Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The partnership offered A. Stone 10% of the ownership of the partnership for $150,000. Ms. Stone accepted the offer, invested the $150,000, and became

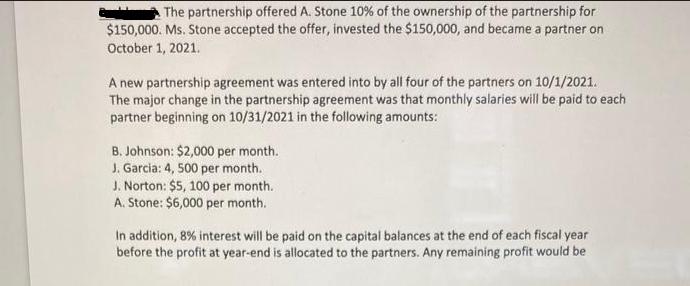

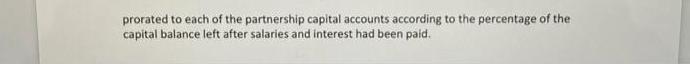

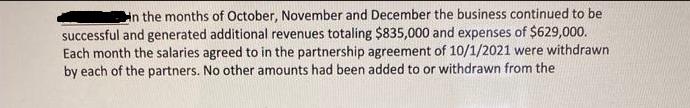

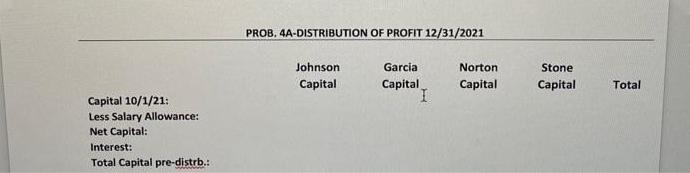

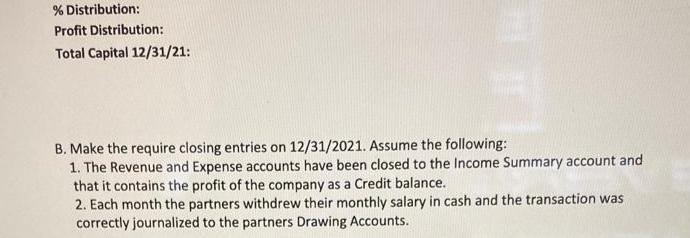

The partnership offered A. Stone 10% of the ownership of the partnership for $150,000. Ms. Stone accepted the offer, invested the $150,000, and became a partner on October 1, 2021. A new partnership agreement was entered into by all four of the partners on 10/1/2021. The major change in the partnership agreement was that monthly salaries will be paid to each partner beginning on 10/31/2021 in the following amounts: B. Johnson: $2,000 per month. J. Garcia: 4, 500 per month. J. Norton: $5, 100 per month. A. Stone: $6,000 per month. In addition, 8% interest will be paid on the capital balances at the end of each fiscal year before the profit at year-end is allocated to the partners. Any remaining profit would be prorated to each of the partnership capital accounts according to the percentage of the capital balance left after salaries and interest had been paid. Required: A. Calculate the bonus paid to each one of the original partners by Ms. Stone for her 10% share. 10/1/2021 Total Capital +Stone Contr Capital 9/30/21 Bonus Destr Total Capital Johnson Capital Garcia Capital Stone. Norton Capital Contribution Stone Capital (10%) Bonus to Original Partners B. The distribution of the bonus, $23,000 was made to each of the founding partners according to the original partnership agreement. The agreement called for all income and bonuses to be distributed to each of the original partners as a percentage of the total capital invested in the partnership. SULIC Required: Calculate the distribution of the bonus to each of the founding partners on 10/1/202 and record the investment of A. Stone in the partnership when she became a partner. in the months of October, November and December the business continued to be successful and generated additional revenues totaling $835,000 and expenses of $629,000. Each month the salaries agreed to in the partnership agreement of 10/1/2021 were withdrawn by each of the partners. No other amounts had been added to or withdrawn from the partnership accounts as of 12/31/2021. The Drawing account each partner was up-to-date as of 12/31/2021. Requred: A. Calculate the distribution of the profit 12/31/2021 using the profit sharing formula agreed to on 10/1/2021. Use the following templet: Capital 10/1/21: Less Salary Allowance: Net Capital: Interest: Total Capital pre-distrb.: PROB, 4A-DISTRIBUTION OF PROFIT 12/31/2021 Johnson. Capital Garcia Capital I Norton Capital Stone Capital Total % Distribution: Profit Distribution: Total Capital 12/31/21: B. Make the require closing entries on 12/31/2021. Assume the following: 1. The Revenue and Expense accounts have been closed to the Income Summary account and that it contains the profit of the company as a Credit balance. 2. Each month the partners withdrew their monthly salary in cash and the transaction was correctly journalized to the partners Drawing Accounts.

Step by Step Solution

★★★★★

3.40 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Solution A Calculate the bonus paid to each one of the original partners by Ms Stone for her 10 share Bonus Total Capital x 10 4 Bonus 23000 Distribution of the bonus to each of the founding partners ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started