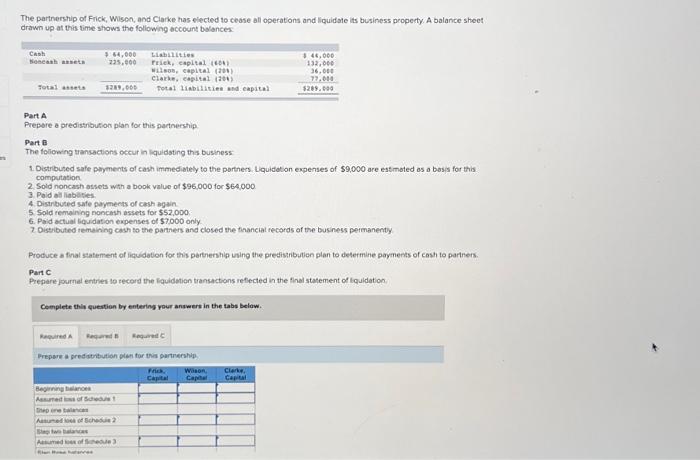

The partnership of Frick, Wisen, and Clarke has elected to cease ali operations and liquidste its business property. A balance sheet drawn up at this time shows the following account bolances: Part A Prepore a predistribution plan for this partnership Part B The following transactions occur in liquidsting this busthess 1. Distributed safe pityments of cash immediately to the porthers. Lquidoton expenses of $9,000 are estmoted as a bosis for this computation 2. Sold noncash assets wth a book value of $96,000 for $64,000 3. Paid alliablities. 4. Distributed safe payments of cash again. 5 Sold remwining noncash dssets for $52,000 6. Paid actual liquidation expenses of 57,000 only 2. Oistributed temaining cash to the parthers and closed the tinancial fecords of the business permanenty. Produce a final satement of liquidation for this partnership uing the predistribution plan to determine payments of cosh to parthers. Part C Prepere journal entries to secord the fquidotion transactions reflected in the final statement of louidation. Cemplete thil euestion by entering pour anwwers in the tabs below. Prepare a gredotibution plen for this gartwership. The partnership of Frick, Wisen, and Clarke has elected to cease ali operations and liquidste its business property. A balance sheet drawn up at this time shows the following account bolances: Part A Prepore a predistribution plan for this partnership Part B The following transactions occur in liquidsting this busthess 1. Distributed safe pityments of cash immediately to the porthers. Lquidoton expenses of $9,000 are estmoted as a bosis for this computation 2. Sold noncash assets wth a book value of $96,000 for $64,000 3. Paid alliablities. 4. Distributed safe payments of cash again. 5 Sold remwining noncash dssets for $52,000 6. Paid actual liquidation expenses of 57,000 only 2. Oistributed temaining cash to the parthers and closed the tinancial fecords of the business permanenty. Produce a final satement of liquidation for this partnership uing the predistribution plan to determine payments of cosh to parthers. Part C Prepere journal entries to secord the fquidotion transactions reflected in the final statement of louidation. Cemplete thil euestion by entering pour anwwers in the tabs below. Prepare a gredotibution plen for this gartwership