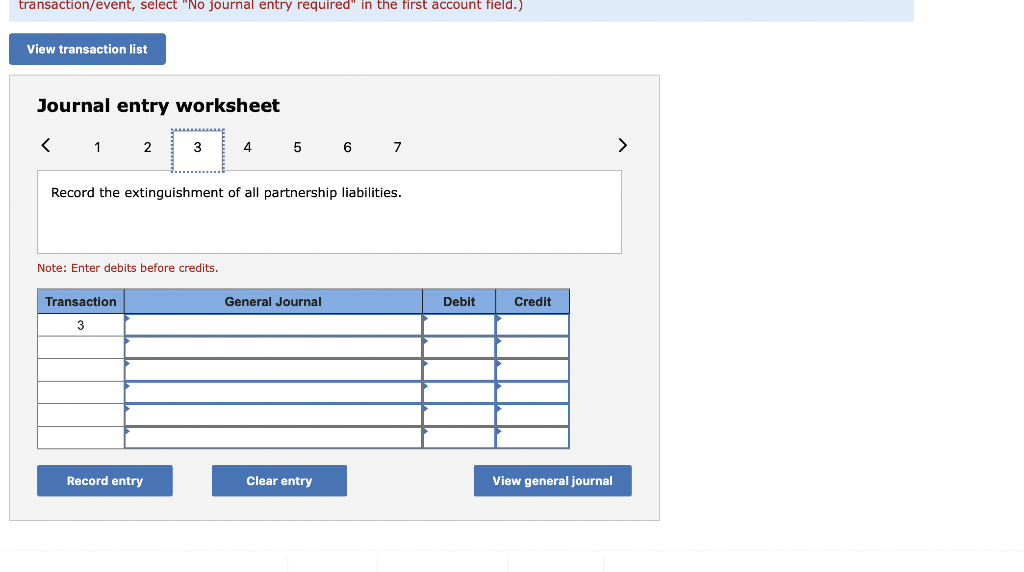

Paid all liabilities.

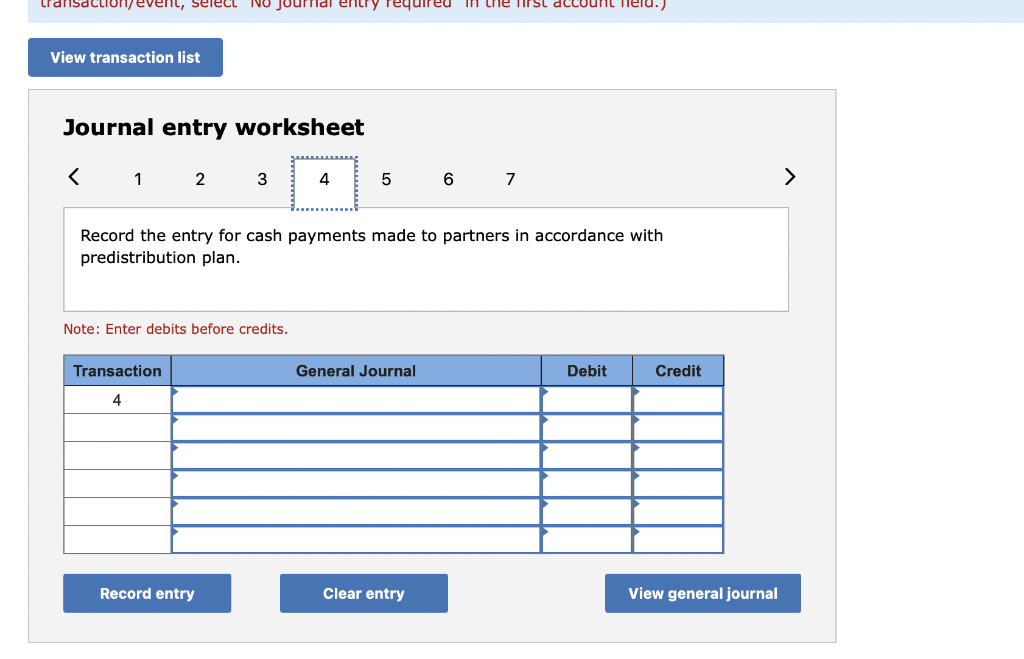

Distributed safe payments of cash again.

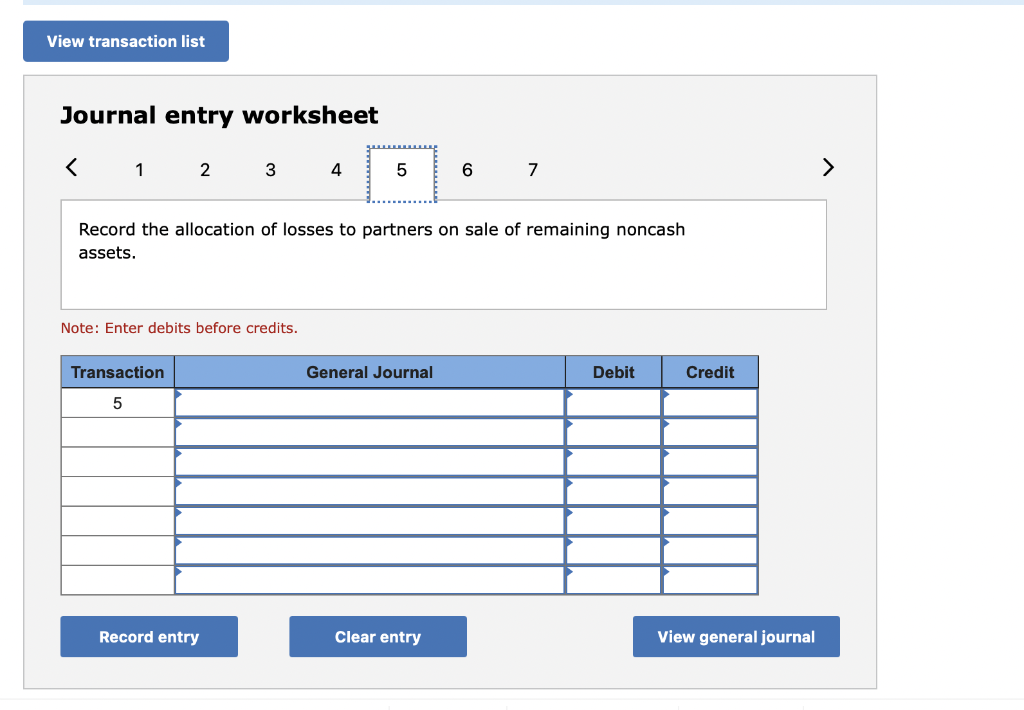

Sold remaining noncash assets for $48,000.

Paid actual liquidation expenses of $7,000 only.

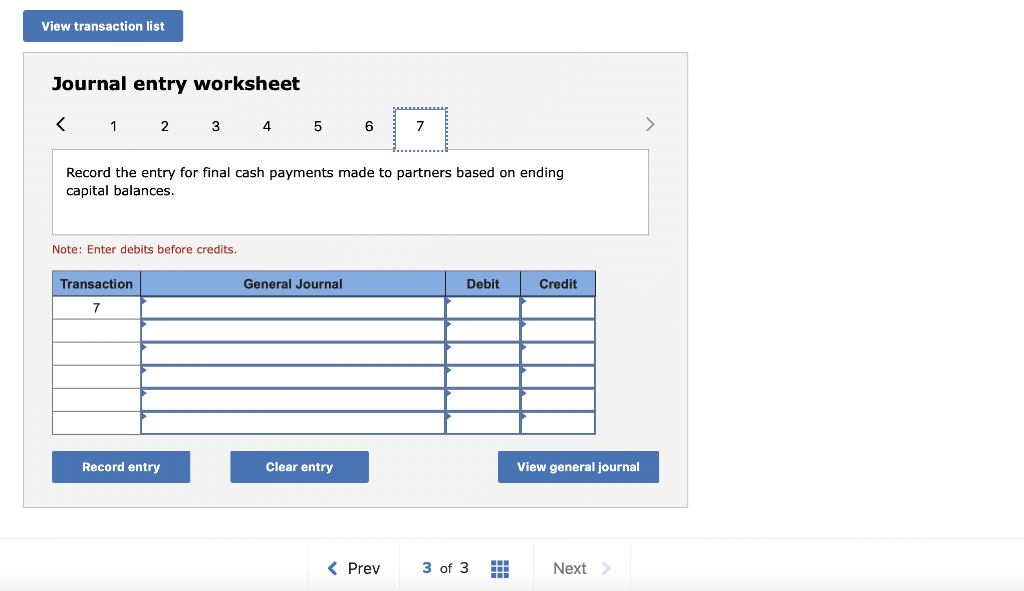

Distributed remaining cash to the partners and closed the financial records of the business permanently.

Produce a final statement of liquidation for this partnership using the predistribution plan to determine payments of cash to partners.

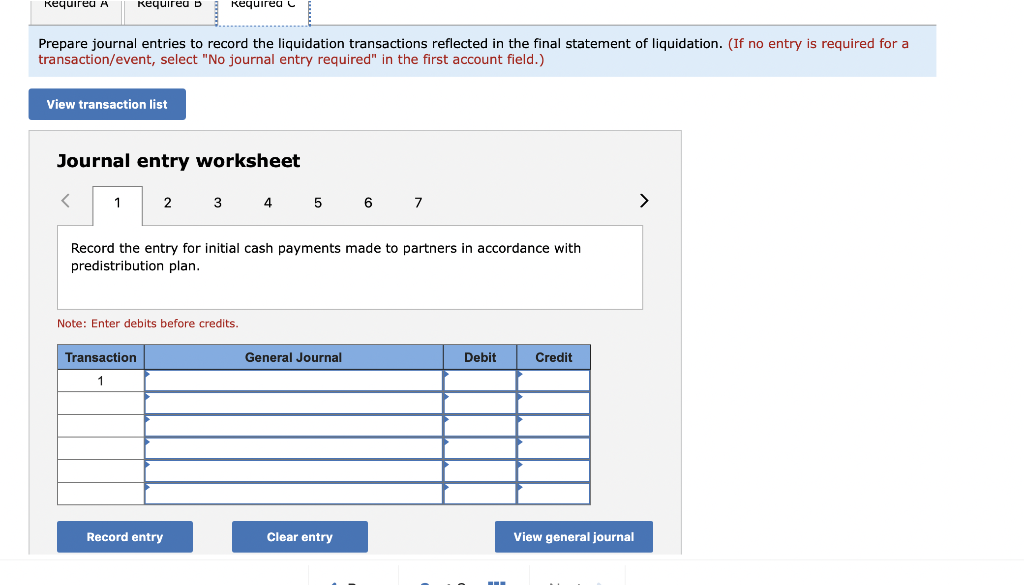

Part C

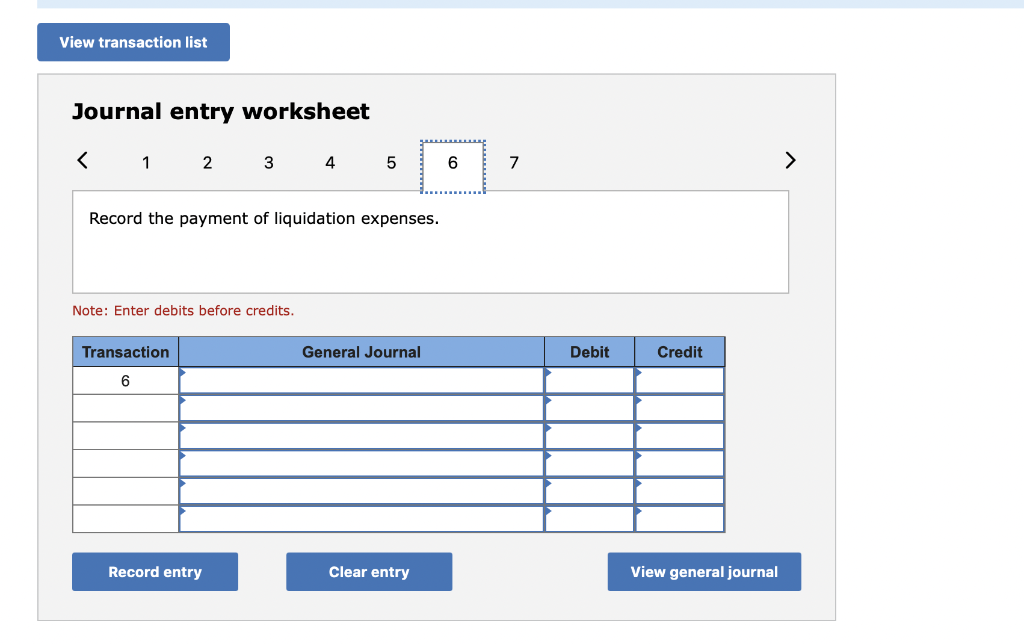

Prepare journal entries to record the liquidation transactions reflected in the final statement of liquidation.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started