Answered step by step

Verified Expert Solution

Question

1 Approved Answer

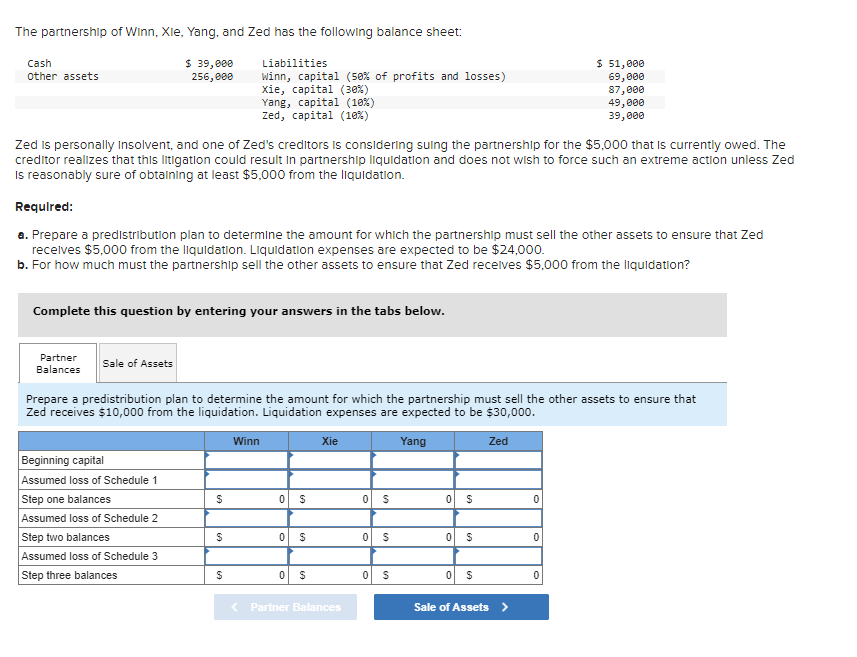

The partnership of Winn, Xie, Yang, and Zed has the following balance sheet: Zed is personally Insolvent, and one of Zed's creditors is considering suing

The partnership of Winn, Xie, Yang, and Zed has the following balance sheet:

Zed is personally Insolvent, and one of Zed's creditors is considering suing the partnership for the $ that is currently owed. The

creditor realizes that this IItigation could result in partnership liquidation and does not wish to force such an extreme action unless Zed

Is reasonably sure of obtaining at least $ from the IIquidation.

Requlred:

a Prepare a predistribution plan to determine the amount for which the partnership must sell the other assets to ensure that Zed

recelves $ from the IIquidation. Liquidation expenses are expected to be $

b For how much must the partnershlp sell the other assets to ensure that Zed recelves $ from the liquidation?

Complete this question by entering your answers in the tabs below.

Partner

Balances

Sale of Assets

Prepare a predistribution plan to determine the amount for which the partnership must sell the other assets to ensure that

Zed receives $ from the liquidation. Liquidation expenses are expected to be $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started